How to use AI in accounting?

The fuel for AI is data. And, since most if not all financial data is usually stored in an exceptionally well-organized format (Excel sheets), such data can be easily become part of automated financial workflows that enhance productivity and provide earlier unavailable insights.

Yet, how to get the most out of AI in accounting?

In this article, we’re answering the question and discussing:

- 2 types of AI accounting tools,

- 5 steps it takes to integrate AI into an accounting workflow in your organization,

- 4 ways we can help you.

AI DEVELOPMENT SERVICES

How can accounting be automated with AI?

First, let’s systematize the main areas of organizational accounting-so that we know what can be automated.

- Bookkeeping: Recording financial transactions, classifying them into appropriate accounts, and maintaining accurate financial records.

- Financial analysis (which leads to forecasting, budgeting, reporting): Analyzing financial data to identify trends, assess performance, and prepare financial reports.

- Tax & regulation compliance: Ensuring that the company complies with all relevant tax laws and regulations. This includes preparing tax returns, calculating tax liabilities, and staying updated on tax changes.

Bookkeeping serves as the foundation for financial analysis, tax compliance, and forecasting by providing accurate and reliable financial data.

AI in bookkeeping

AI can streamline the bookkeeping process by:

- Extracting data from various sources

- Categorizing transactions

- Grouping related financial information

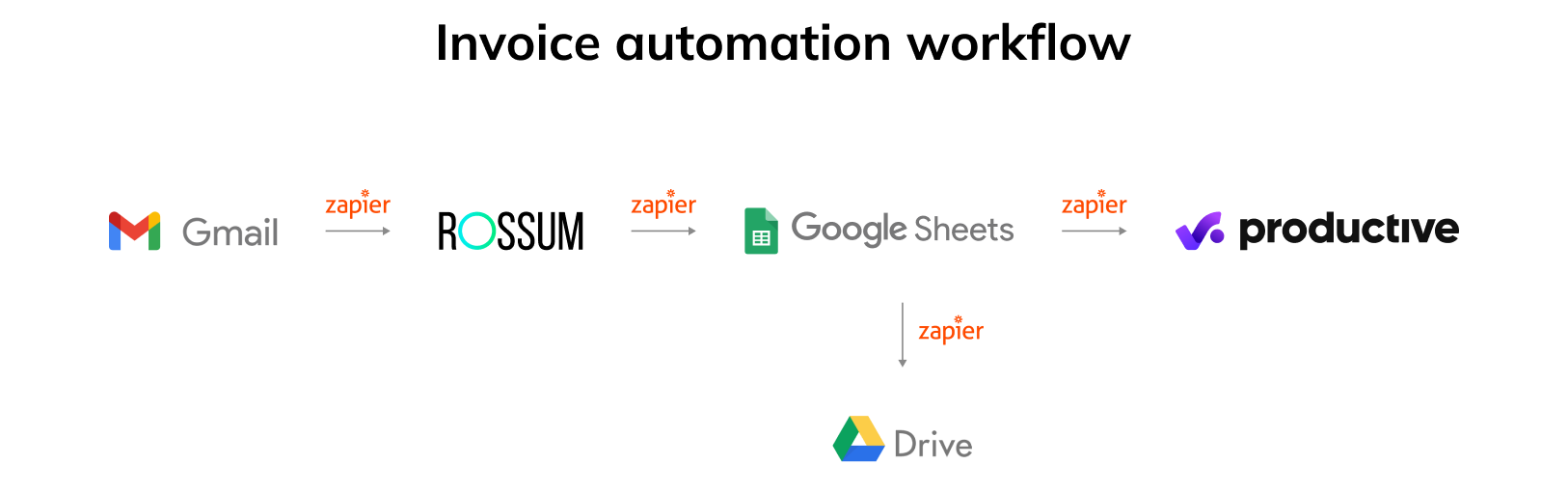

Let’s take a quick look at an example of an invoice processing workflow we’ve implemented at Pragmatic Coders (we’ll cover it in more detail later in this article).

Martyna, finance specialist at Pragmatic Coders, was overwhelmed by the daily task of manually inputting invoice data (PDFs, scans, or images) from various departments into Google Sheets and Productive. To deal with this problem, we used low-code and artificial intelligence (OCR) to create a simple document management workflow. Our system now captures invoice data automatically from emails, extracts key information, and organizes it in spreadsheets. It also categorizes expenses and stores documents digitally.

Result?

