12 (innovative) mobile banking features you need to know

How do you do that?

How do you attract new customers to your fintech product while keeping the existing ones?

The ultimate way to achieve both is to give users the exact functionalities they want.

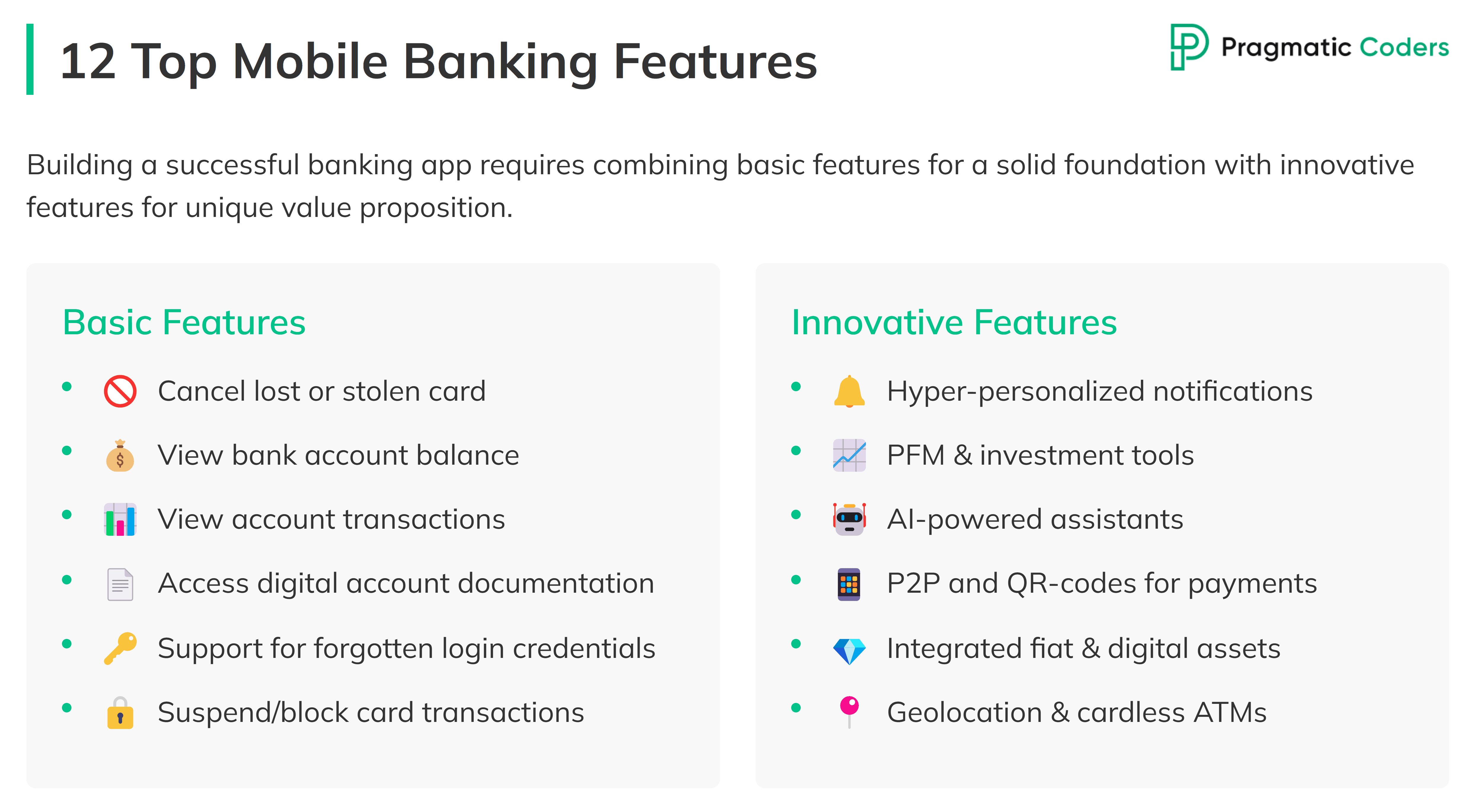

To address this need, we’ve created a research-based list of the 12 best mobile banking app features (6 essential + 6 innovative) people want, along with trends and upcoming opportunities.

Mobile banking app development

6 best mobile banking features of all times

Before we move on to the innovative features, let’s first face this fact:

People want basic features (but they want them different depending on where they live).

