15 Saudi Arabian Apps for Alternative Investing to Watch in 2025

Each year, Saudi Arabia impresses not only with its GDP growth but also with its innovative technological solutions! At Pragmatic Coders, we keep our finger on the pulse and strive to stay up-to-date with the fintech market in Saudi Arabia. The year 2024 demonstrated how dynamic the Kingdom’s financial technology ecosystem is, and 2025 promises to be even more exciting when it comes to innovations in the fintech world.

The fintech market is thriving thanks to the Vision 2030 program, launched in 2016 by Crown Prince Mohammed bin Salman. This bold and ambitious initiative aims to transform the future of Saudi Arabia and position the Kingdom as a leader in the global economy, culture, and innovation by 2030. And being a leader is impossible without innovative technology!

Below, we present 15 fintech apps for alternative investing. Our shortlist highlights apps that will stand out in the Saudi Arabian market in 2025. Here, you’ll find the best, in our opinion, crowdfunding platforms and applications.

These platforms are democratizing investment opportunities, enabling all types of investors to participate in real estate funds, equity investments, and Islamic-compliant debt instruments (Sukuk).

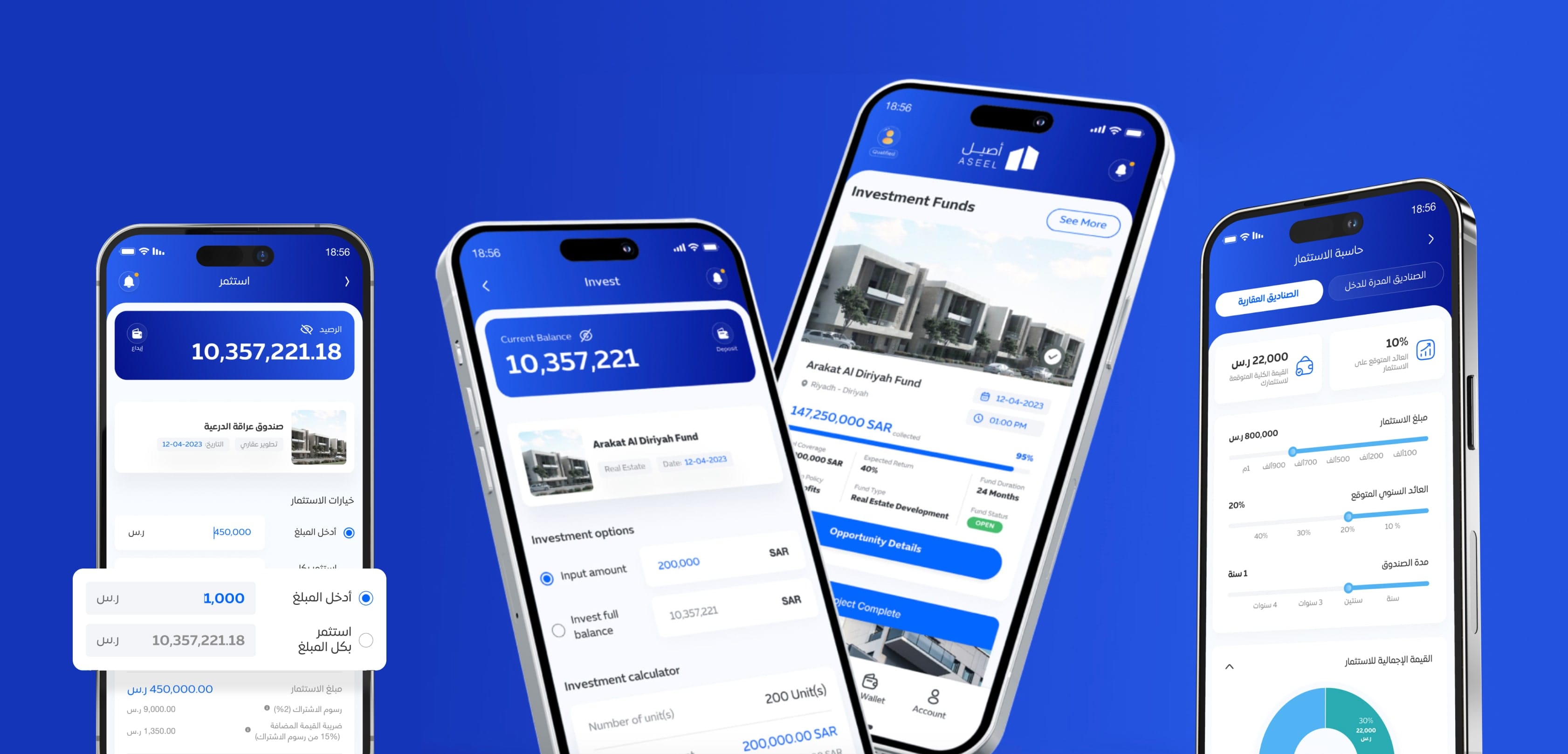

Aseel | أصيل

Asel will make waves in Saudi Arabia’s fintech scene in 2025! Founded in 2020 and licensed by the Capital Market Authority’s (CMA) FinTech Lab, it specializes in real estate crowd-investing. The app features an extremely user-friendly interface and provides support for both individual and corporate clients offers three main types of real estate investment opportunities:

- Real Estate Development: Investments in construction projects such as residential and commercial complexes.

- Infrastructure Development: Investments in raw land development and infrastructure establishment.

- Income-Producing Properties: Investments in existing rental properties that generate periodic returns.

With Apple Pay integration and fast money transfers, purchasing units is simple and convenient. Additionally, the app is available not only in a web version but also on iOS and Android. Definitely one to keep an eye on in 2025!

