11 Must-Know Open Banking Apps in Saudi Arabia

Saudi Arabia is experiencing a transformation in its financial landscape, largely driven by the rapid development of open banking. Since 2021, when the Saudi Central Bank (SAMA) launched its roadmap for implementing Open Banking, the Kingdom has witnessed remarkable growth in this sector, culminating in the establishment of the Open Banking Framework in November 2022 and the Open Banking Lab in January 2023. This initiative aims to empower bank customers to safely share their financial data with approved Third-Party Providers (TPPs), fostering innovation, increasing competition, enhancing financial inclusion, and improving overall efficiency in the banking system.

In our guide, you’ll find 11 of the most important apps in the field of Open Banking in Saudi Arabia! This is our curated list of key tech developments solutions to watch in 2025! It includes not only apps that allow individuals to manage all their finances in one place but also a range of B2B SaaS applications designed for small and medium-sized enterprises.

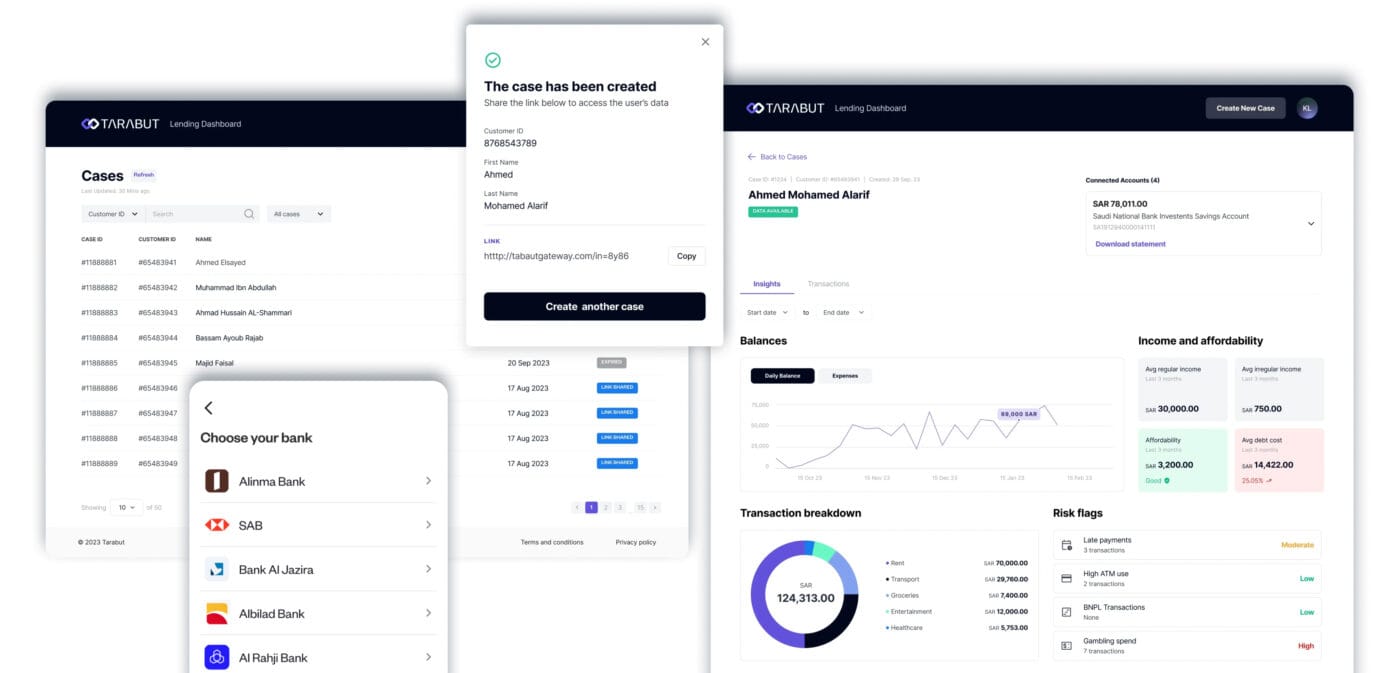

Tarabut Gateway

Tarabut Gateway is the first and largest regulated Open Banking platform in the Middle East and North Africa (MENA) region. Founded in Bahrain, Tarabut Gateway connects financial institutions, fintech companies, businesses, and consumers through secure APIs, facilitating seamless sharing of financial data and initiation of digital payments.

Tarabut was established in 2018 by Abdulla Almoayed. Tarabut Gateway aims to create a collaborative environment that empowers new entrepreneurs and enhances financial inclusion for unbanked and underserved populations in the MENA region. This app popularizes access to financial services through emerging technologies.

Remember to focus on this app because, with their CEO’s leadership and creative mindset, they have strong potential to grow not only in Saudi Arabia but also to expand into other countries across the EMEA region.

Who Uses Tarabut?

Tarabut operate with many financial institutions in Saudi arabia including top banks as: Riyad Bank, Saudi British Bank (SABB), Alinma Bank, Banque Saudi Fransi (BSF), Arab National Bank and Saudi National Bank.

Open Bankin apps is not only for banks but many fintech app can use Tarabut solutions to expand their solutions to client without built from teh scratch finccial services. Tarabut operate with quote popular fintech apps in Saudi Arabia as:

- Rain.com: A cryptocurrency platform that, through partnership with Tarabut Gateway, allows users to fund their crypto wallets directly via bank transfers within the app.

