Customer Retention Strategies for Banks in 2025, Backed by Stats

Customer retention is the key to sustainable growth in banking. Today’s market is crowded, and many banks struggle to keep their best customers. Retention costs less than constant acquisition. It leads to stronger profits, higher lifetime value, and a better brand reputation. In this article, we’ll show you how to keep customers engaged and loyal through cross-selling, (hyper) personalization, seamless experiences, proactive feedback, effective staff training, and more. We’ll also give you concrete steps you can take right now.

Key Points

|

Understanding the Importance of Customer Retention

Cost-Effectiveness Compared to Acquisition

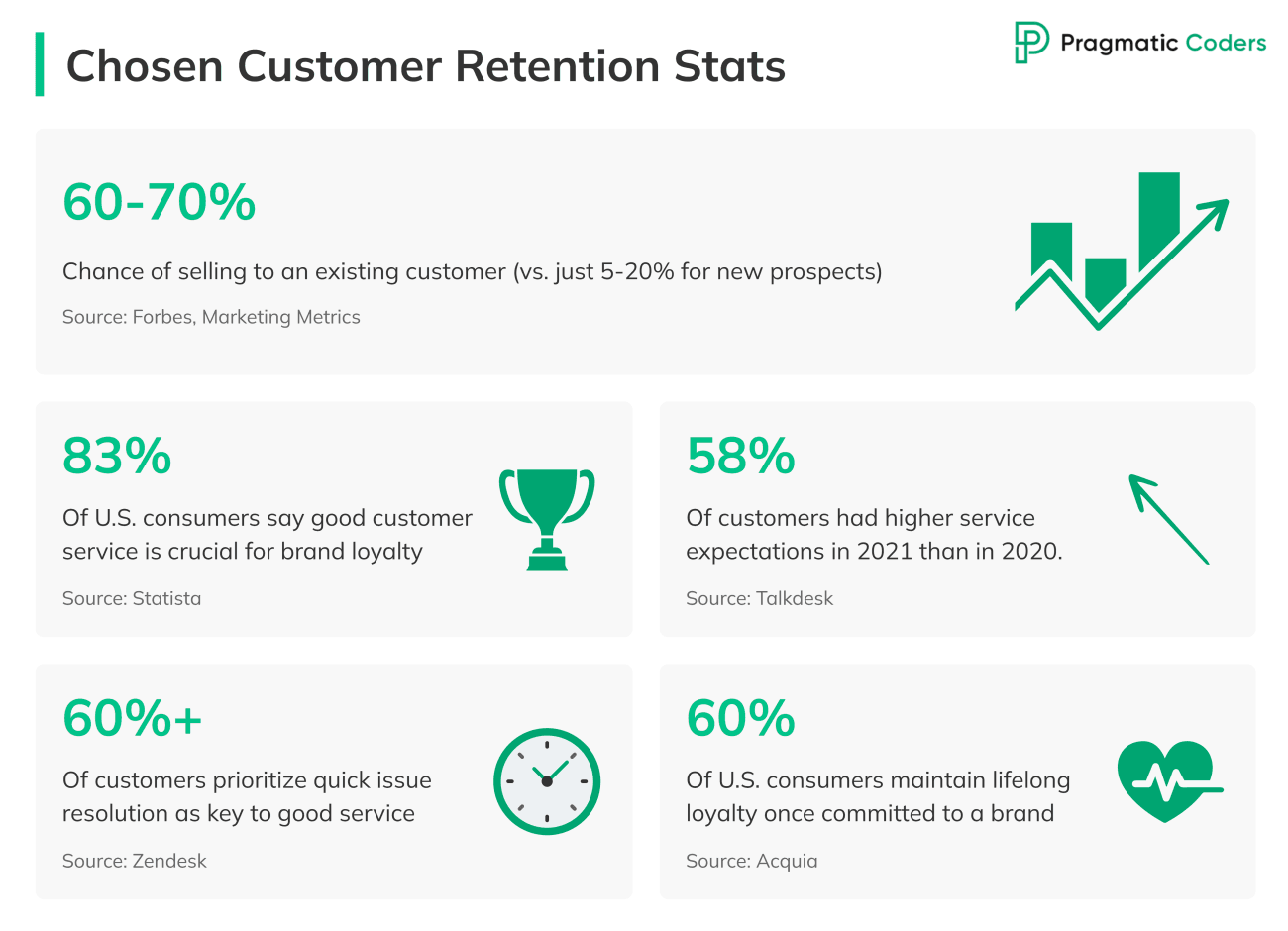

Acquiring a new customer can cost far more than keeping one. Banks pay for ads, promotions, and special offers to attract new clients. By investing in retention, you can focus on building a stronger bond with the people who already trust you. This often leads to higher returns and lower churn. As Marketing Metrics states, businesses have a 60% to 70% chance of selling to someone who is already a customer, compared to just 5% to 20% for new prospects. Over time, retention campaigns lower marketing costs and boost margins. Over time, retention campaigns lower marketing costs and boost margins.

Enhancing Customer Loyalty and Advocacy

Happy customers become brand champions. They tell friends and family about their positive experiences. Data shows that 52% of customers go out of their way to purchase from their favorite brand. Moreover, loyal customers are more willing to recommend you; Sixty percent of loyal customers share their favorite brand with friends and family, generating powerful word-of-mouth. These referrals feel authentic, cost you nothing, and help boost your bank’s public image and credibility.

Boosting Revenue Through Retention

Customers who stay with you often deepen their relationship. They open more accounts. They try new services. With each new purchase, the odds of another sale rise. After one purchase, a customer might come back 1/4th of the time. After two, the chance nearly doubles. And after three, it grows even more, reaching ~62%. This steady flow of repeat business lowers risk, strengthens your financial base, and supports long-term stability.

Customer Retention Strategies for Banks

Below you will find a series of focused strategies. Each one tackles a different part of the customer experience. When combined, these strategies form a complete blueprint for stronger retention. They help you understand customer needs, deliver real value, and keep improving over time.

Cross-Selling and Upselling Strategies

Identifying Opportunities for Additional Offerings