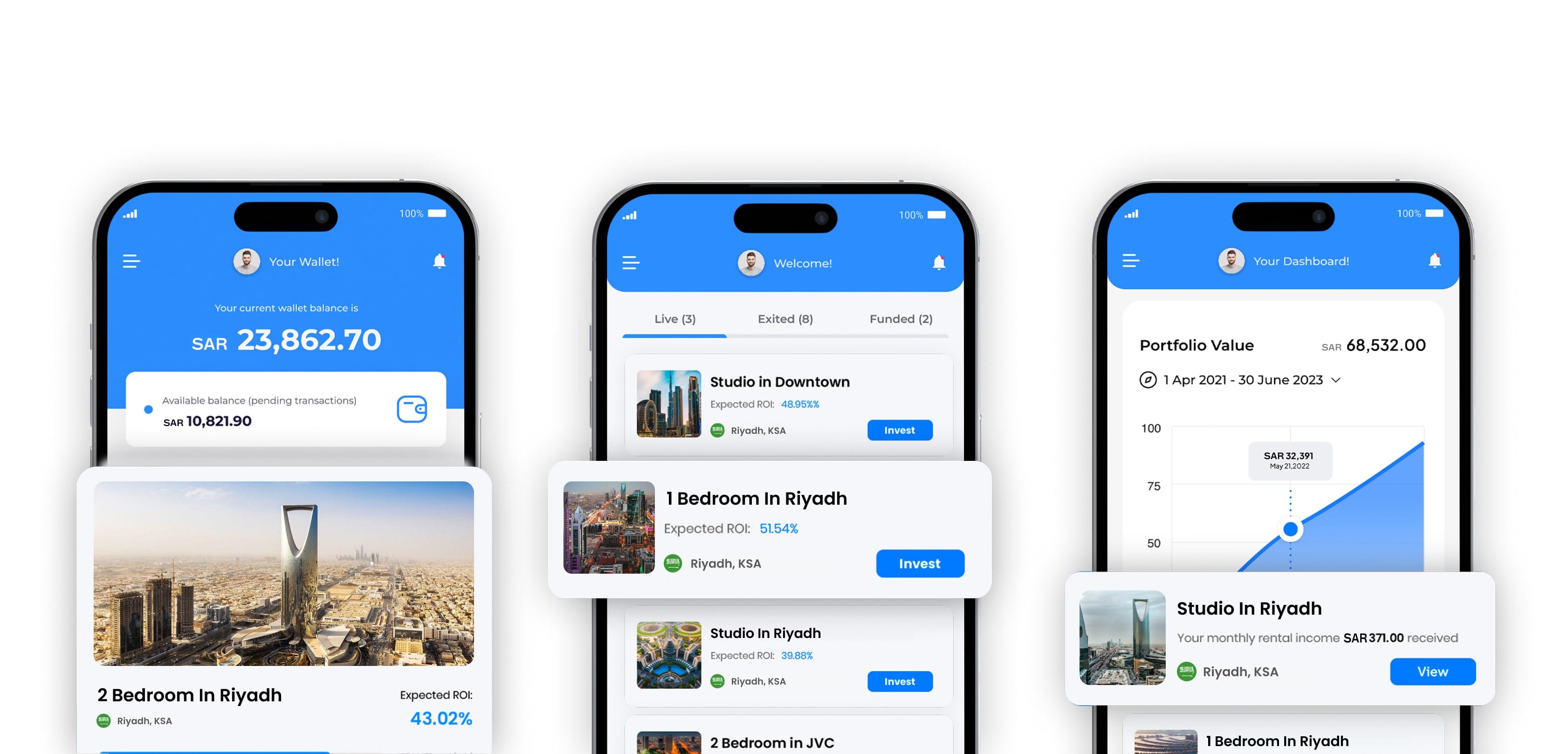

Smart Crowd Saudi Arabia

SmartCrowd.ae is one of the most popular crowdfunding apps in the United Arab Emirates, with over 90,000 users and more than 100 funded properties in Dubai. Recently, SmartCrowd secured approval from Saudi Arabia’s Capital Market Authority (CMA) to operate in the Kingdom of Saudi Arabia, and the outlook for this app in 2025 looks incredibly bright! Keep an eye on this app!

The app has the potential to achieve great success in Saudi Arabia in 2025. With Saudi Arabia’s real estate market valued at SAR 156 billion and projected to grow at a CAGR of 9.74% through 2027, SmartCrowd’s expansion into the Kingdom represents a significant opportunity to boost their revenue.

We have added this app to our shortlist because it could significantly disrupt the crowdfunding app market in Saudi Arabia. The market is slowly becoming highly competitive, with apps like: Aseel | أصيل, Arat | آرات, Safqah Capital | صفقة المالية, Rakeez | ركيز, GetStake App, Sukuk Capital | صكوك, Tarmeez Capital | ترميز المالية, Dinar Investment | دينار . It appears that for smaller firms, this app could pose serious competition!

If you want your fintech app to remain competitive, contact us. At Pragmatic Coders, we are specialists in fintech applications.

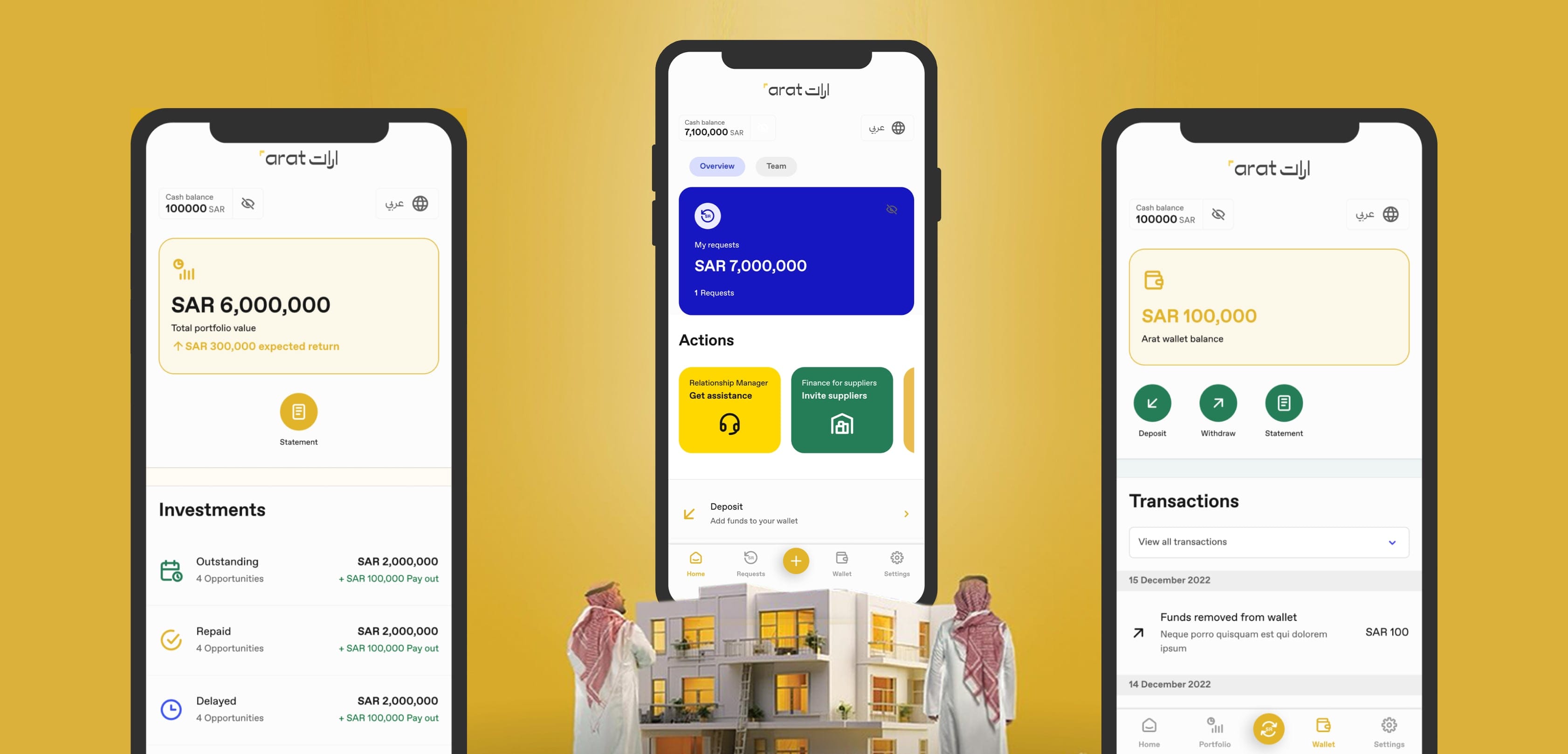

Arat | آرات

Arat is another fintech application specializing in Sharia-compliant real estate crowdfunding through the issuance of Sukuk (Islamic investment certificates). Fully licensed, it allows investment not only for ordinary citizens of Saudi Arabia but also for companies and corporations.