- Tamam.life: A Shariah-compliant micro-lending service provider in Saudi Arabia. By integrating Tarabut Gateway’s Account Information Services (AIS), Tamam can access real-time financial data (with user consent), streamlining income verification processes and potentially expanding its client base.

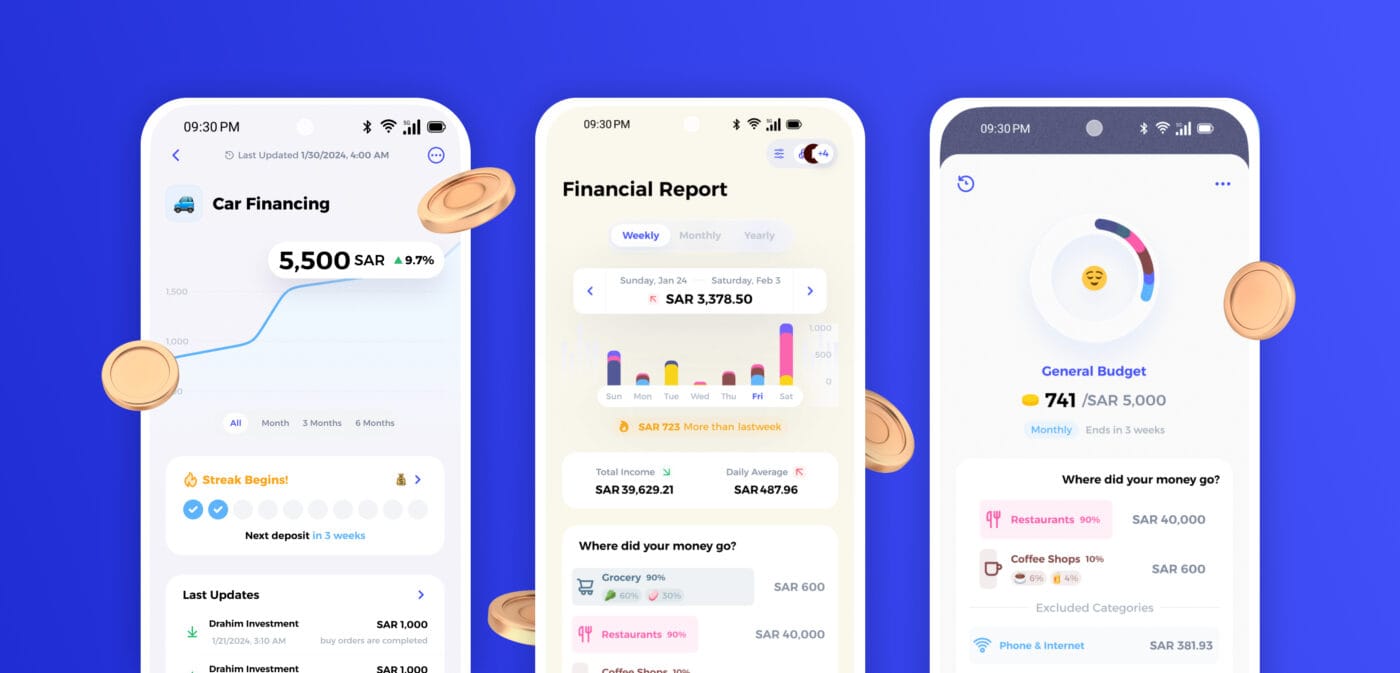

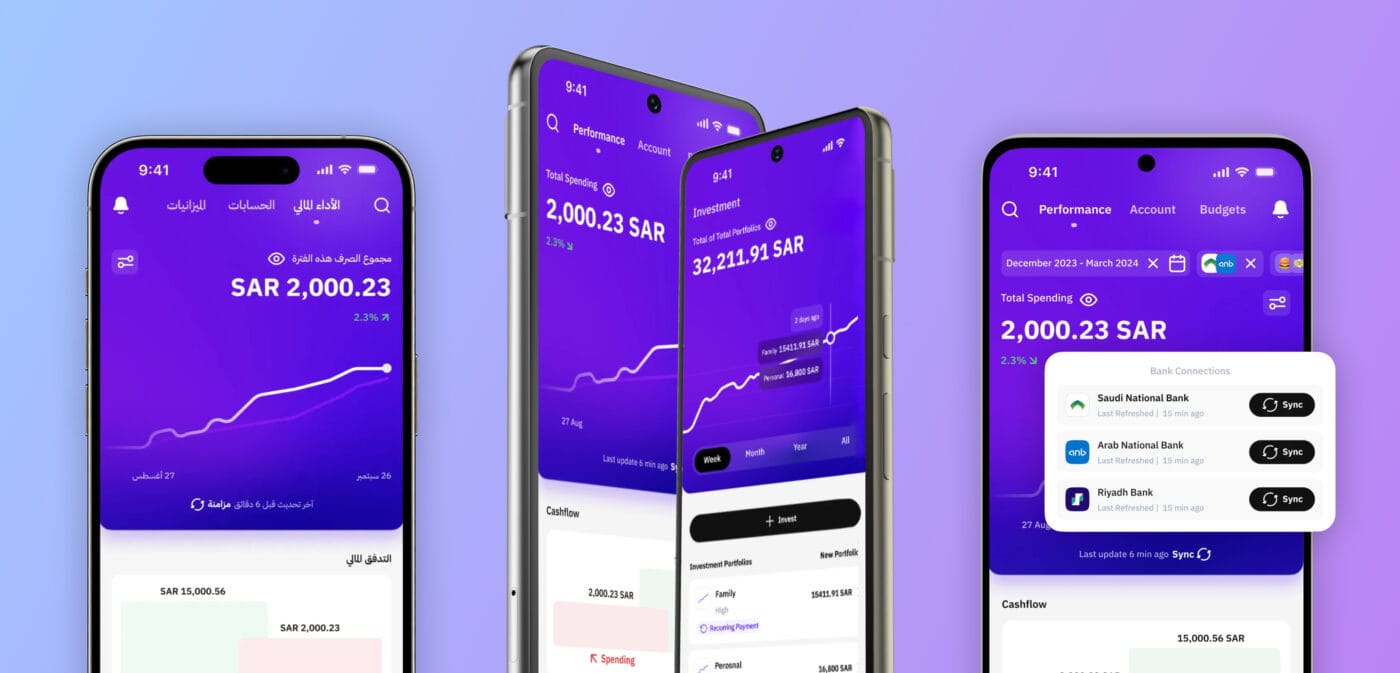

Drahim.sa

Drahim is an app designed to help individuals manage and grow their finances. Established in August 2021 established in August 2021 by co-founders Sultan Alkhayal (currently CEO of Drahim )and Yasser Alshurihi (CFO). Drahim offers a comprehensive platform that integrates personal budgeting with investment opportunities.

Who Uses Drahim?

Drahim is growing very fast, which means that from time to time, it signs strategic partnerships with various startups and other applications in the Fintech sector. In 2024, Drahim signed a contract with walaone.com — a digital wallet with rewards and gamification features that allow users to collect points from various partners such as nana.sa, deraahstore.com, and toyou.io.

Drahim app partnered with Alpaca, a platform that enables seamless integration with the U.S. stock market. Thanks to this collaboration, Saudi Arabian citizens using Drahim now have access to the U.S. stock market and can easily invest in U.S. stocks directly through the app.

The app is evolving not only as a platform to connect all your bank accounts in one place but also as a gateway for Drahim users to access a wide range of investment solutions offered by Al Istithmar Capital (in 2024, they signed a memorandum of cooperation with the company, which is well-known for its asset management and financial services.)

Drahim has established cooperation with several fintech companies and banking, including tawuniya.com (for buying and managing insurance), bankalbilad.com, jarir.com, mobily.com.sa, bankaljazira.com, and Dr. Sulaiman Al Habib Medical Group. During the #FinTech24 conference, Drahim also signed a memorandum of understanding with another investment company, musharaka.sa.

Notably, the app is also collaborating with neoleap.com.sa, a company specializing in the production of payment terminals and POS software.

This growing network of strategic partnerships clearly shows that Drahim.sa is a fintech app to watch in 2025.

