Cloud Computing in Banking & Financial Services Industry

Cloud computing is a key trend shaping the future of banking. It’s no longer optional for major banks—it’s now the standard for financial institutions worldwide. This shift makes cloud computing one of the six major banking technology trends of 2025.

At its core, cloud computing means accessing data storage, applications, and computing power via the internet. Banks no longer need to depend solely on local servers or personal devices. This technology delivers flexibility, efficiency, and cost savings, making it highly attractive to financial institutions.

In 2025, banks worldwide are investing heavily in cloud services. Cloud adoption in finance surpassed 83% back in 2022. Just a year earlier, a survey found that 91% of banks planned to expand their cloud usage. Banks view cloud technology as essential for faster growth, stronger security, and better customer experiences.

This article explores the benefits and challenges of cloud computing in banking. By the end, you’ll clearly see why cloud technology is critical for modern banks—and how they can leverage it successfully.

Key Points

|

What is Cloud Computing in Banking?

Cloud computing means renting technology resources over the internet, eliminating the need for banks to own and maintain their own servers or data centers. Financial institutions can access data storage, apps, and computing power on demand, paying only for what they use. This model offers flexibility, efficiency, and significant cost savings. What cost savings, exactly?—AYA Bank cut its TCO (total cost of ownership) by 55% with a cloud solution.

Banks handle massive amounts of data each day. They need systems that are secure, quick to adapt, and easy to scale. Cloud computing meets these needs. According to American Banker’s 2025 Predictions Report, over 80% of executives from 212 banks, fintechs, and credit unions plan to increase their technology spending in 2025. Most of this increase will focus on cloud-based services.