Use customer data to learn what each person needs. Track their spending, saving, and borrowing patterns. Look for signals that they need a new product. For example, a sudden increase in savings might mean they’re building a house fund. Suggest a mortgage when the time is right. Timing matters. Suggest products that fit their life stage. This shows respect and thoughtfulness.

Enhancing Customer Value and Satisfaction

Customers want solutions, not random pitches. Offer product bundles that solve their real problems. By focusing on existing clients—where you have five times the chance of making a sale—you can boost revenue and satisfaction together. Show how a particular credit card or savings plan can help them achieve their goals. This builds trust and strengthens the relationship.

Implementing Effective Cross-Selling Techniques

Train your staff to listen closely. Give them checklists that help spot customer needs. Offer role-play sessions so they practice suggesting products naturally. Provide simple scripts or talking points. Use digital prompts in your CRM tools. The goal is smooth, friendly advice. Customers should never feel pressured. They should feel guided and supported.

Personalized Customer Experiences

Leveraging Data for Personalization

Data drives personalization. Look at transaction histories, product usage, and online behavior. Use analytics to predict what might help each customer. If they travel often, suggest a travel-friendly credit card. If they have children, consider savings plans for college. Personalization shows you care about their unique life.

Delivering Tailored Banking Services

Provide custom advice. Offer step-by-step guidance for different financial goals. Make it easy to understand. Offer insights through online, mobile, or in-person channels. This level of care encourages loyalty. Many customers stay loyal to brands they love even if cheaper options exist—over 39% are willing to spend more with a brand they’re loyal to.

Building Emotional Connections

Customers often stay loyal to brands that share their values. If your bank supports local charities, let customers know. Offer loyalty perks that match their interests. Over half of consumers (55%) stay loyal because they truly love a product. When you connect with what matters to them, you build a deeper, more meaningful bond.

Providing a Seamless User Experience (UX)

Ensuring Consistency Across Channels

Customers expect the same level of service, no matter how they interact with your business—branch, website, or support line. Keep your branding, tone, and policies aligned. Over 90% of consumers say a great customer service experience makes them more likely to return. Consistency builds loyalty.