Using this innovative application is complemented by a fully responsive website, enabling businesses to add their investment projects and promote them through the app available on iOS and Android. Investors looking for your project can easily find it thanks to the CMS system, which simplifies the process of discovery.

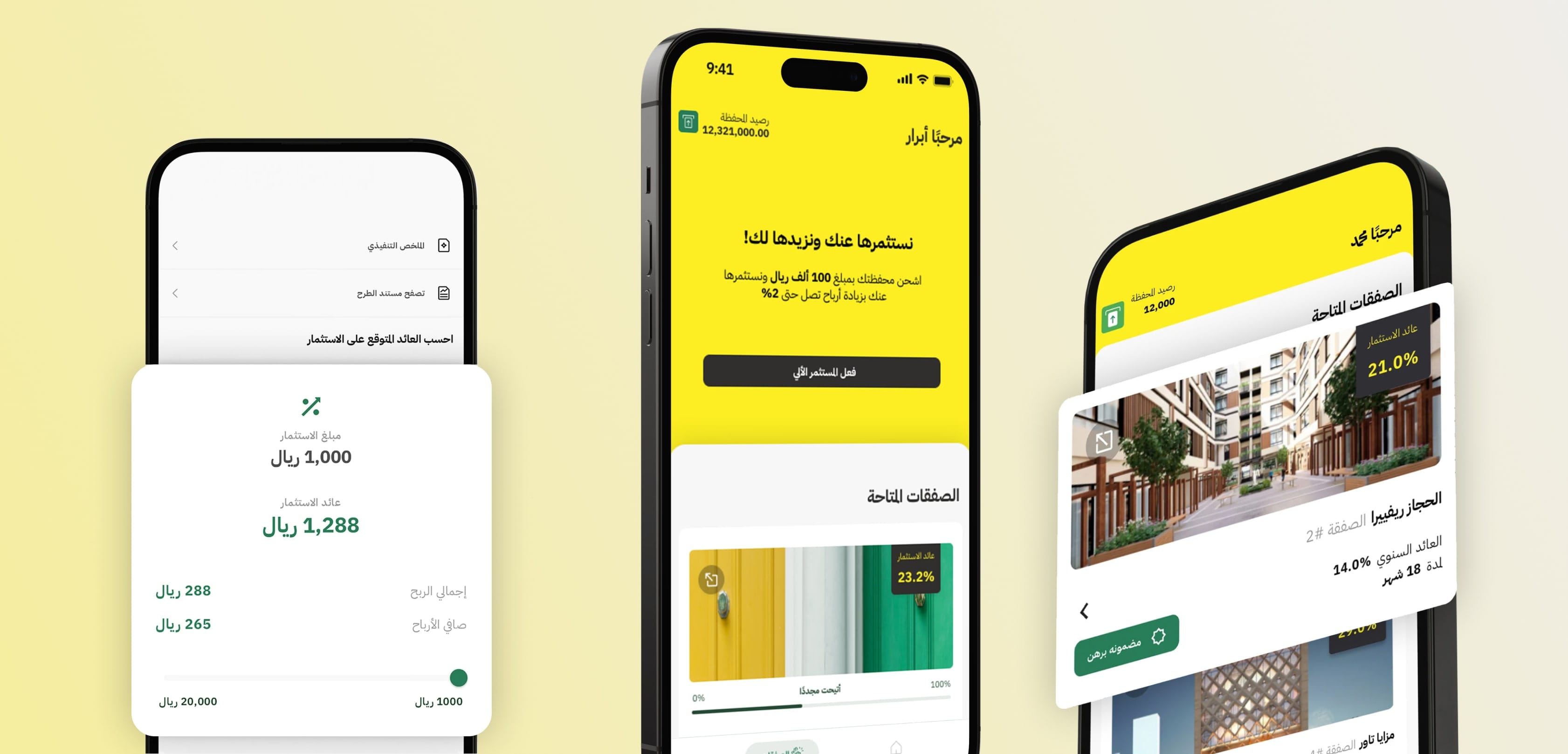

Safqah Capital | صفقة المالية

A platform approved by the Capital Market Authority (CMA) in 2023, the app has been thriving and growing rapidly since then. The year 2025 will be their time, and it’s worth keeping an eye on what new features and updates they will introduce!

The Safqah app offers debt instruments and financing for development projects. The Safaq app is available for download on both iOS and Android. They also provide a fully responsive web application. Interestingly, the promotional website for the platform was created and implemented using the Framer app (if you need a no-code website designed and deployed for your business or app within 24 hours, contact us—we are Framer experts!).

A unique feature of the platform is that it provides not only a native app for individual clients but also an online system for businesses ready to crowdfund their investments. Projects can be added within 48 hours, and the entire process can be managed through their online system!