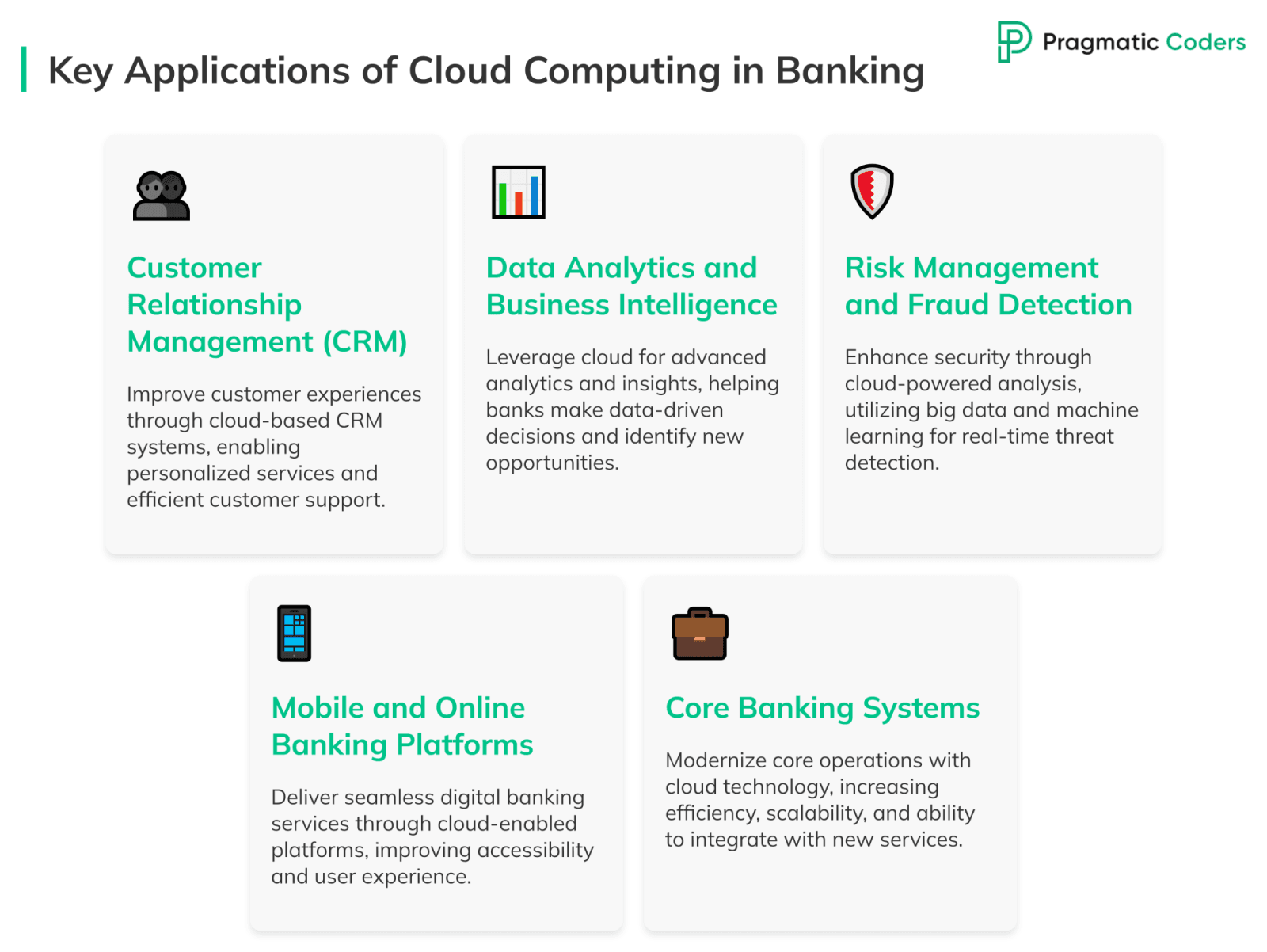

How Cloud Computing Applies to Banking and Financial Services

Banks process a wide range of transactions. During peak times, like holiday shopping seasons, transaction volumes skyrocket. With traditional setups, banks risk outages if their servers can’t keep up. In contrast, cloud solutions scale up instantly to handle these surges.

For example, during busy times like Black Friday or the end of the financial year, banks see a surge in transactions. Cloud computing allows banks to scale their resources up or down to meet these demands. They don’t need to over-invest in permanent infrastructure. This scalability helps banks maintain performance and customer satisfaction without unnecessary costs.

Cloud-based services also boost collaboration. Teams in different cities (or countries) can view and edit data in real time. This improves decision-making and helps banks respond to market changes.

Cloud adoption also opens doors for advanced technologies such as AI and machine learning. Banks can analyze customer data faster, detect fraud in real time, and personalize services.

Overview of Cloud Service Models

There are three main types of cloud service models: Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS). Each model offers different levels of control, flexibility, and management.

Software as a Service (SaaS)

SaaS delivers software apps over the internet. Users can access these apps via a web browser without installing or maintaining software on their devices.

- Example: Office 365, Google Workspace. Banks use SaaS for customer relationship management (CRM) systems, email services, and financial planning tools.

Platform as a Service (PaaS)

PaaS provides a platform for customers to develop, run, and manage apps without dealing with the underlying infrastructure. It supports the complete lifecycle of an app, from building and testing to deployment and updates.

- Example: Microsoft Azure, Google App Engine. Banks use PaaS to develop in-house apps, such as mobile banking apps or customer portals, without worrying about server management.

Infrastructure as a Service (IaaS)