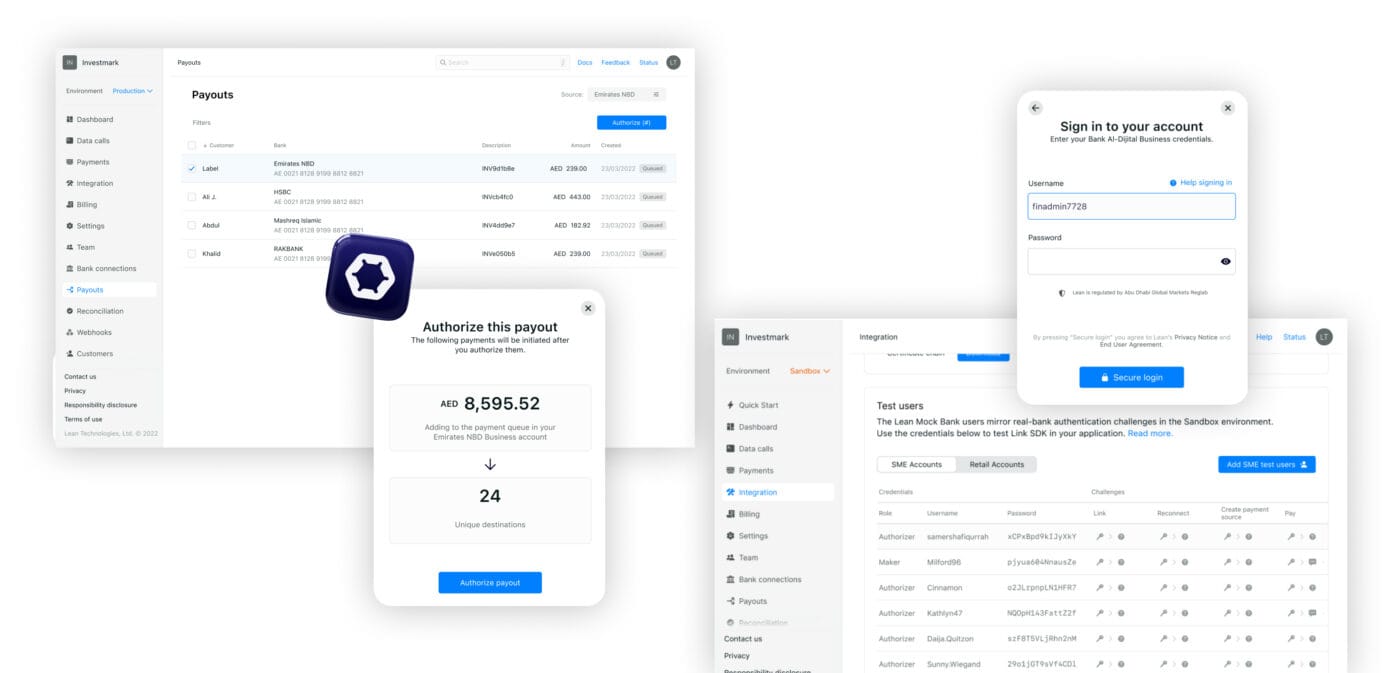

leantech.me

Lean is a company that specializes in Open Banking. As the name suggests, it enables the sharing of data between bank accounts and other applications. It acts as a bridge between banks and third-party applications, providing integration in a secure and reliable way.

Lean is more of a technological solution for companies than an app for everyday users. However, if you’re looking for a technology partner to provide a secure connection between various financial institutions, Lean is a great choice.

Contact us if you’re looking for a partner with experience in integrating with Lean. (Fun fact: many Polish professionals work in Lean’s technology teams, which can significantly improve communication with us.)

Who Uses leantech.me?

The list of clients using Lean is a trade secret. However, by reviewing their website, blog, and LinkedIn, we found several top application companies that use Lean’s technology solutions, such as Payments, KYC, and Credit Risk Scoring:

- Baraka – an investment platform enabling GCC investors to trade over U.S. stocks and ETFs, including Shariah-screened options

- Tabby – a shopping assistant that allows users to split purchases into four interest-free payments, both online and in-store

- erad.co – provides working capital to online businesses by connecting their analytics and offering non-dilutive funding as fast as 48 hours

- Wafeq – a comprehensive accounting and e-invoicing solution for business owners and accountants, offering features like invoicing, inventory management, payroll, and financial reporting

- Circlys | سيركليز – a mobile app digitizing traditional rotating savings and credit associations (ROSCA), providing users with a secure and innovative platform for managing financial circles

- drahim.sa | دراهم – A financial planning platform that integrates with banks to provide individuals with meaningful spending insights and auto-savings and investment advice.

- Hubpay – a corporate FX service and digital global currency account for UAE-based businesses and individuals, offering secure and efficient international payment solutions.

- BitOasis – a cryptocurrency exchange platform allowing users to buy, sell, and trade over 60 digital assets, including Bitcoin and Ethereum, in the MENA region

- LuLu Money – a remittance and e-wallet app facilitating instant and secure money transfers to over 140 countries, with features like transaction tracking and real-time exchange rates.

- MultiBank Group – offers a range of trading platforms, including MetaTrader 4 and 5, enabling users to trade forex, commodities, and other financial instruments.

- MySyara – a car service app providing on-demand automotive services, including maintenance and repairs, with free pickup and delivery

- Capital.com – an online trading platform offering access to over 3,000 markets, including stocks, forex, indices, and commodities, with advanced tools and educational resources

- tawuniya – a mobile application designed to provide users with convenient access to a range of eServices related to insurance and healthcare.

Malaa Technologies

Malaa Technologies is a Saudi Arabian fintech company that offers an all-in-one financial application designed to help users track, save, and grow their money. The app integrates users’ bank accounts, provides insights into spending patterns, and facilitates investments in Shariah-compliant Exchange-Traded Funds (ETFs). Regulated under the Saudi Central Bank’s guidelines and the Saudi Capital Market Authority, Malaa ensures users’ financial data is secure and used solely to enhance their financial understanding.

Malaa is a well-established app that’s secure in its development, so you don’t have to worry about it suddenly halting progress. It’s not just a startup in its early stages – it’s a dynamic company with solid financial backing. They recently secured another Series A funding round, raising SAR 65 million (€240,000), led by SNB Capital, the largest asset manager in the Kingdom, with additional support from Derayah Financial, Khwarizmi Ventures, Impact46, and Waken Wealth. If you’re living in Saudi Arabia, this is definitely an app you’ll want to download.

Malaa is growing fast, with new features rolling out every month. Big applause for the team’s focus on user experience—constantly improving the app and making it more enjoyable to use. In today’s market, the winners are the ones who prioritize great UI design and solid user research, and Malaa is clearly on the right track. With talented designers like Maaz Alside, Waleed Bahadi, and Abdulaziz Al-Ghamdi behind it, the app is in great hands. We’re excited to see what’s coming next!