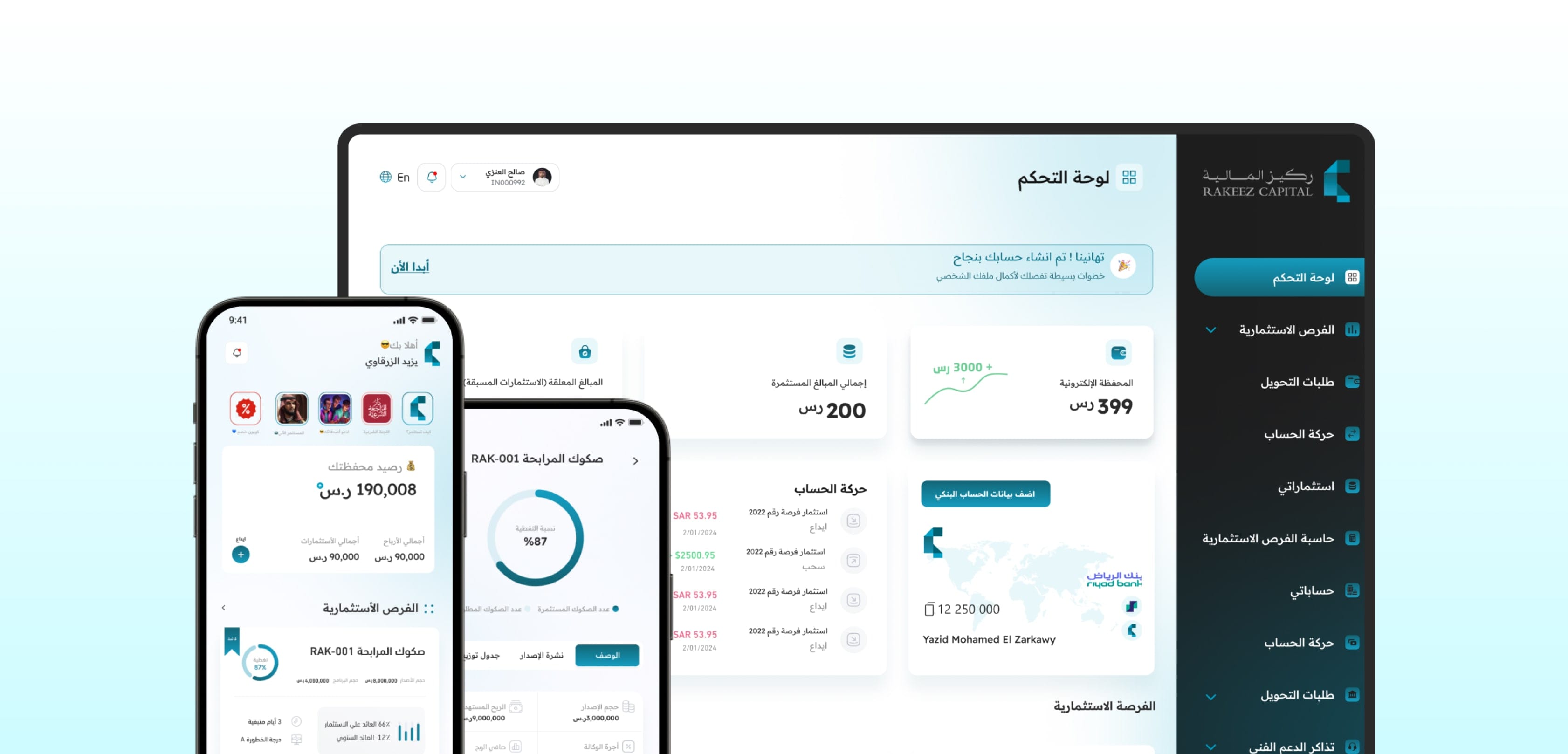

Rakeez | ركيز

Rakeez app was co-funded by the CMA’s Fintech Lab (Fintech Laboratory associated with the Saudi Arabia Capital Market Authority). The Fintech Lab focuses exclusively on innovators working in securities-related activities, providing companies with the opportunity to scale their projects over several years.

Undoubtedly, 2025 will be a pivotal year for Rakeez, marked by scaling efforts and the introduction of new, innovative functionalities in the app. We recommend downloading their app for iOS and Android to explore the new features they offer to their users.

Rakeez seems to combine AI-powered credit assessment with human expertise for project evaluation. Compared to platforms like Tarmeez and Villa Capital, which use traditional assessment methods, Rakeez employs a more sophisticated technological approach—and we truly love that! AI in fintech is what we specialize in!

If you’re looking to develop an app in Saudi Arabia through the Fintech Lab, you can submit your application here. Contact us, and we will help you implement your fintech application.

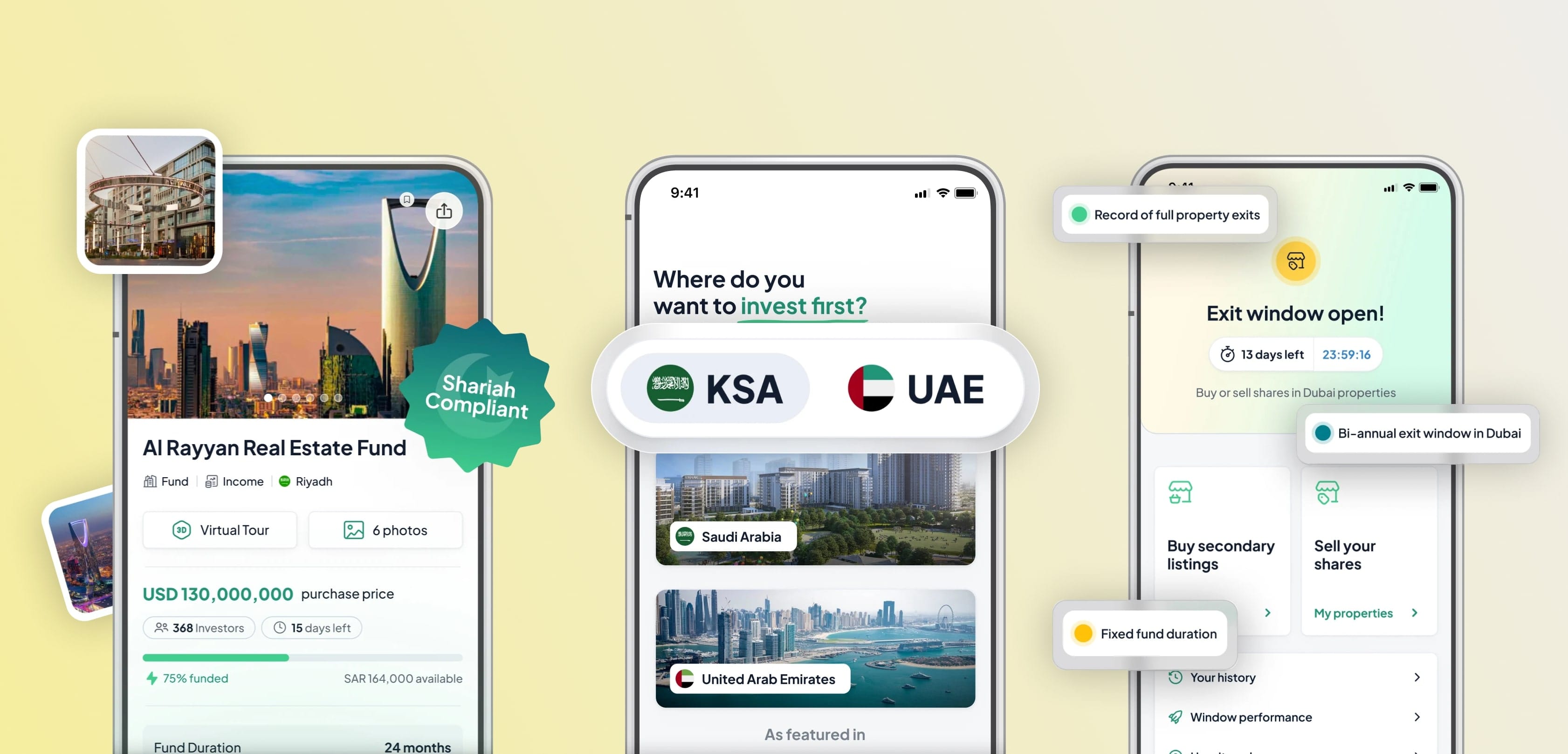

GetStake App

GetStake is an app that needs no introduction. It’s a leading crowdfunding application in the EMEA region. Stake boasts over 800,000 users from more than 200 countries. And in 2025, it is set to make a significant impact on the Saudi Arabian market. As Manar Mahmassani, co-founder and co-CEO of Stake, stated: “Saudi Arabia is a cornerstone of Stake’s vision to redefine real estate investment.”

Stake was recognized as one of the top startups in 2024 by LinkedIn and was listed in the 2024 Top 100 Global Fintech list by CB Insights. We eagerly await to see if it maintains its high ranking in 2025!

If you want to invest in real estate in Saudi Arabia, download their app on iOS and Android.