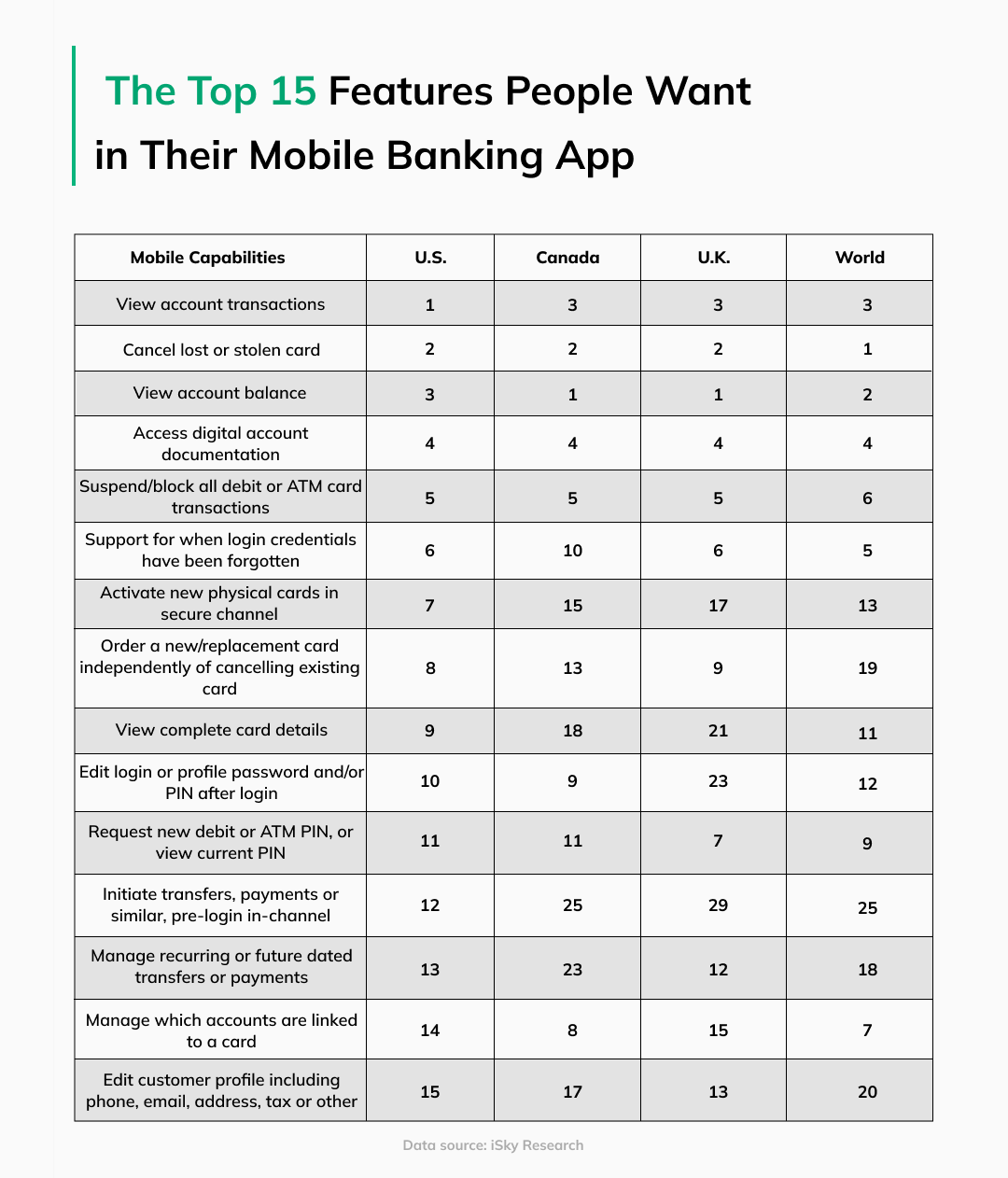

iSky surveyed 5,149 adults across 10 countries in the first quarter of 2023 for its report. According to it, the top 6 mobile banking app features globally are…

- Cancel lost or stolen card

- View bank account balance

- View account transactions

- Access digital account documentation

- Support for when login credentials have been forgotten

- Suspend/block all debit or ATM card transactions

You can compare it to the top 5 most in-demand features in Canada as of January 2023, according to research by Insider Intelligence:

- Easy-to-understand transactions

- Debit cards on file

- Order replacement card

- Change PIN

- Manage third-party services data access

Surprised?

As you can see, all these features are quite generic. However, the basic functionalities (account management and security & control) executed correctly make for the base of the best mobile banking apps.