Simplifying the Customer Journey

Cut unnecessary steps. Make it easy to open new accounts online. Reduce forms and wait times. Streamline ID verification processes. Offer clear instructions and quick confirmations. In other words, optimize your digital onboarding process as much as possible. The simpler the journey, the less chance customers will give up halfway. Simple interfaces and logical menus keep customers engaged.

Utilizing Technology for Improved UX

Implement tools that save customers’ time. Chatbots can handle basic queries. AI can predict needs and send timely alerts. Offer mobile apps with simple navigation and quick logins. Around 70% of customers want to solve issues on their own. Self-service tools can boost their satisfaction.

Utilizing Customer Feedback

Gathering Insights Through Surveys and Reviews

Regular surveys and online reviews show what customers think. Use short surveys on your app or website. Ask direct questions about satisfaction and pain points. Read online comments and social media posts. Monitor recurring complaints. These insights offer clear direction on where to improve.

Implementing Feedback-Driven Improvements

Listen to your customers and take action. If they complain about long wait times, add staff during busy hours. Responding to feedback builds trust. Poor service drives 61% of customers to switch brands. Fixing issues quickly helps retain them.

Enhancing Loyalty Through Active Listening

When customers see real changes based on their words, they feel valued. Respond to negative reviews with a genuine apology and a promise to fix the issue. Thank customers who highlight something good. Active listening proves that you care. It encourages customers to stay and engage more deeply.

Understanding and Addressing Customer Needs

Analyzing Customer Data for Insights

Segment customers by age, income, behavior, and digital habits to uncover patterns. Younger customers might favor mobile banking, while retirees may prefer in-person guidance. Use these insights to create tailored retention strategies. Personalization matters—75% of U.S. consumers are more loyal to brands that understand them on a personal level. Data-driven strategies maximize impact.

Tailoring Retention Strategies Effectively

Focus on what each segment values. Offer student customers lower fees or help with student loans. Give business clients faster lending decisions or cash management tools. Offer retirees clear guidance on wealth preservation. Tailored solutions show customers that you know them well.

Addressing Pain Points Proactively

Don’t wait for complaints. Anticipate issues and solve them early. If your mobile app is slow during peak times, upgrade it before customers voice concerns. If new regulations confuse customers, send clear explanations. Proactive action shows foresight and commitment to a smooth experience.

Fostering Stronger Customer Connections with Your Bank

Loyalty Programs and Rewards

Offer points or perks that matter. For example, waive ATM fees after a customer’s first year. Provide better rates for loyal savers. Offer special credit card deals for long-term customers. Loyalty program members drive 43% of annual sales, and 95% of companies report they spend more. In fact, 79% of U.S. consumers say loyalty programs make them buy from a brand more frequently. Simple, transparent rewards build loyalty and keep customers coming back.

Financial Education Initiatives

Run free workshops on budgeting, investing, and retirement planning. Host webinars that explain how credit scores work. Provide guides that simplify complex topics. Education empowers customers. It helps them make better choices. When customers feel more confident, they trust your bank as a reliable partner.

Proactive Customer Support

Reach out with helpful tips before problems arise. Send alerts if account activity looks suspicious. Offer personalized financial health checks. Suggest strategies for managing debt or improving credit. Proactive support shows genuine care. It keeps customers safe and informed, which builds strong bonds over time.