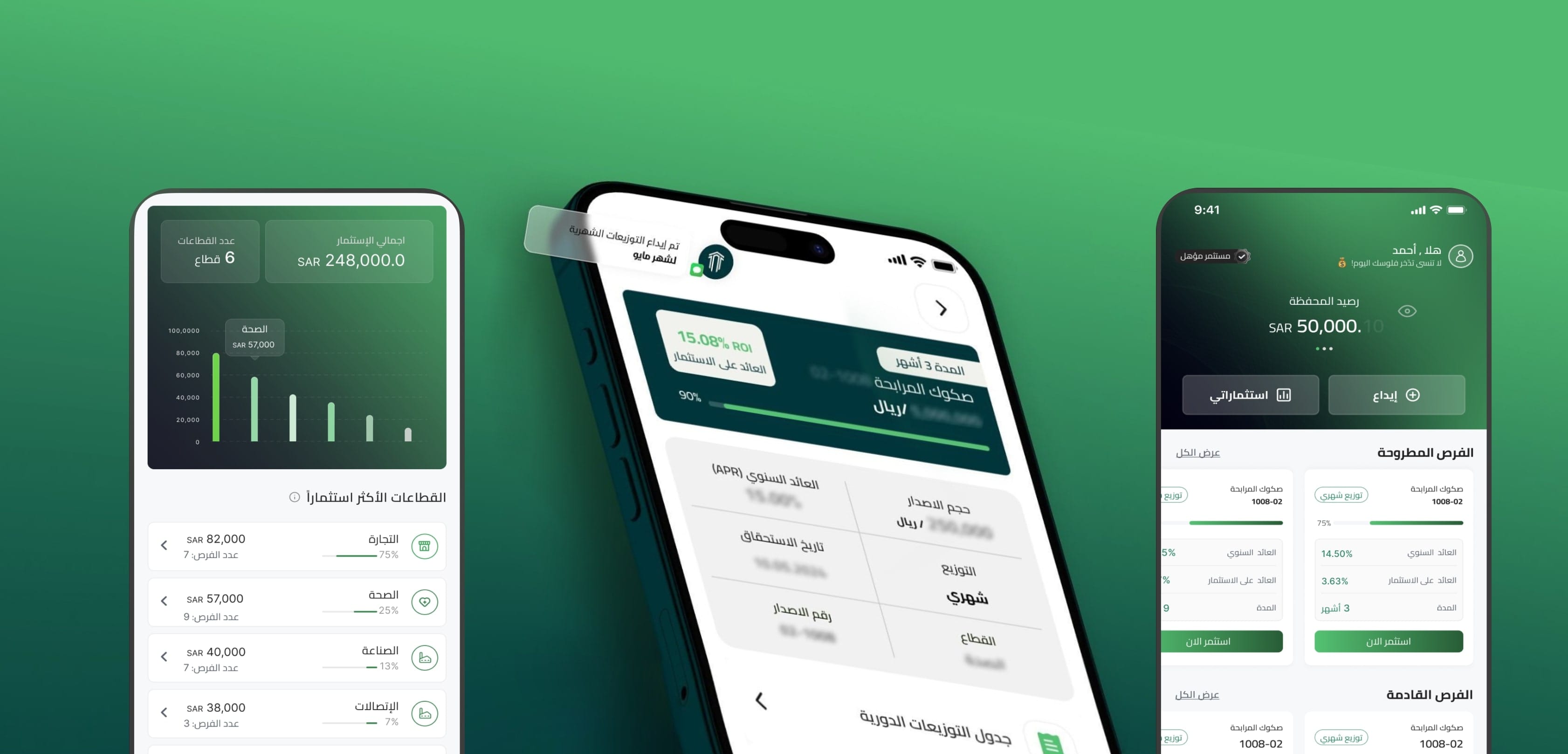

Sukuk Capital | صكوك

The app is renowned for its history and scale – one of the first in the market (launched in 2020) with proven results. Sukuk stands out as a pioneer in democratizing Islamic bonds through technology, offering a fully responsive web app along with iOS and Android apps. The platform boasts impressive funding programs, with over SAR 5.6 billion raised, making it one of the most profitable fintech apps in the Saudi Arabian market.

A key difference is that, while other platforms attempt to offer multiple services, Sukuk has mastered one specific niche—Islamic bonds—and built superior technology and processes around it. This focused approach has resulted in better returns (higher average returns of 11.81% compared to similar platforms), lower risk, and a more streamlined user experience than its competitors.

This makes Sukuk particularly appealing to investors seeking a proven platform with strong risk management and consistent returns in the Islamic bonds space.