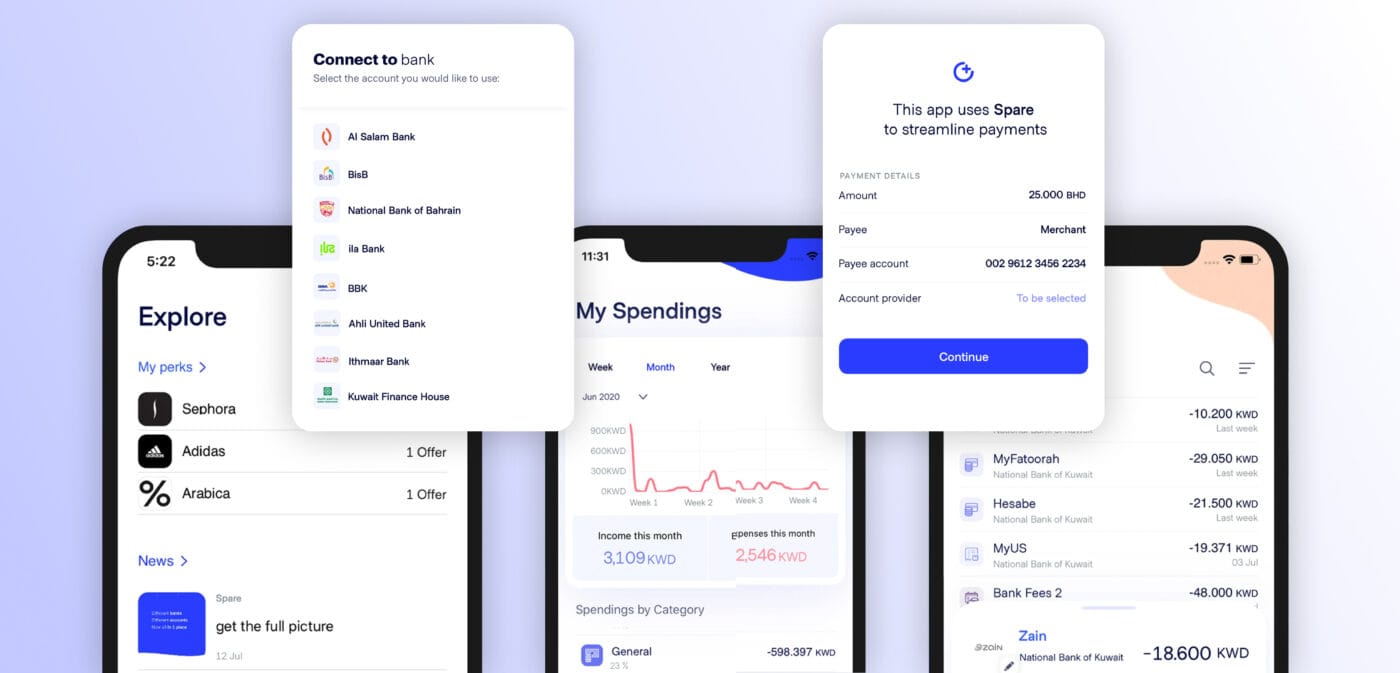

Spare

Spare is a fintech company specializing in open banking solutions, providing businesses with seamless and secure access to their customers’ financial data through a unified platform. This enables the development of innovative financial products and services.

Spare is licensed by the Central Bank of Bahrain as an Account Information Service Provider and Payment Initiation Service Provider (AISP/PISP). Additionally, it is certified as an open banking provider in Saudi Arabia under SAMA’s Fintech Regulatory Sandbox.

Spare is a tech solution designed to help companies integrate with various financial institutions. By using Spare, your app can seamlessly connect with multiple banks in Saudi Arabia to securely access information like account details, balances, transactions, and statements.

Spare also offers Payment Initiation, allowing you to make electronic payments on behalf of individuals or businesses. This feature enables transactions such as transferring funds between bank accounts or making payments to merchants and service providers.

If you’re looking for a tech solution for a future fintech app targeting the Arabic market, Spare is a solid choice. It’s more affordable than leantech.me, though it offers fewer features. If you need help integrating with either Spare or leantech.me, reach out to us – we have experience with Open Banking integrations.

Sanam

SANAM is a FinTech company that offers a personal financial management (PFM) application designed to help users manage their finances more effectively. By leveraging Open Banking principles, SANAM enables users to securely connect all their bank accounts in one place, providing a consolidated view of their financial information.

Right now, the app isn’t available for download on Apple or Google Play. Instead, you can join the waiting list to stay updated. In 2023, they received approval from the Saudi Central Bank (SAMA) to begin testing their product within the Regulatory Sandbox. We’re excited to see how the app develops, especially looking forward to its public release!