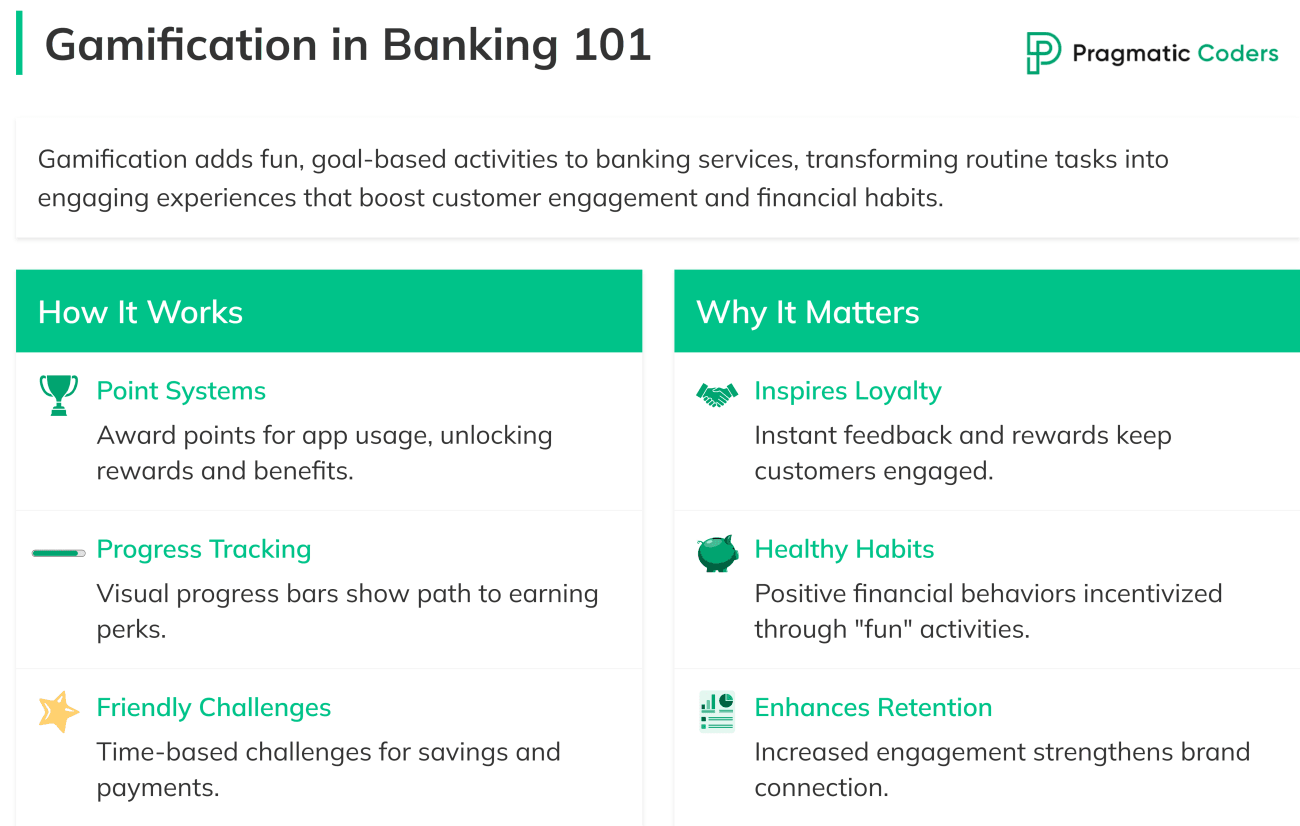

Introducing Gamification to Boost Engagement

Gamification adds fun, goal-based activities to your banking services. It transforms routine tasks into interactive experiences. This approach motivates customers to explore more products, increase their digital usage, and even learn healthy financial habits.

How It Works

- Point Systems: Award points or badges for regular use of the bank’s app or tools. Points unlock small rewards or higher-tier benefits.

- Progress Tracking: Use progress bars or achievement levels to show customers how close they are to earning perks.

- Friendly Challenges: Host short-term challenges for things like saving goals or timely bill payments. This can spark a sense of community or competition when customers compare milestones.

Why It Matters

- Inspires Loyalty: Gamification keeps customers involved in their banking journey. It provides instant feedback and frequent little wins.

- Encourages Healthy Habits: By rewarding positive actions like consistent saving or on-time payments, you help customers build better money habits.

- Enhances Retention: When banking feels engaging, customers return more often. They also feel more connected to your brand.

Quick Implementation Tips

- Start simple with a points-based system for everyday banking tasks.

- Offer rewards that matter to your audience, such as fee waivers or interest rate bonuses.

- Test and refine the program based on user feedback.