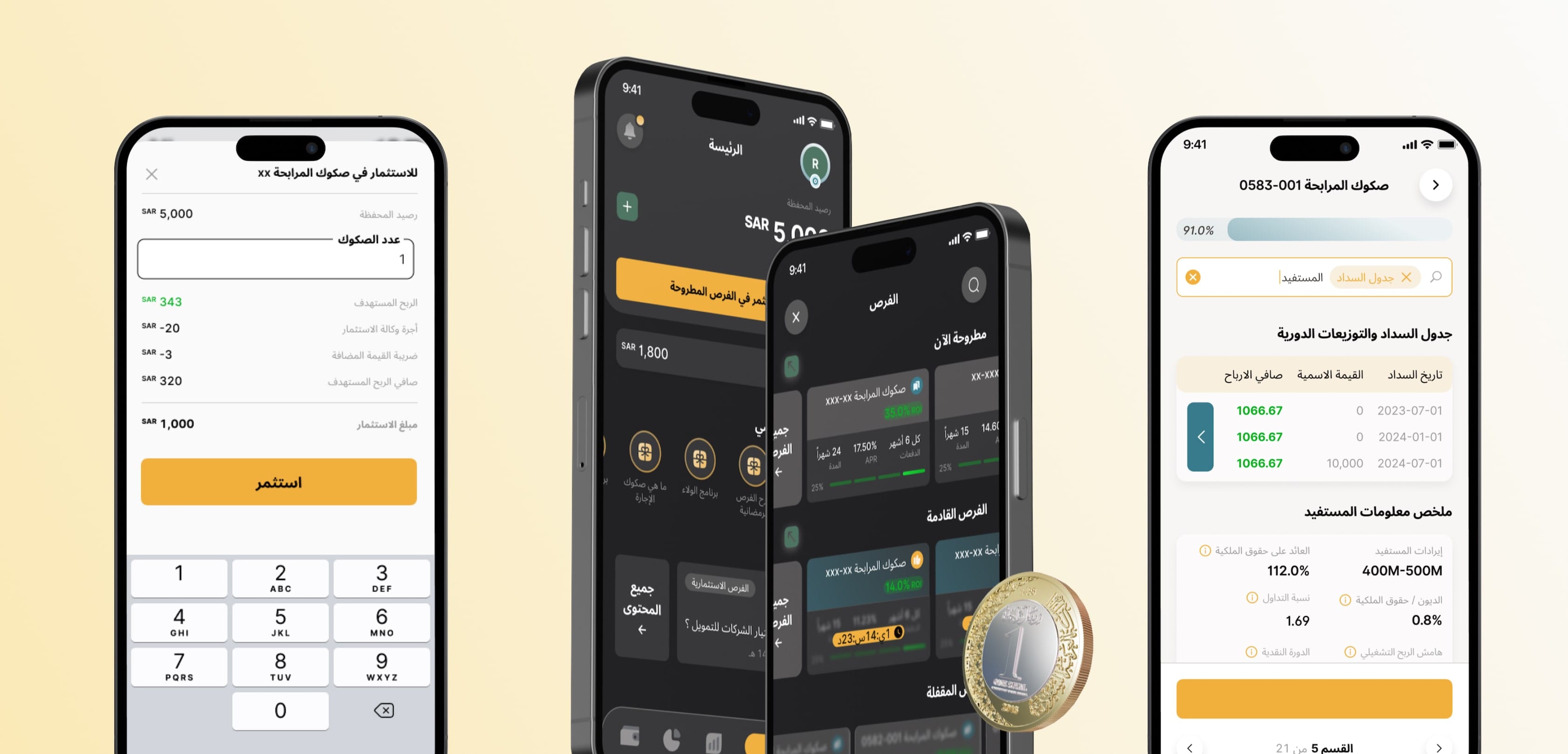

Tarmeez Capital | ترميز المالية

Tarmeez Capital stands out in Saudi Arabia’s fintech landscape! While other platforms focus on real estate or equity, Tarmeez uniquely enables investments in corporate debt instruments starting from just 1,000 SAR, filling a crucial market gap where previously only large investments over 240 million SAR were possible. With its recent government partnership and specialized focus on Murabaha Sukuk, Tarmeez is transforming how everyday investors can access corporate Islamic bonds in Saudi Arabia.

The app provides a user-friendly digital experience with Apple Pay payments and traditional bank transfers. Users can complete the investment process through the mobile app and monitor their investments in real time! Check it out on iOS and Android to see what opportunities it offers!

Dinar Investment | دينار

Dinar is the next Saudi Arabian fintech company specializing in corporate Sukuk (Islamic bonds) investments. The platform enables companies to obtain financing and allows investors to participate in debt instrument investments in a Sharia-compliant manner.

The app collaborates with numerous financial companies and institutions in Saudi Arabia. Recently, it launched a joint financing product worth 2 billion riyals in partnership with major banks, including Alinma Bank and Bank Aljazira. This demonstrates the significant appetite for growth, which is expected not only to continue but accelerate in 2025!

At Pragmatic Coders, we love advanced technology, especially when it aligns with local KYC legislation. That’s why we’ve chosen the Dinar app, as it is the first fintech company from SDAIA’s Data and Privacy Sandbox Initiative (a program by Saudi Arabia’s Saudi Data and Artificial Intelligence Authority designed to enable secure and innovative data sharing while ensuring robust privacy protections and compliance with data regulations.)

Dinar is available on iOS and Android platforms. They also offer a responsive web application, making the app accessible on any device.

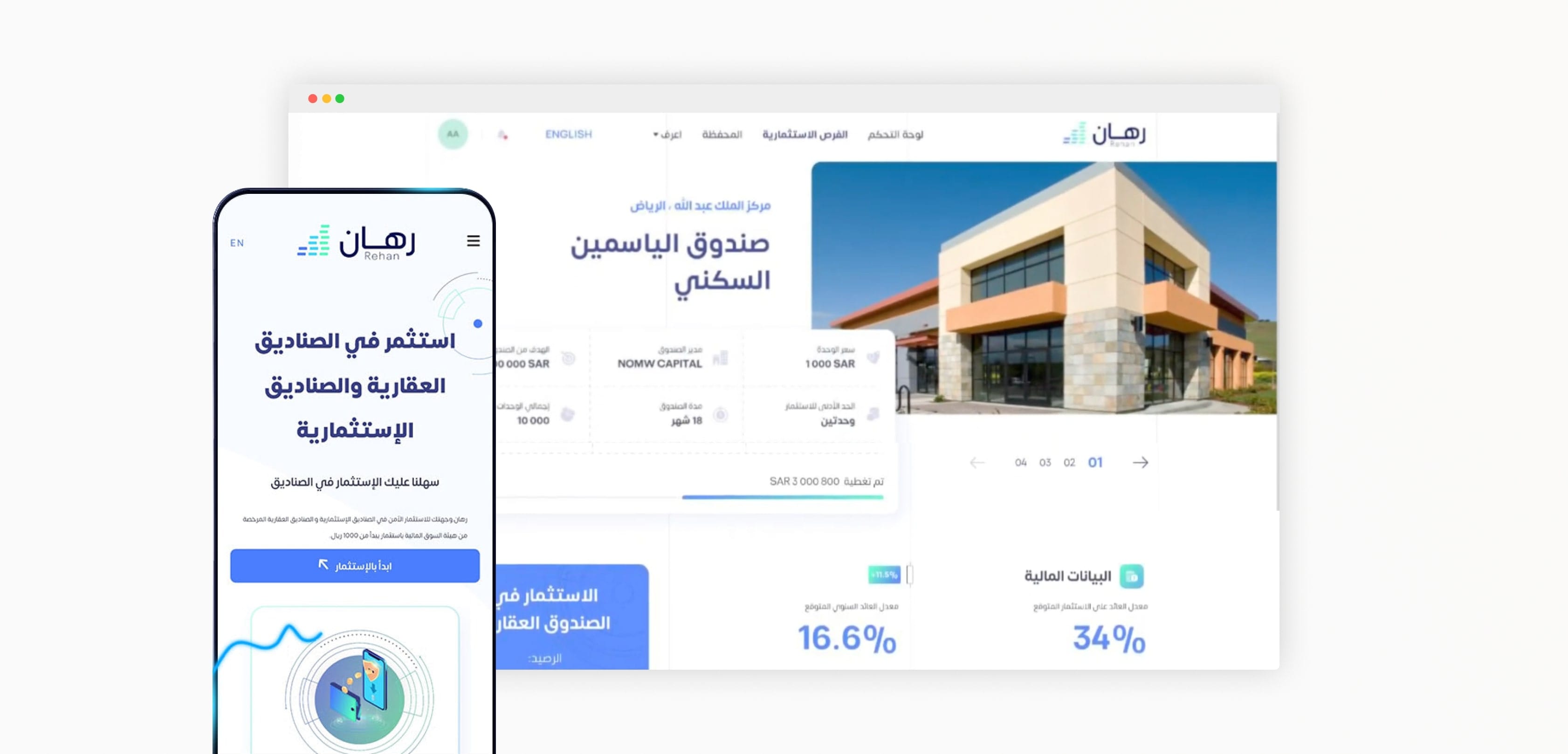

Rehan Capital | رهان المالية

Rehan isn’t particularly unique in its core offering compared to other Saudi fintech platforms. They do not currently have dedicated iOS and Android apps, but from their social media channels, we know… they plan to launch native apps for iOS and Android, which makes them worth keeping an eye on in 2025!

What’s notable is that Rehan appears to be competing in an increasingly crowded space where several platforms are striving to stand out with lower fees, reduced costs, flexible investment options, AI integration, and most importantly, better user experience.

We will keep an eye on them and keep our fingers crossed for the release of their app on iPhone and Android systems.