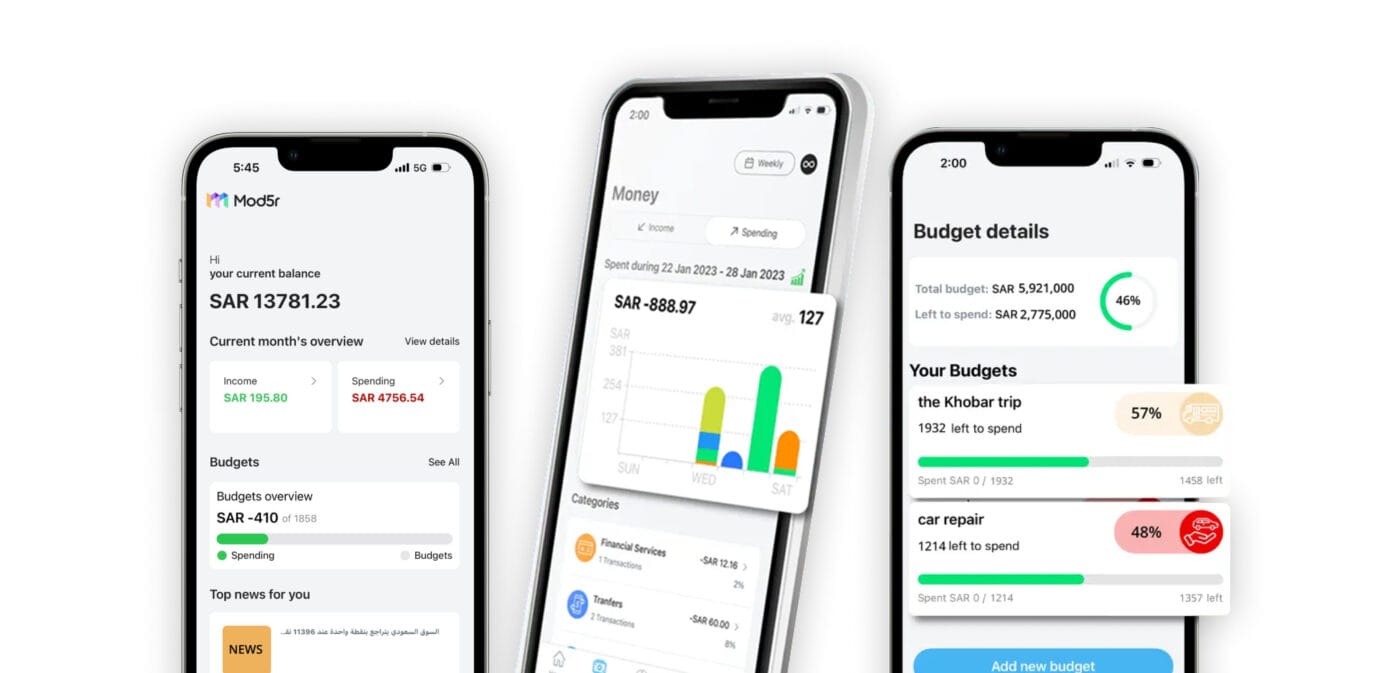

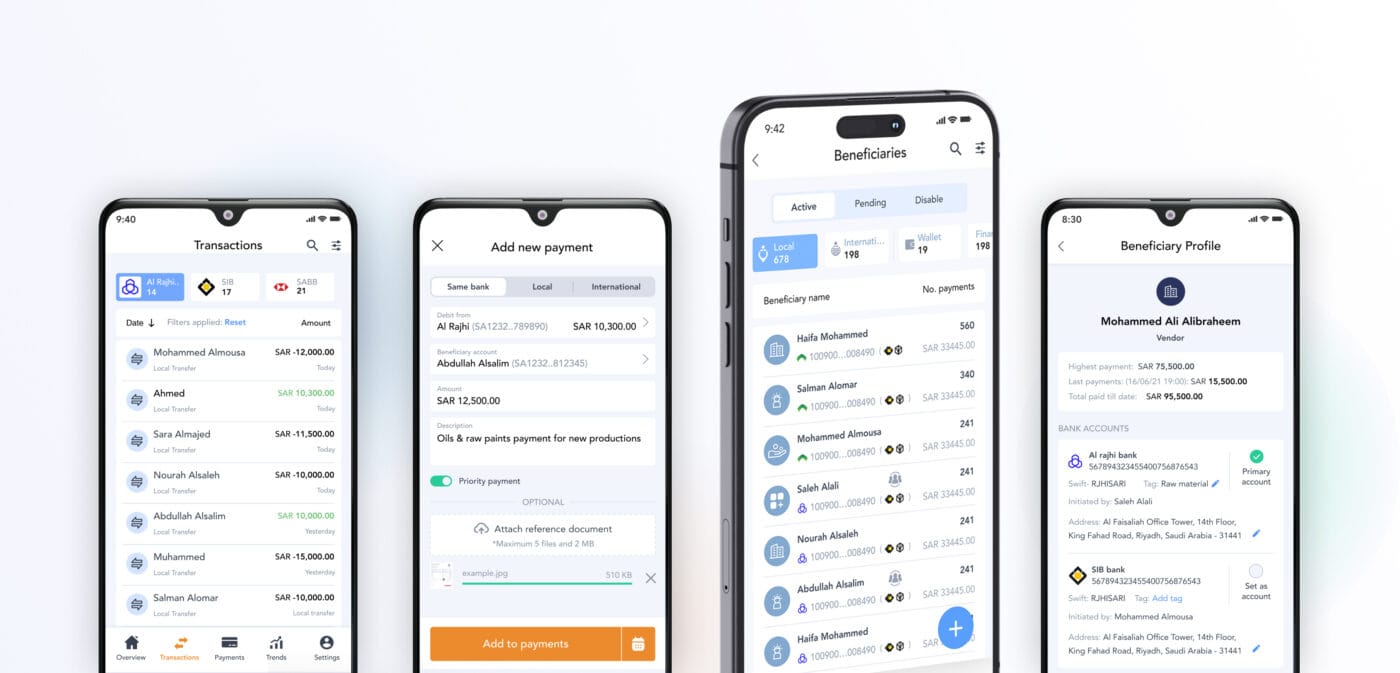

Mod5r

Mod5r is another Open Banking app based in Saudi Arabia. Founded in 2020 by Jubran Alshahrani, who currently serves as CEO, the app is available for both iOS and Android. It allows users to link multiple bank accounts in one place to track their budgets, expenses, and income. With a unified view of all financial transactions, users can easily filter and sort their data.