Up to 2h of repetitive everyday work saved.

AI in financial analysis (forecasting, budgeting & reporting)

The fuel for AI is data. And, since most if not all financial data is usually stored in an exceptionally well-organized format (Excel sheets), such data can be easily analyzed. With the data analysis serving as the base, AI can then provide insights that support forecasting and budgeting activities, and generating reports.

What can AI do?

Pattern recognition & trend analysis

AI algorithms can identify patterns and trends in historical financial data that might be invisible to human analysts. It could recognize seasonal fluctuations, cyclical patterns, and long-term trends in revenue, expenses, and other key financial metrics. It could also create multiple forecast scenarios based on different sets of assumptions or potential market conditions.

Anomaly detection

AI can flag unusual transactions or patterns that deviate from historical norms. This helps in identifying potential errors, fraud, or significant changes in financial behavior.

Automated reporting & recommendations

With so much data gathered and analyzed, generating reports, whether in written or graphic form, including insights, and recommendations, is a natural final step.

AI in tax & regulation compliance

When it comes to tax and regulation compliance, accountants’ role is to ensure that the company complies with all relevant tax laws and regulations. This includes preparing tax returns, calculating tax liabilities, and staying updated on tax changes.

I asked Martyna for her opinion in this field. While she said she wouldn’t trust AI with staying up to date on tax changes (as Poland’s regulation ecosystem is really complex), she expressed her belief that artificial intelligence could be used to:

- Look for information within an accounting database;

- Summarize long documents;

- Generate some types of financial documents (like applications).