Mudaraba Financial Company | مضاربة

Mudaraba connects entrepreneurs with investors through Sharia-compliant crowdfunding. The platform specifically focuses on helping small and medium enterprises (SMEs) raise capital through Mudaraba Sukuk (Islamic debt instruments) without requiring them to give up ownership stakes.

Undoubtedly, the company itself is highly innovative in terms of technology:

- Utilizes a proprietary, state-of-the-art algorithm-driven funding platform.

- Employs ModeFinance’s sophisticated credit decision engine, powered by 40,000 different data models.

It also stands out among other applications with its investor protection mechanisms:

- Investment management fees are only collected after successful repayment.

A significant differentiator is their fully responsive web application, as well as their iOS and Android apps, making the platform accessible and versatile for all users.

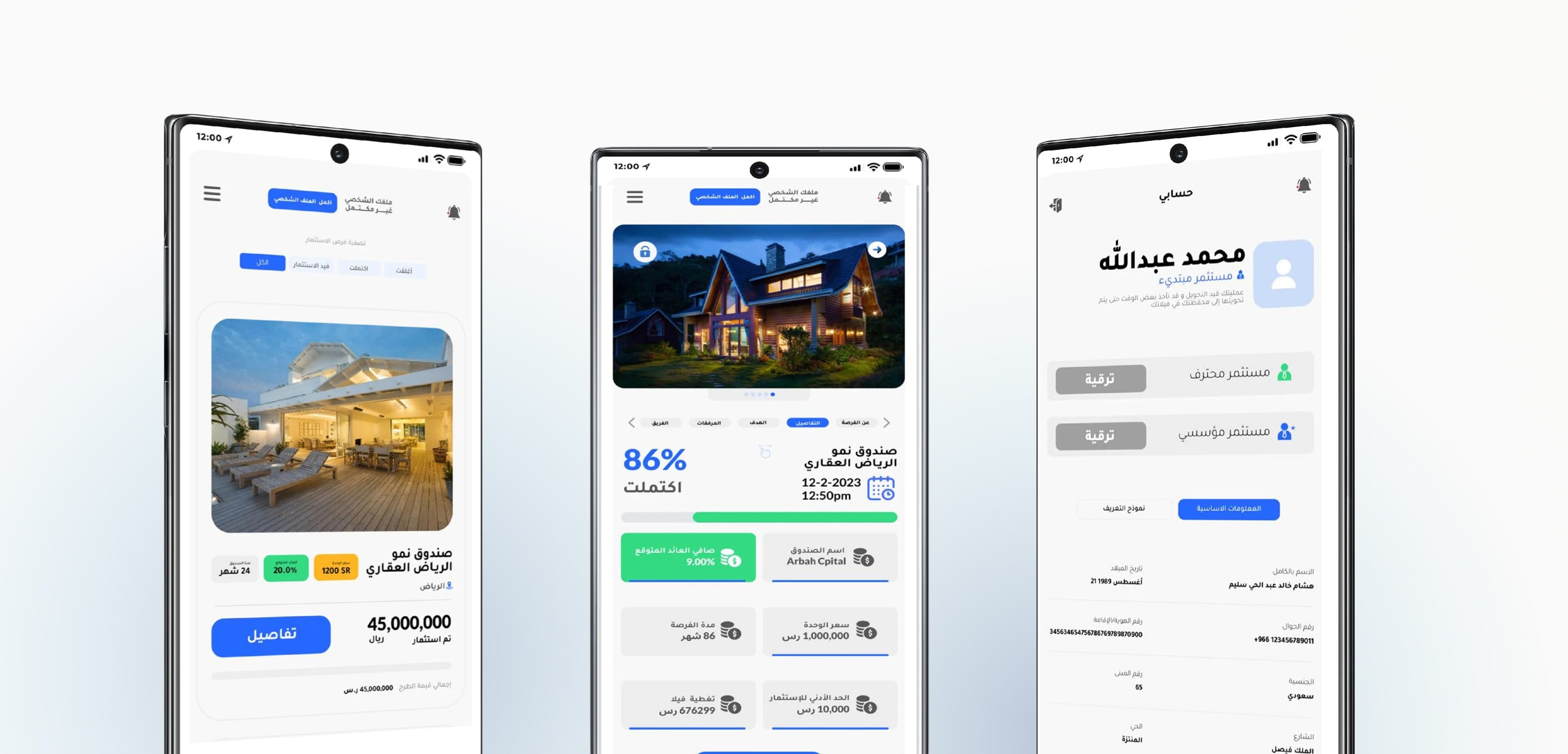

Jana Financial | جنى المالية

The year 2024 was a period of significant growth for “جنى المالية | Jana Financial.” They received a license from the CMA and launched their mobile app on iOS and Android platforms.

Jana is a typical crowdfunding app that offers diverse investment opportunities across multiple fund types, including:

- Real Estate Funds

- Fixed Income Funds

- Private Equity Funds

- Venture Capital Funds

Jana Financial has been actively expanding through strategic partnerships with key Saudi Arabian companies, such as:

- Inovest Real Estate Company – one of the first developers in the Kingdom of Saudi Arabia to implement building sustainability standards

- Watheeq Capital – One of the largest investment firms in Saudi Arabia. Abdullah Al Muhareb himself is on the board of Jana and Watheeq.

- Alpha Real Estate

- Rabeh Capital

Jana knows how to collaborate with innovative companies in the real estate sector and those offering financial services! Without a doubt, Jana is worth noting if you’re looking to invest in real estate in Saudi Arabia. It is set to become one of the most important crowdfunding apps in 2025, especially as the focus shifts toward local rather than global investments. The Jana app is dedicated to increasing small investor participation in regional investment opportunities.

Undoubtedly, 2025 will be a pivotal year for this platform. We look forward to seeing how it develops and will be closely monitoring its progress!

Villa Capital | فيلا المالية

Villa Capital (فيلا المالية) is a financial technology company that positions itself as a platform making real estate investment accessible to a broader range of investors, with their slogan being “We are all real estate agents through Villa Finance.” Villa specializes in providing individual investors with carefully selected real estate investment opportunities. If you want to invest, download the app for iOS and Android.

Villa works closely with the Arab National Bank, which serves as their strategic partner in financial technology. It’s worth noting that this is one of the most advanced banks in Saudi Arabia, suggesting that in 2025, Villa Capital is likely to offer its clients even more options for financing their investments.

Unlike platforms that offer a broad range of investment products, Villa Capital specializes exclusively in the real estate sector. An increasing number of individual clients who want to start investing with as little as 1,000 SAR are primarily choosing real estate investments, suggesting that the Villa Capital app will be one of the most popular in 2025.