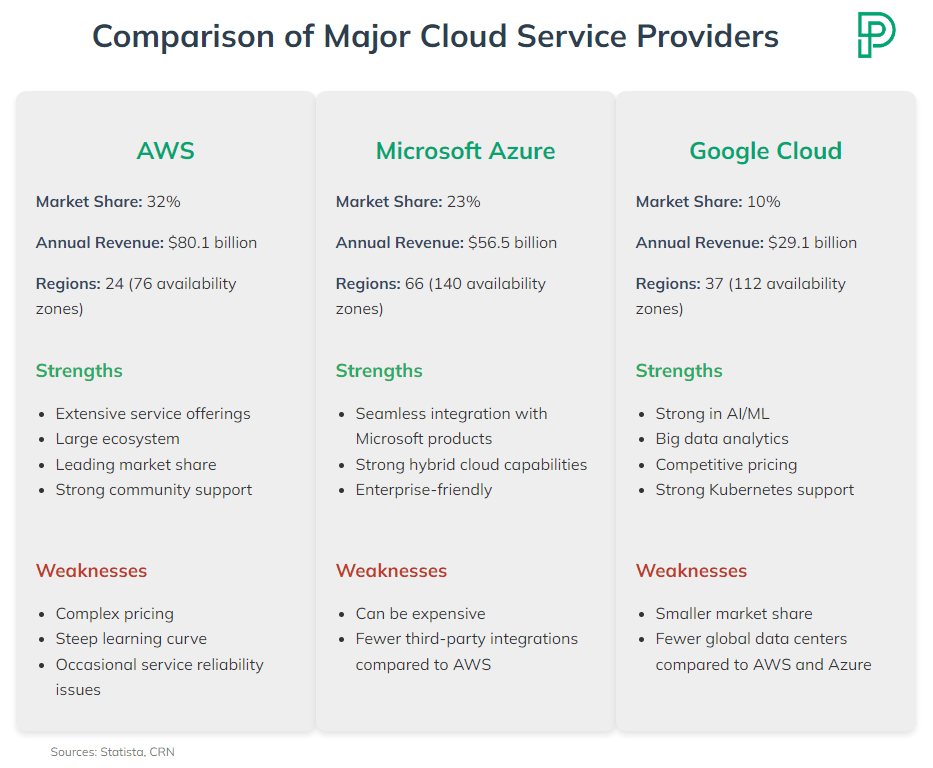

IaaS offers virtualized computing resources over the internet. It provides essential infrastructure like virtual machines, storage, and networks. Businesses can rent these resources instead of buying and managing physical servers.

- Example: Amazon Web Services (AWS), IBM Cloud. Banks use IaaS for data storage, backup, and disaster recovery solutions. This allows them to scale infrastructure as needed.

Benefits of Cloud Computing in the Banking Sector

Cost Efficiency

Traditionally, banks had to invest heavily in physical hardware and data centers. These are capital expenditures (CAPEX) that involve significant upfront costs. With cloud computing, banks can shift to an operational expenditure (OPEX) model. This means they only pay for the resources they use, as they use them.

Overhead is one of the biggest challenges for banks. By reducing the need for physical infrastructure and maintenance, banks can save a lot of money. For example, instead of buying expensive servers and hiring IT staff to maintain them, banks can rent the same services from cloud providers like AWS or Microsoft Azure. Capital One became cloud-native by doing exactly this. This approach not only cuts costs but also allows banks to invest in other important areas like innovation and customer service.

Enhanced Customer Support through AI Chatbots

Banks are increasingly using AI-powered chatbots to enhance customer service. By leveraging cloud-based infrastructure, these chatbots can be rapidly deployed and scaled, allowing for 24/7 support while reducing staffing costs. Unlike traditional customer support methods, chatbots can handle routine questions and tasks instantly, freeing human agents to focus on more complex requests.

Here are some key advantages:

- Immediate responses: Chatbots can reply to queries in real-time. Whether it’s resetting a password or checking an account balance, customers receive immediate assistance rather than waiting in a phone queue.

- Personalization: With the help of cloud-based analytics, chatbots can process large volumes of customer data to provide personalized recommendations—like tailored product offers or financial advice.

- Reduced operational costs: Implementing a chatbot is significantly more cost-effective than staffing full-scale call centers. Cloud providers offer pay-as-you-go pricing models, so banks only pay for the computational power used.

- Seamless integration: AI chatbots can integrate with banking applications, CRM systems, and other services hosted in the cloud. For example, a chatbot might access a customer’s account information to provide real-time updates on recent transactions.

- Constant improvement: Machine learning models can be updated automatically with new data, refining chatbot accuracy and effectiveness over time. Cloud platforms such as AWS and Azure offer managed machine learning services that streamline this process.

For example, Bank of America’s virtual assistant, Erica, uses AI to answer questions, analyze spending, and offer real-time insights. Running on cloud infrastructure, it handles millions of interactions daily while continuously refining its capabilities.