One of the app’s key advantages is its operation within the Saudi Central Bank’s Regulatory Sandbox. This allows Mod5r to test its solutions using APIs from various Saudi banks, all under regulatory oversight – helping the company refine and enhance its innovative services.

BwaTech

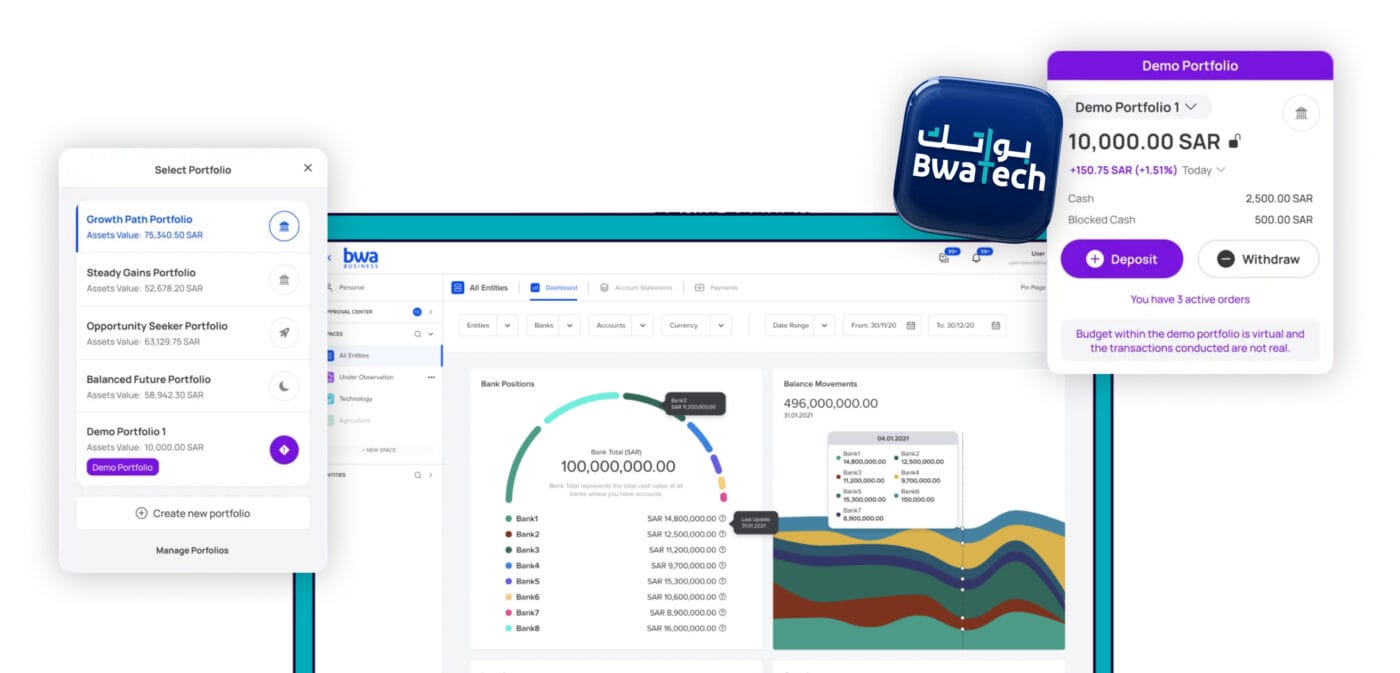

Finally, a SaaS/B2B app in the Saudi Arabian Open Banking space! BwaTech is an enterprise solution that brings together all your bank accounts and fintech apps in one place. Its flagship platform, Bwa Business, serves as a centralized hub for managing financial transactions and transfers, making it easy for corporations to handle everything from a single dashboard.

BwaTech is one of the most innovative Open Banking solutions for businesses. They offer not only a web application for managing financial transactions in one place but also several mobile applications:

- bwa Business | بوا أعمال – This mobile app provides access to data from multiple bank accounts in one place. While it’s not as comprehensive as the web/browser version, it allows users to conveniently track transactions and receive push notifications.

- BwaKey Authenticator – A standard two-factor authentication app, similar to Google Authenticator. The main advantage is that it’s tailored for the Arab market. If you need to link bank accounts registered in Saudi Arabia, this app is an ideal solution.

- Bwa Invest – A mobile app that displays all purchased assets in one place, with a clear UI showing costs and dividend payments. Bwa Invest allows users to browse both closed and open fund offerings. It also provides access to various asset classes such as Private Equity, Bonds/Sukuk, Commodities, and even Real Estate investments.

PS. Read our article on Saudi crowdfunding apps, where we detail platforms that allow you to invest in closed and open funds. We’ve listed 15 must-know applications!

Data Insights Saudi

Data Insights Saudi is another standout app for both businesses and individual users, specializing in Open Banking solutions. Founded in 2020 by Talal AlBakr, the app was originally designed to help businesses manage payments in one place, though it can also be used by private users.

One of the app’s key strengths is its partnerships with several major Saudi banks, including Alinma Bank, Banque Saudi Fransi, Riyad Bank, SNB Bank, Bank Albilad, SAB, Gulf International Bank, Arab National Bank, The Saudi Investment Bank, and Al Rajhi Bank. What really sets it apart is its extensive portfolio of integrations – far more than many competing apps offer.