Gamification can energize your retention strategy. It creates memorable touchpoints that go beyond standard transactions. By weaving fun into the banking experience, you keep customers excited to come back and explore more.

Strengthening Staff Training and Culture

Building a Customer-Centric Mindset

Train employees to see things from the customer’s perspective. Recognize and reward those who solve problems quickly and with care. A shared focus on customer retention improves service and satisfaction. Poor experiences can cost you—72% of customers will likely switch their banking service provider after a bad call center interaction.

Providing Tools and Resources to Staff

Give front-line employees the data they need. If a teller can see notes on a customer’s recent issues, they can address them right away. Provide simple guides on cross-selling best practices. Offer refresher courses on new digital tools. Well-equipped staff creates smoother interactions and higher retention.

Encouraging Continuous Improvement

Urge employees to share ideas. Maybe a customer service rep suggests a new way to handle complaints. A loan officer might have insights on speeding up approvals. Listen to internal feedback. Invest in training and internal workshops. Continuous improvement in staff skills leads to continuous improvement in retention.

Ensuring Data Security and Compliance

Building Trust Through Security Measures

Customers want their data safe. Invest in top-notch cybersecurity. Encrypt data, use multi-factor authentication, and monitor accounts for suspicious activity. Communicate these steps clearly. When customers trust you with their data, they feel safer staying with your bank.

Complying With Regulations

Stay up to date with banking rules. Keep policies clear and transparent. Explain fees and terms in plain language. Respond quickly to new regulations. Show customers that you respect their rights and protect their interests. Compliance builds credibility, which supports retention.

Community Involvement and Social Responsibility

Aligning With Community Values

Support local events, sponsor financial literacy programs, or partner with charities. Show customers you care about more than profits. Banks that help their communities thrive build strong emotional connections. Almost 60% of U.S. consumers say they remain loyal to a brand for life once they commit. Investing locally fosters trust and encourages long-term loyalty.

Promoting Sustainable and Ethical Practices

Today’s customers watch what companies stand for. If your bank embraces green initiatives, highlight them. If you have fair lending practices, make it known. Strong ethics and sustainability matter. They boost goodwill and attract customers who share those values.

Leveraging Technology and Innovation

Investing in Predictive Analytics

Use predictive analytics to spot trends early. For example, if data shows a customer is close to leaving, send a special offer or personal call. Catching problems early lets you act fast. Predictive models can also suggest the right products at the right time.

Embracing New Service Platforms

Consider partnering with fintechs that offer innovative solutions. Add value by integrating budgeting apps, robo-advisors, or faster payment options. Show customers that you evolve with their needs. Staying current prevents them from looking elsewhere.

Measuring Success: Key Performance Indicators (KPIs)

Two-fifths of companies place equal focus on retention and acquisition, yet many overlook continuous tracking. Don’t be one of them.

Track metrics that reflect the health of your retention efforts. Start with customer retention rates. They show how well you keep customers over time. Next, follow product cross-selling rates. If these drop, consider adjusting your approach or providing staff with better training. Check average revenue per customer. A rising figure means customers trust you with more financial products, boosting long-term value. And remember, 84% of companies that improve customer experience see a boost in revenue. This shows how important these efforts are.

Monitor Net Promoter Score (NPS) to see if customers recommend your bank. High NPS? Strengthen those winning strategies. Low NPS? Identify weak spots and fix them fast. Look at complaint resolution times. Quicker solutions usually mean happier customers.

Finally, review digital engagement metrics. Track app usage, online account openings, and website visits. Low engagement can signal a need for simpler features or better navigation. By keeping an eye on these KPIs, you gain clear insights. If something falters, make adjustments. If something thrives, build on it. Over time, these measurements help you fine-tune your strategies and increase overall customer loyalty.

Conclusion

Retention isn’t an afterthought. It’s a cornerstone of lasting success in banking. By focusing on existing customers, you save costs, grow revenues, and earn trust. Offer personalized experiences, simplify journeys, and respond to feedback. Train staff to deliver top-notch service. Secure their data and respect their values. Innovate with new tools, monitor results, and keep improving. This holistic approach leads to deeper loyalty, steady growth, and a stronger brand.