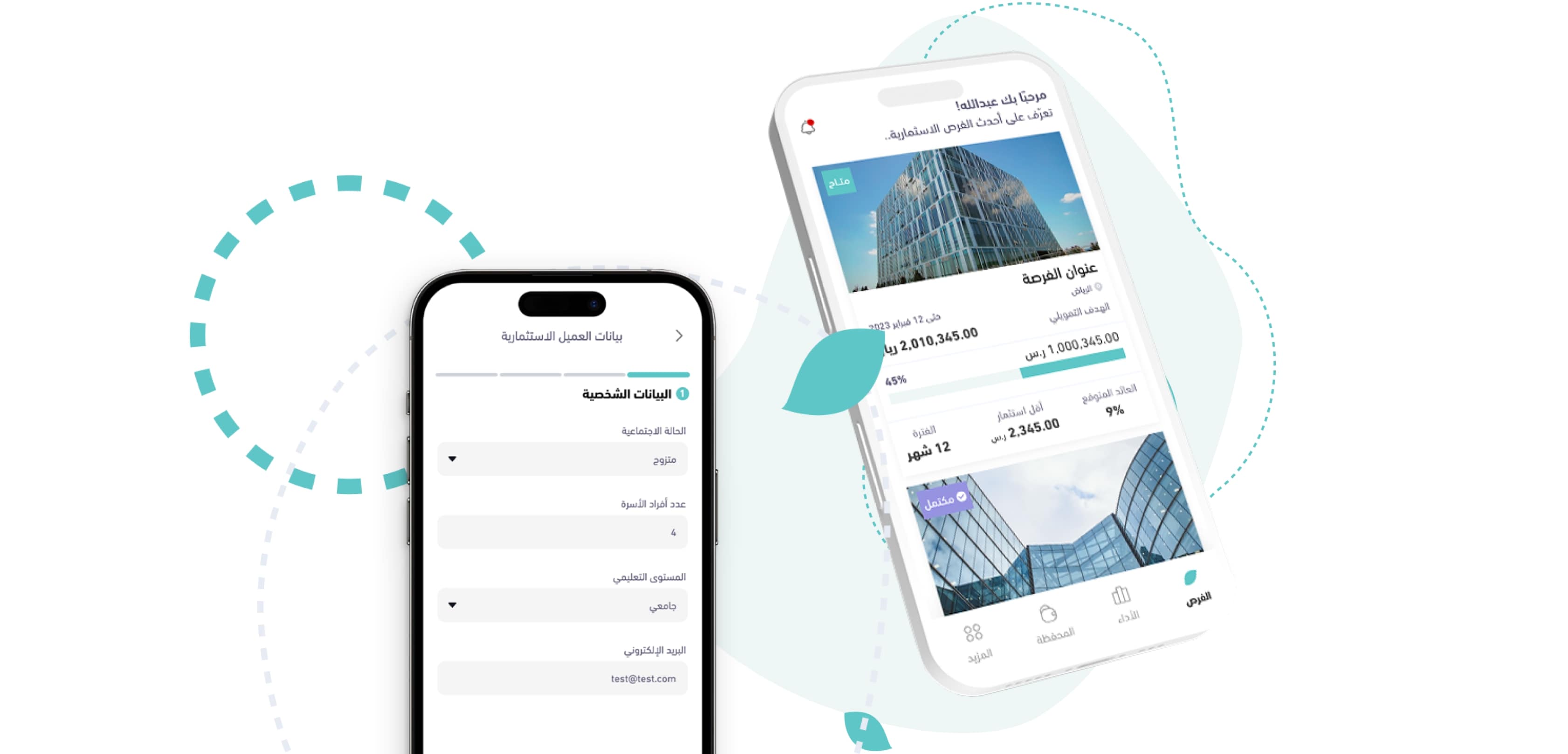

Nama.fund

Although the Nama.fund app does not yet exist and is still under development, we included it for a good reason. Nama.fund is funded by one of the largest venture capital firms in Saudi Arabia—Fintactics Ventures.

The app was also recognized in the Annual Fintech Report 2023 by Fintech Saudi (an initiative launched by the Saudi Central Bank in partnership with the Capital Market Authority to develop the fintech ecosystem in Saudi Arabia). With such significant entities collaborating on this app, it’s definitely worth keeping an eye on in 2025!

Mekyal Financial Technologies

Mekyal is a typical crowdfunding app, but with big ambitions. As stated on their website, their goal is to become the largest crowdfunding platform in Saudi Arabia. It offers its clients a variety of investment options and does not focus solely on one type of investment (such as real estate or Sukuk).

Mekyal provides both equity crowdfunding and debt instrument offerings. The app serves as a bridge between multiple stakeholder groups, including entrepreneurs, startups, SMEs, and investors (You can check their app on iOS and Android.).

If you’re a fan of crowdfunding apps and want to invest not just in Sukuk or real estate but also in equity crowdfunding like gyms, cafés, apps, or eCommerce – this is the app for you!

Summary

Alternative Investment apps in Saudi Arabia are continuously evolving. There is significant potential not only for introducing new apps to the market but also for enhancing existing ones. Individual investors are eager for new forms of investment, and the market in the Kingdom of Saudi Arabia holds tremendous potential.

Based on the Annual Fintech Report 2023, the Saudi market has shown remarkable growth, with key metrics such as:

- The total number of investors grew to 305.8K, with a 147% YoY growth in qualified/institutional investors.

- The total value of debt investments raised reached SAR 2.1 billion (a 244% YoY growth).

- The number of debt instruments issued increased by 478% to 2,000.

The growth of innovative fintech apps in Saudi Arabia is made possible not only by the support of the Capital Market Authority (CMA), which has created a favorable regulatory environment through its FinTech Lab, but also by the ambitious Vision 2030 program.

If you want to build your own fintech app in Saudi Arabia, contact us. At Pragmatic Coders, we know how to develop innovative fintech solutions, and have experience working on products for the markets of the Middle East. Contact us!

Sources

Sources

- https://cma.org.sa/en/AboutCMA/Pages/AboutCMA.aspx

- https://cma.org.sa/en/Market/fintech/Pages/default.aspx

- https://www.vision2030.gov.sa/en

- https://fintechsaudi.com/wp-content/uploads/2024/10/Annual%20Fintech%20Report%202023_-_English.pdf

- https://fintechsaudi.com/

- https://mekyal.com/en/

- https://nama.fund/

- https://fintactics.ventures/

- https://www.sama.gov.sa/en-US/pages/default.aspx

- https://anb.com.sa/web/anb

- https://www.villacapital.sa/en

- https://innovest.com.sa/en/

- https://www.watheeq.com/en/

- https://alpha-estate.sa/en/

- https://www.rabeh.sa/en

- https://janafinancial.sa/

- https://mudaraba.sa/

- https://rehan.com.sa/

- https://www.dinar.sa/

- https://www.alinma.com/en/

- https://www.bankaljazira.com/en-us/personal-banking/digital-banking/aljazira-online

- https://sandbox.sdaia.gov.sa/en/index.aspx

- https://sdaia.gov.sa/en/default.aspx

- https://tarmeez.co/

- https://sukuk.sa/

- https://getstake.com/

- https://www.arabnews.com/node/2582339/corporate-news

- https://www.linkedin.com/in/manarm/

- https://www.cbinsights.com/research/report/top-fintech-startups-2024/

- https://cma.org.sa/en/Market/fintech/Pages/default.aspx

- https://rakeez.sa/

- https://safqah.co/

- https://www.arat.co/en

- https://www.investopedia.com/terms/s/sukuk.asp

- https://www.zawya.com/en/press-release/companies-news/smartcrowd-secures-cma-permit-to-expand-into-saudi-arabia-jflnberi

- http://SmartCrowd.ae

- https://investaseel.sa/