We believe this app is one to watch. It has strong growth potential under the leadership of Talal AlBakr, a CEO with deep corporate and tech experience. He’s a true innovator with the vision to scale the app not only within Saudi Arabia but also globally. According to their LinkedIn page and official website, several exciting new features are in the pipeline – like instant payments, payment requests, and scheduled future-dated payments – that will clearly set them apart from the competition.

In 2025, this will be one of the fastest-growing apps in the space. Keep an eye on it!

SingleView

In our opinion, Singleview App is the best application we’ve analyzed so far. In addition to integrating with most banks operating in the Kingdom of Saudi Arabia, it offers a range of innovative features, including:

- Account-to-Account Payments (A2A): Fast transfers that help both businesses and individual users reduce reliance on card transactions and lower payment processing fees.

- IBAN Validation: Thanks to integration with various banks, users can verify IBAN numbers in real time. This significantly reduces errors caused by incorrect transfer data.

- Letter of Guarantee (LG): A powerful and convenient feature for users. The app allows users to generate Letters of Guarantee—formal agreements issued by a bank on behalf of an individual or company, ensuring payment to a third party if the customer defaults on their financial obligations. By providing assurance that a payment or transaction will be executed as agreed, LGs help reduce the risk of non-payment or late payment, ultimately minimizing financial losses for all parties involved.

- Bank Reconciliation Process: With Singleview’s centralized platform, individuals, SMEs, and large corporations can manage all payments and transactions in one place. This includes data collection and reporting, enabling more efficient audit trails and improved financial transparency.

Each version of the app – iOS, Android, and web-offers the same full set of features. According to their website and LinkedIn page, Singleview is planning to launch several exciting new features in 2025, such as:

- Direct bank account payments between consumers and merchants (similar to Poland’s BLIK system for instant account transfers), and

- Recurring payments with fixed amounts, supported by a notification system.

This is definitely an app worth following!

Rabet.sa

Rabet is primarily a technology platform designed for developers and financial institutions – it’s not a traditional mobile app for consumers like a digital wallet or banking app.

Why Rabet is Important

Rabet is not just another fintech product – it’s the rails on which other fintechs can run.

It’s like the “AWS for banking APIs” in Saudi Arabia. Others may offer parts of the solution, but Rabet brings everything together with local focus, regulation, and ease of use. But what exactly does the app offer, and what is it all about?

- API Aggregation Platform: Rabet acts as a middleware layer between banks and fintech apps. It provides a developer portal where companies can browse, test, and integrate APIs from various financial institutions.

- Target Audience: It’s aimed at developers, fintech startups, and financial institutions, not everyday consumers. Think of it like a “hub” for Open Banking APIs -a place where engineers go to plug into banking services like account info, payment initiation, and identity verification.

- No User Interface: While there is a web-based portal with a polished dashboard and documentation (designed for ease of use by engineers and product teams), there’s no mobile app for consumers like you’d find with Revolut or STC Pay.

This is an application that offers a range of technology solutions for other companies. Instead of building your fintech app from scratch, you can license Rabat’s solutions to bring your vision to life. If we at Pragmatic Coders were to create a financial application in Saudi Arabia, we would definitely choose this option. Our developers have reviewed their technical documentation—it uses the latest technologies, and the API integrations are straightforward and easy to implement.

Need a rabet.sa integration for your startup? Get in touch with us! We’re experts in building applications for the financial sector!

Summary

The Kingdom of Saudi Arabia is rapidly advancing in the development of new technologies in the financial sector, largely thanks to the funding provided by Saudi Vision 2030, the initiatives of the Saudi Central Bank, and a flexible legal framework. Open Banking projects are centrally managed, enabling the involvement of all banks and ensuring the implementation of consistent solutions.

Saudi Arabia is currently experiencing a significant boom in the field of Open Banking. As a result, numerous applications have been developed – not only for individuals but also for businesses – offering innovative financial services. From Tarabut Gateway, the first and largest regulated Open Banking platform in the MENA region, to pioneering solutions such as Drahim, Malaa Technologies, and SingleView, these platforms empower users to consolidate financial information, gain insights into their expenses in one place, make seamless payments, and access investment opportunities, such as stocks, Open and Closed Funds. All of these applications operate through secure APIs and under the regulatory oversight of the Saudi Central Bank.

There is no doubt that the market for fintech and Open Banking applications in Saudi Arabia remains highly receptive. Every year, new fintech startups emerge, offering cutting-edge solutions. A great example is the crowdfunding application market, where investing in shares and both open and closed funds is becoming increasingly accessible to the average Saudi citizen (check out our article on the best crowdfunding applications in Saudi Arabia). The Saudi tech ecosystem offers a range of ready-made solutions that can be licensed instead of being built from scratch – outstanding examples include platforms like leantech.me or rabet.sa.

If we at Pragmatic Coders were to build another startup in Saudi Arabia, we would leverage many of these ready-made tools to accelerate development and reduce the cost of building your fintech application.

If you’re looking for a company to develop your future application using Open Banking solutions, get in touch with us. We are experts in fintech app development and would be delighted to help you design your next innovative app in Saudi Arabia!