Scalability and Flexibility

Banks often experience changing demands, especially during busy times like the end of the financial year or major shopping events like Black Friday. With cloud computing, banks can easily scale their resources up or down based on demand. Moreover, scalable solutions help to better accommodate dynamic growth, as showcased by BILL’s partnership with AWS.

For instance, if a bank sees a sudden increase in online transactions, it can quickly add more computing power to handle the load. This prevents downtime and ensures a smooth customer experience. When demand decreases, banks can scale back to save on costs. This kind of flexibility is hard to achieve with a traditional IT setup.

Enhanced Security

Cloud computing offers advanced security measures that greatly benefit banks. Service providers invest heavily in cutting-edge security tech to protect data from cyber threats. These include:

- Multi-layered security: Cloud providers use multiple layers of security controls, including firewalls and intrusion detection systems.

- Advanced encryption: Data is encrypted both in transit and at rest, using up-to-date encryption methods (by the way, here’s how encryption differs from data tokenization).

- Access management: Strong identity and access management systems ensure only authorized personnel can access sensitive information.

- Compliance support: Cloud providers often have built-in compliance tools and certifications that help banks meet regulatory requirements easily.

- Automated security updates: Cloud providers continuously update their security measures, keeping banks protected without manual work.

For example, AWS offers services like GuardDuty for threat detection and Macie for data loss prevention. Microsoft Azure provides Advanced Threat Protection and Security Center. These enterprise-grade security features often surpass what individual banks can implement on their own, enhancing overall data security and customer trust.

Innovation and Competitive Edge

With cloud technology, banks can accelerate their digital transformation and bring new products and services to market faster. For example, by using Platform as a Service (PaaS), banks can develop and deploy payment processing solutions without worrying about the underlying infrastructure.

A prime example of such innovation is ClearBank’s expansion with the help of Azure. Their new cloud-based platform processes approximately 20 million payments a month, up from just 8,000. How fast is it, exactly? ClearBank processes most of its payments in less than 3 seconds!

Business Continuity and Disaster Recovery

Banks must ensure their services are always available, even during disasters. Cloud providers offer redundancy and data backup across multiple locations. For example, AWS has its infrastructure spread across 33 geographic regions, and Azure’s infrastructure spans the entire globe and multiple satellites. If one data center goes down, another can take over, ensuring uninterrupted service.

This redundancy minimizes downtime and ensures that customers can always access their accounts and perform transactions. When will this matter? During power outages, natural disasters, and infrastructure failures, to name a few.

Challenges of Cloud Computing in the Banking Industry

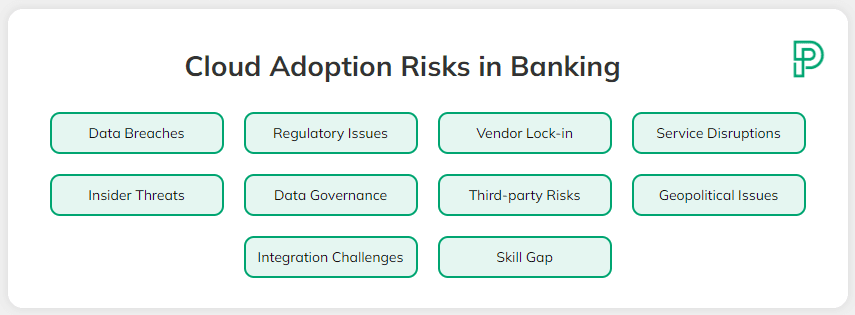

Data Security and Privacy

While cloud computing offers enhanced security features, it also brings new challenges in data security and privacy for banks:

- Shared responsibility: Banks must understand that cloud security is a shared responsibility. Providers secure the infrastructure, but banks are responsible for securing their data and apps.

- Data sovereignty: Storing data in the cloud can raise concerns about data sovereignty, especially when data centers are in different countries with varying privacy laws.

- Insider threats: With cloud systems accessible from anywhere, there’s an increased risk of insider threats, requiring more sophisticated monitoring and access controls.

- Third-party risk: Banks must ensure that their cloud providers and any third-party cloud computing services meet the same strict security standards.

- Data breaches: Despite enhanced security, the risk of data breaches remains a concern, potentially exposing sensitive financial information.