These 6 features, though in various orders, remain common for the US, UK, Canada, and worldwide. And what’s more important, they have remained fairly consistent through the last several years (even through the pandemic), so we can predict it will stay this way for the upcoming years.

It gets more diverse down from number 7, as you can see in the table above. For example, there’s a big stress on credit card management in the US (numbers 2, 5, 7, 8, 9, 14), a tendency that isn’t reflected in other researched countries.

Here’s another disparity: while Americans want to be able to initiate transfers, payments, or similar pre-login (number 12), people in Canada, the UK, and other countries don’t find it that important (numbers 25, 29, 25 respectively).

Indeed, customers are generally the same around the world. However, the word “generally” is key here.

While users share the same basic needs, the further we go, the more variations we’ll find. It’s important to recognize that the “ideal” user experience varies from country to country.

That’s why tailored UX research will prove extremely useful for anyone who wants to build a banking app (or any other type of product, really).

6 innovative mobile banking features

Fact: You can stand out in the market through innovative features.

In the paragraph above, we named the exact functionalities customers want to have in their mobile banking apps. Now, let’s dive into innovation – the mobile banking features that will make your product stand out.

1. Context-aware notification and hyper-targeted engagement

The stronger the personal connection with a bank, the more likely a customer will stick to it.

Hyper-personalized banking is like having a financial coach who knows you inside and out, guiding you at every step of your journey. Interestingly, industry insiders state that true personalization is about serving customers daily with advice, tools, and support—not just pushing products. For instance, AI and machine learning are used to spot key moments in a customer’s life, like buying a home, and provide tailored financial help like mortgage advice or insurance that aligns perfectly with the customer’s needs.

Key traits of hyper-personalized banking then include:

- Predictive: Anticipates customers’ future needs based on their actions.

- Relevant: Delivers personalized, non-generic solutions tailored to individual contexts.

- Useful: Helps users achieve specific financial objectives.

- Timely: Provides assistance when it’s most needed

A great example of how hyper-targeted banking can look like is in-app communication. AI can analyze customer profiles and behaviors, so the notifications have become highly specific, grouping users by interests like health or sports to deliver targeted offers and advice. And it pays off: TSB’s personalized loan notifications replaced generic messages with realistic borrowing amounts for each customer, resulting in a 300% increase in leads.

Learn more: Personalized banking & AI: How to build a loyal customer base

2. Personal finance management & investment tools

The rising inflation, the aftermath of the COVID-19 pandemic, and the turmoil that affected various regions of the world have many of us tightening our belts. We’re paying more attention to our expenses and monitor budgets more thoroughly. Still, regardless of age, many consumers face challenges in understanding fundamental aspects of their finances,

No wonder personal financial management (PFM) tools – expense trackers that show spending and savings patterns – are becoming a standard feature to include in a bank’s mobile app.

The juice is worth the squeeze: if financial institutions can effectively integrate them into their mobile apps, they can enhance customer retention and gain a decent competitive advantage. But before you rush to integrate PFM tools into your mobile banking app, here are 3 insights you should consider, as highlighted in the article by The Financial Brand:

- Nice to have, but not a must: Personal finance management is a nice addition to an overall customer experience, but the isn’t as useful as other, more basic, app features, such as checking transaction history or accessing savings accounts.

- Best when grouped: PFM tools drive the most satisfaction when used as a group, for example, when users get insights from budgeting, spending, and credit score monitoring tools.

- Combine PFM tools and AI: J.D. Power’s research discovered that consumers are four times more likely to use the entire PFM tool suite when offered alongside a virtual assistant. The study concluded that the simultaneous use of these tools creates a synergistic effect, significantly boosting customer satisfaction.

3. AI and Virtual Assistants

There’s Erica by Bank of America and witty Cleo AI that can roast you if you overspend your monthly budget.

But are all AI-powered chatbots really this good?

A recent Gartner survey of nearly 500 B2B and B2C customers revealed that only 8% had interacted with a chatbot during their most recent customer service experience. Moreover, only 25% indicated a willingness to use one again among those who interacted with a chatbot.

It’s harder than it seems to craft an AI-powered assistant that actually works – a problem buunq, a Dutch neobank has faced. They launched their chatbot Finn that replaced the traditional search function and was intended to be more intelligent and simply better. The problem is… users want the traditional search option back (Finn is horrible : r/bunq).

Learn more: Conversational banking: How to implement conversational AI in banking?