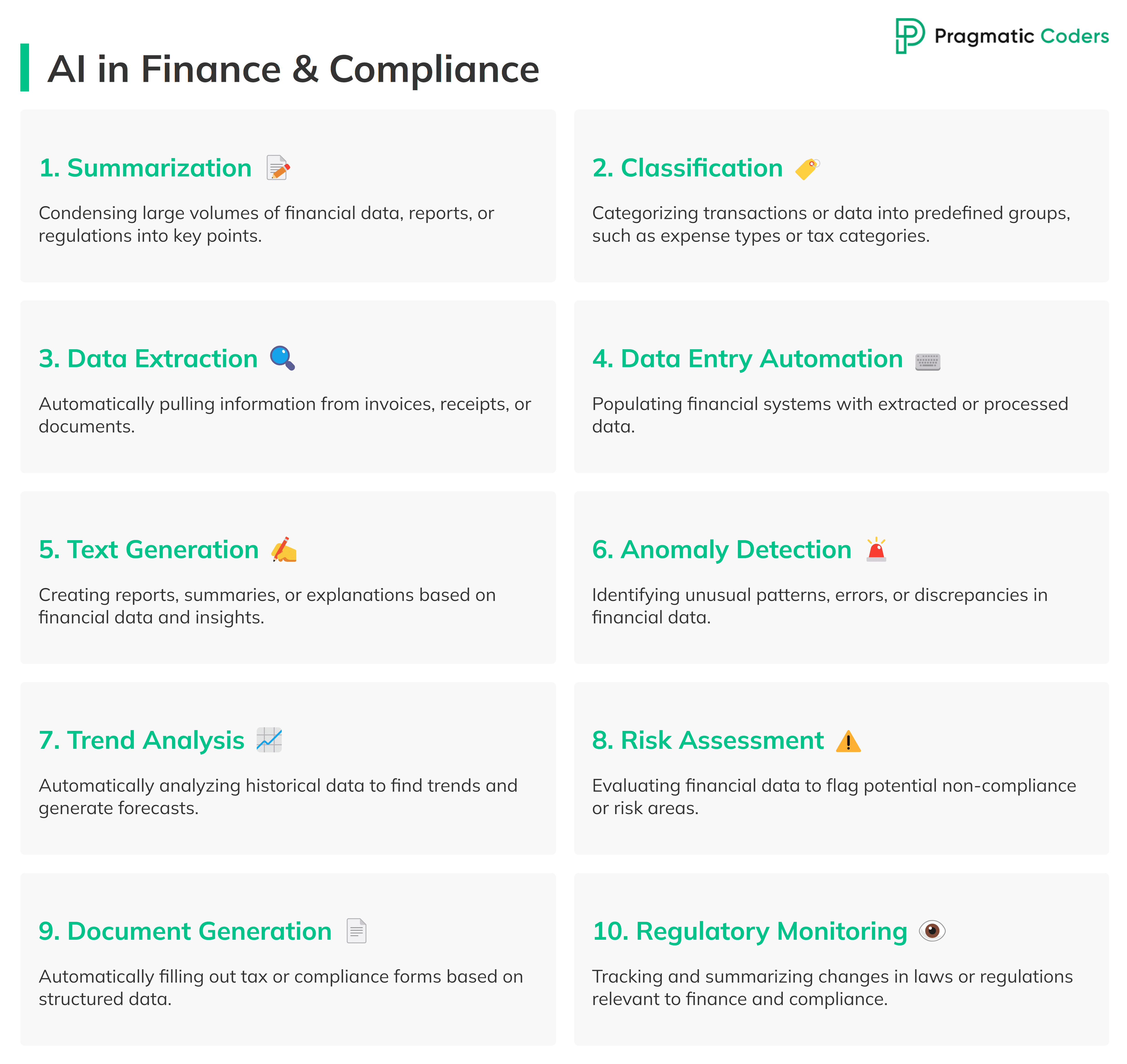

Detection, generation, automation and more – there are many field where AI can really boost your productivity. What other specific tasks can AI handle for you?

What accounting tasks can be automated with AI?

First, AI tackles data tasks. This includes pulling out important information, filling in data automatically, and sorting transactions.

Next, it makes analysis and reporting better. It can spot trends in financial data, find unusual patterns that might indicate problems, and create summaries of complex information. It can even predict future financial trends, helping companies plan ahead.

Lastly, AI could help companies follow rules and manage risks by regulatory monitoring. However, as I mentioned earlier, accountants might be skeptical about trusting AI in this field.

2 types of AI accounting tools

You know what to automate and how… in general. Let’s now talk about the technological aspect of this endeavor.

There are two ways to integrate AI into accounting workflows. You can use

- AI technologies & tools as parts of workflows;

- AI copilots.

Artificial intelligence can function as a link in a multi-element process (like the OCR tool we used in our bookkeeping workflow). However, it can also function as an AI assistant accountants chats with to solve all of the tasks mentioned earlier.

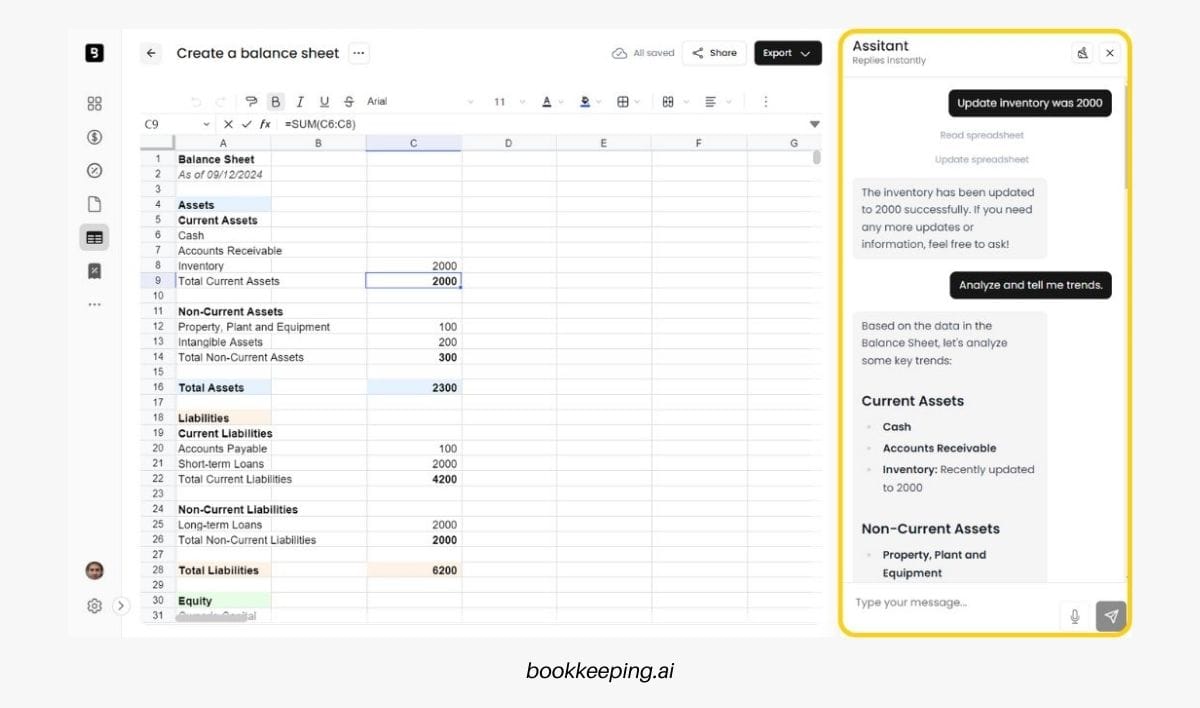

AI accounting assistant: 2025 trend

For the sake of the article, we examined AI-powered accounting startups launched from 2022, and some of them seem to target exactly the AI copilot approach:

- Materia AI | Partner of Accounting Leaders

- Basis. The AI platform for accounting firms

- Bookkeeping.ai: Chat to Complete Financial Tasks

- Leapifai. AI Tax Copilot

With the conversational AI redefining the way we’ve been interacting with technology, from web search (asking Chat GPT for information instead of googling it) to coding (chatting with GitHub copilot to accelerate development), we can say this is an actual trend in AI accounting.

However, while a copilot seems the ultimate way we’ll be interacting with AI in the future, right now, there are at least two problems these startups (some of which are still in their wish-list or beta stages) need to solve to make their accounting products not only competitive-but even usable in the first place:

- Designing AI interfaces right. We should remember that the chatbot-like way of interacting with software is still much of terra incognita, unknown land of UX design. There are many usability issues designers must tackle when designing AI experiences.

- Making the chatbot’s replies make sense. AI chatbots have a tendency to answer consistently wrong, take long for a very simple search, answered in the generic ChatGPT-like fashion just so that it turns out… the answer isn’t even relevant.

While it’s not impossible to create a copilot that can solve many user problems, the two aspects mentioned above pose a significant challenge. Yet, if the AI accounting copilot startups mentioned above can overcome them, we will get tools that could truly revolutionize the way we approach financial management.

How to integrate AI in accounting workflows. 5 steps

So, how do you integrate AI into your accounting workflow?

We’ll explain it using the already-mentioned example of our own internal accounting automation system.

Identify oportunities

- Spot repetitive tasks in your accounting workflow

- Note areas where errors often occur

We began by pinpointing repetitive tasks in the accounting workflow. Martyna, our finance specialist, was spending excessive time manually processing invoices, entering data into Google Sheets and Productive, and organizing files in Google Drive. This manual work was time-consuming and prone to errors.

Choose AI solutions

- Select AI tools that fit your needs

- Ensure they can work with your current systems

We evaluated different AI tools that could automate these tasks. Rossum, an AI-powered OCR (Optical Character Recognition) tool, was selected to automate data extraction from invoices, while Zapier was chosen to connect all the necessary platforms (Gmail, Google Sheets, Google Drive, Productive) to create a seamless workflow.

Prepare your data

- Organize your financial data

- Make sure it’s in a format the AI can use

The financial data, including invoices, needed to be organized and standardized so the AI tool could process it accurately. Rossum’s machine learning capabilities improved over time, allowing it to better identify critical details like currency and account numbers from various invoice formats.

Implement and test

- Start using the AI tool in one area

- Check if it’s making things faster or more accurate

We first implemented the system by automating the invoice processing workflow. Emails with invoices were automatically sent to Rossum for data extraction, and Martyna only needed to confirm the accuracy. The extracted data was then sent to Google Sheets for further processing twice a day. We tested this workflow to ensure it was saving time and improving data accuracy.

Expand and refine

- Roll out the AI to more accounting tasks

- Keep improving based on results

After the successful implementation, we expanded the automation to cover other financial tasks, like assigning expenses to the appropriate departments and automatically creating monthly folders in Google Drive.

This approach saved Martyna up to 2 hours daily and significantly reduced errors, allowing her to focus on more strategic tasks. And that’s just for one aspect of her work – we created similar workflows for other financial activities, such as validation and execution of B2B supplier payments.

AI ACCOUNTING CASE STUDY

Integrate AI into accounting

We understand AI automation and the challenges it comes with, because we’ve been applying it across our company since gen artificial intelligence took off, including both product development teams and back-office.

We can help you:

- Design and integrate AI into your existing accounting workflows;

- Build a custom AI accounting chatbot to streamline your organization’s productivity;

- Improve your current accounting software product (if you’re a startup);

- Develop custom AI software for (financial) tasks.

Schedule a call – we’ll talk your individual case through.