To address these challenges, banks must implement comprehensive cloud security strategies. This includes regular risk assessments, strong data classification and governance policies, and end-to-end encryption for all sensitive data. Banks should also consider using cloud access security brokers (CASBs) to gain visibility and control over their cloud services, helping to prevent data leaks and ensure compliance with data privacy regulations like GDPR or CCPA.

Regulatory Compliance

Regulatory compliance is another big challenge for financial institutions using cloud computing. Banks must follow strict regulations regarding data residency and privacy, which vary by country. For instance, some countries require customer data to be stored within their borders, which can complicate the use of global cloud services.

To ensure compliance, banks need to work closely with cloud providers to understand where their data is stored and how it’s managed. They should choose providers that offer data residency options and have a strong track record of complying with local regulations. Regularly reviewing and updating compliance policies is also crucial. Fortunately, providers often offer detailed compliance resources and support.

Integration with Legacy Systems

Many banks still rely on old core banking systems, which can be hard to integrate with modern cloud solutions. These older systems may not work well with new cloud technologies, making the migration process complex and time-consuming.

To address this, banks can adopt a step-by-step approach to integration. They can start by moving less critical systems to the cloud to minimize risk and disruption. Over time, more critical systems can be migrated as compatibility issues are resolved. Using middleware solutions that bridge the gap between old systems and cloud apps can also help smooth the transition. Here’s a case study to showcase what a large-scale cloud migration looks like from within.

Vendor Lock-In

Vendor lock-in is a risk associated with relying on a single cloud provider. If a bank becomes too dependent on one provider, switching to another can be difficult and costly. This reliance can limit flexibility and negotiating power.

To avoid lock-in, banks should consider using multiple cloud providers for different services. This not only reduces the risk of dependency but also allows banks to use the best features of each provider. Additionally, using open standards and ensuring that apps can work across different cloud environments can make it easier to switch providers if needed.

Best Practices for Cloud Adoption in Banking

Risk Assessment and Management

When implementing cloud computing, banks must start with thorough risk assessments. This means identifying potential risks and understanding how they could impact the organization. Regularly reviewing these risks helps in staying ahead of new threats.

Banks should regularly evaluate their cloud environments to identify vulnerabilities. This involves looking at both internal and external threats and understanding how they might affect the bank’s operations. It’s crucial to have strong security measures in place, including data encryption, multi-factor authentication, and regular security audits.

Vendor Management

Choosing the right cloud service provider is key to a successful cloud strategy. Banks should carefully evaluate potential vendors and ensure they meet the required security and compliance standards.

When selecting cloud service providers, look for those with a proven track record in security and reliability. Check for certifications like PCI DSS, SOC 2, and ISO 27001. These certifications show that the provider follows industry best practices for security and data protection.

Clear service level agreements (SLAs) are essential to ensure that the cloud provider meets the bank’s performance and security requirements. These agreements should outline the provider’s responsibilities, performance metrics, and penalties for not meeting standards. Regular performance reviews help maintain the quality of service.

For banks seeking to develop custom fintech solutions that integrate seamlessly with their chosen cloud services, partnering with an experienced fintech software development company, such as Pragmatic Coders, can significantly streamline the process.

Hybrid and Multi-Cloud Strategies

Adopting a hybrid or multi-cloud strategy can offer flexibility and reduce risks associated with relying on a single provider.

A hybrid cloud combines on-premises infrastructure with cloud services, offering a balance of control and flexibility. Multi-cloud uses multiple cloud providers, reducing the risk of vendor lock-in and allowing banks to leverage the best features of each provider. This approach also enhances resilience and disaster recovery capabilities.

Conclusion

Cloud computing has transformed the banking industry. It cuts costs, increases speed, and supports next-level security. Banks can now roll out new features in weeks, not months. They also enjoy robust disaster recovery options with data centers spread across multiple regions.

Yet, banks must handle privacy, compliance, and vendor risks with care. Detailed planning, multi-cloud tactics, and ongoing risk reviews are vital. Done well, cloud adoption gives banks a clear advantage. They can stay competitive, serve customers better, and keep up with fast-changing financial trends.