Voice banking

Another aspect of virtual assistants that’s going to grow in 2025 is voice banking.

Voice technology and AI are transforming banking by offering real-world conveniences like checking your account balance through Alexa or making payments by giving a command to Google Assistant. DBS Bank in Singapore now allows customers to pay bills or transfer funds through voice commands, adding a layer of biometric security with voice recognition to prevent fraud. In India, voice banking services in regional languages have brought banking to rural areas, where literacy levels can be a barrier.

These advancements both save time and make banking more inclusive and adaptable to diverse customer needs. Yet, only 17% of companies in the financial sector (personal banking and insurance companies) use voice bots… which represents a huge competitive opportunity.

4. QR Code Payments and Peer-to-Peer Systems in Mobile Banking

When you shop at a store, eat at a restaurant, or buy something from a small business, you’re shown a QR code. You scan the code with your phone, and the payment happens instantly. You don’t need to swipe a card or type in payment details.

The little black-and-white squares are now changing how people transact. As such, they are especially popular in places like the Asia-Pacific region.

- India has embraced QR codes through the Unified Payments Interface (UPI), with over 10 billion QR-based transactions recorded monthly as of 2023.

- In China alone, over 90% of urban residents use QR codes for payments, especially through apps like Alipay and WeChat Pay.

What’s more, it’s becoming a thing for foreigners, too. Before, they have often struggled to make payments because their credit cards are not widely accepted, especially in smaller shops. To solve this, Thunes has launched a QR Code Payments solution that lets travelers from other countries use their mobile wallets, like Airtel and m-Pesa, to easily scan merchant-present QR codes and pay through platforms like e-CNY, Alipay, and WeChat Pay.

But will the concept of QR code payments become a thing in the West, too?

P2P payment systems, on the other hand, let you send money directly to someone else using an app, without going through a bank. You just pick someone’s name, type how much you want to send, and hit confirm. The money usually gets there right away. It’s great for everyday use (splitting a bill at a restaurant, paying a friend back, or sharing rent money with roommates), and contactless. But there’s more context to it apart from these scenarios.

Why Are Payment Apps Startups Booming, Especially in Africa?

The growth of payment app startups, especially in Africa, is driven by key factors like financial inclusion and mobile penetration, as many people lack access to traditional banks but own mobile phones. Startups like m-Pesa and Airtel Money simplify remittances and provide quick, affordable alternatives to cash. With support from governments and investors, these apps meet local needs while driving economic growth and improving financial access.

Because of these factors, payment apps are booming not only in Africa but also in other emerging markets across Asia and Latin America.

5. Integrated Fiat and Digital Asset Management

In the past, people needed different apps or platforms to manage their fiat money (like dollars or euros) and their digital currencies (like Bitcoin). Now, some mobile banking apps let you manage both at the same time. This creates an integrated platform, a unified dashboard where users can track all their money in one place.

More banking apps now combine regular money and digital assets for a few key reasons:

- Crypto Popularity: Bitcoin and other cryptocurrencies grew a lot during 2020 and 2021, making banks and apps add crypto tools.

- Big Companies Joining In: Businesses like Tesla and PayPal started accepting crypto for real purchases.

- Economic Problems: Inflation and financial instability made people look for alternative options like Bitcoin or stablecoins.

- New Rules: Governments now recognize and regulate cryptocurrencies.

6. Cardless ATM Withdrawal and Advanced Geolocation

Cardless ATM withdrawals let you take out cash without needing your debit or credit card. Instead, you use your mobile banking app or mobile wallet (using the NFC technology (Near-Field Communication) or scanning a QR code) to access the ATM.

Advanced geolocation is a related concept. It uses your phone’s GPS to help you find ATMs, bank branches, or other services nearby. Some apps use location data to confirm that you are near the ATM before allowing a cardless withdrawal. If you’re on vacation and forget your card, apps like Chase, Wells Fargo, and Bank of America let you use cardless withdrawals. Geolocation tools also guide you to the nearest ATM that works with your mobile app, making travel and banking stress-free.

Conclusions

If you want to build a banking app, you need a solid foundation with the most basic features. Your unique value proposition (UVP) will come from innovation. Still, in both cases, you need UX research to make sure the features will resonate with the needs of the target audience in the country where you’re operating.

Fintech is hard: it’s competitive, ever-changing, and security regulation-heavy. Luckily, we’ve worked with large and small European banks to develop their banking software solutions. Our teams combine UX & technical expertise with a strong understanding of the banking sector’s unique requirements.