Healthcare as a Service (HaaS): What it means and why it matters in 2025

Healthcare is changing fast, and healthcare as a Service (HaaS) is replacing the old fee-for-service model with something more flexible — subscription plans, pay-as-you-go, or outcome-based care.

Instead of unpredictable bills and long waits, HaaS offers on-demand, continuous care that puts patients first.

This isn’t theory — it’s already happening in the US, UK, and EU. In this article, we break down what HaaS really means, how the business models work, and the tech making it all possible — with real examples and practical takeaways.

What does healthcare as a service (HaaS) mean?

HaaS means delivering healthcare like a subscription or on-demand service — ongoing, flexible, and easy to access, not just one visit at a time.

Instead of bills for every test or appointment, patients get predictable costs and 24/7 access through digital tools, home care, or remote visits. It works for everything from primary care to chronic condition support.

Why now? People expect care to be as simple as booking a ride. Providers want to cut costs and improve outcomes. HaaS meets both needs — it’s scalable, patient-friendly, and built for the real world.

Let’s break down how it works.

| DISCLAIMER ⚠️ Babylon Health helped launch the UK’s digital GP subscription model, offering 24/7 care via app. It changed how people expected to access healthcare. The company shut down in 2023, but its early impact shaped today’s more sustainable HaaS models — that’s why it’s still worth mentioning here. |

HaaS business models

Modern HaaS ventures are experimenting with adaptive revenue models to make care more accessible and aligned with value. The primary models include

- pay-as-you-go services,

- subscription-based care, and

- outcome-based (value-driven) models – often combined in hybrid ways.

Here’s how each works and is being adopted in practice:

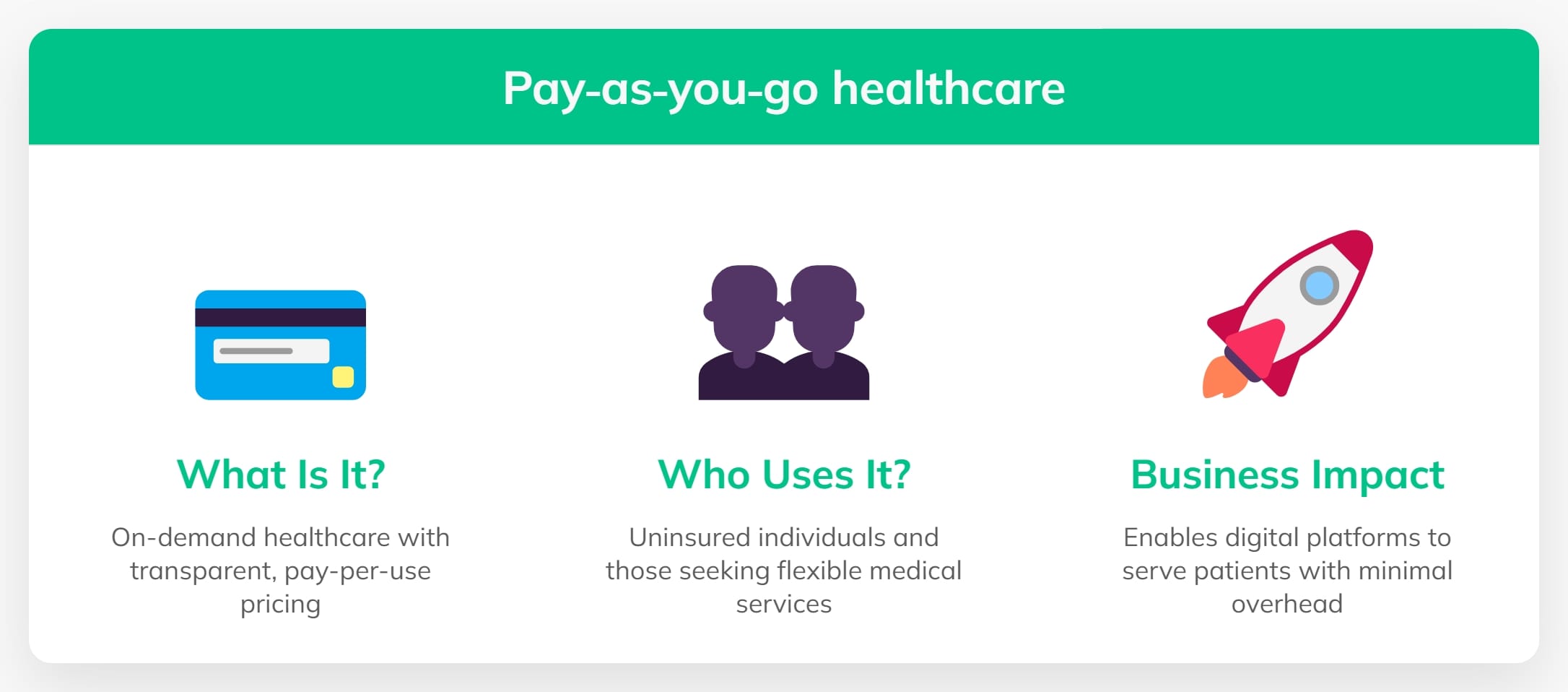

Pay‑as‑you‑go healthcare services

In a pay-as-you-go model, patients pay for each visit or service on demand, with no long-term commitment. Think of it as “on-demand healthcare” – you use it when you need it, like any other service. This model isn’t entirely new (fee-for-service is the old norm), but what’s different is the context and transparency.

Today’s pay-as-you-go HaaS offerings are often digital-first, with upfront pricing and immediate access:

- Telemedicine Consults: Many telehealth platforms offer flat fees per video consultation (e.g. a virtual urgent care visit for a fixed price). A patient with a minor issue can fire up an app, pay $50-$75, and see a doctor in minutes – no insurance maze, no surprise bills.

- Urgent Care and Specialist On-Demand: Walk-in clinics and online specialists use this model for those willing to pay one-time fees. For example, a virtual dermatology consult or an AI-driven symptom check might be offered for a per-use charge.

Who Uses It: This model appeals to uninsured or high-deductible patients who prefer paying directly for a single episode of care. It’s also popular for services not fully covered by insurance (like extra mental health sessions or niche consultations).

Business impact: Pay-as-you-go brings volume and flexibility. Providers can tap into a larger market of patients who otherwise avoid care due to cost barriers. Because it’s straightforward (“I pay $X for this service”), it builds trust through transparency. Digital health startups leverage this model to scale quickly – e.g., Ro (US) for on-demand men’s health, or pharmacy clinics in the UK offering pay-per-use GP appointments to bypass long NHS waits.

The model is scalable: an urgent care app can see thousands of one-time patients without long-term contracts.

For providers, while revenue per patient is episodic, margins can be healthy due to low overhead (especially if services are delivered virtually or via automation). In essence, pay-as-you-go makes healthcare more like a retail experience – simple transactions – which lowers the barrier for patients to seek help when they need it.

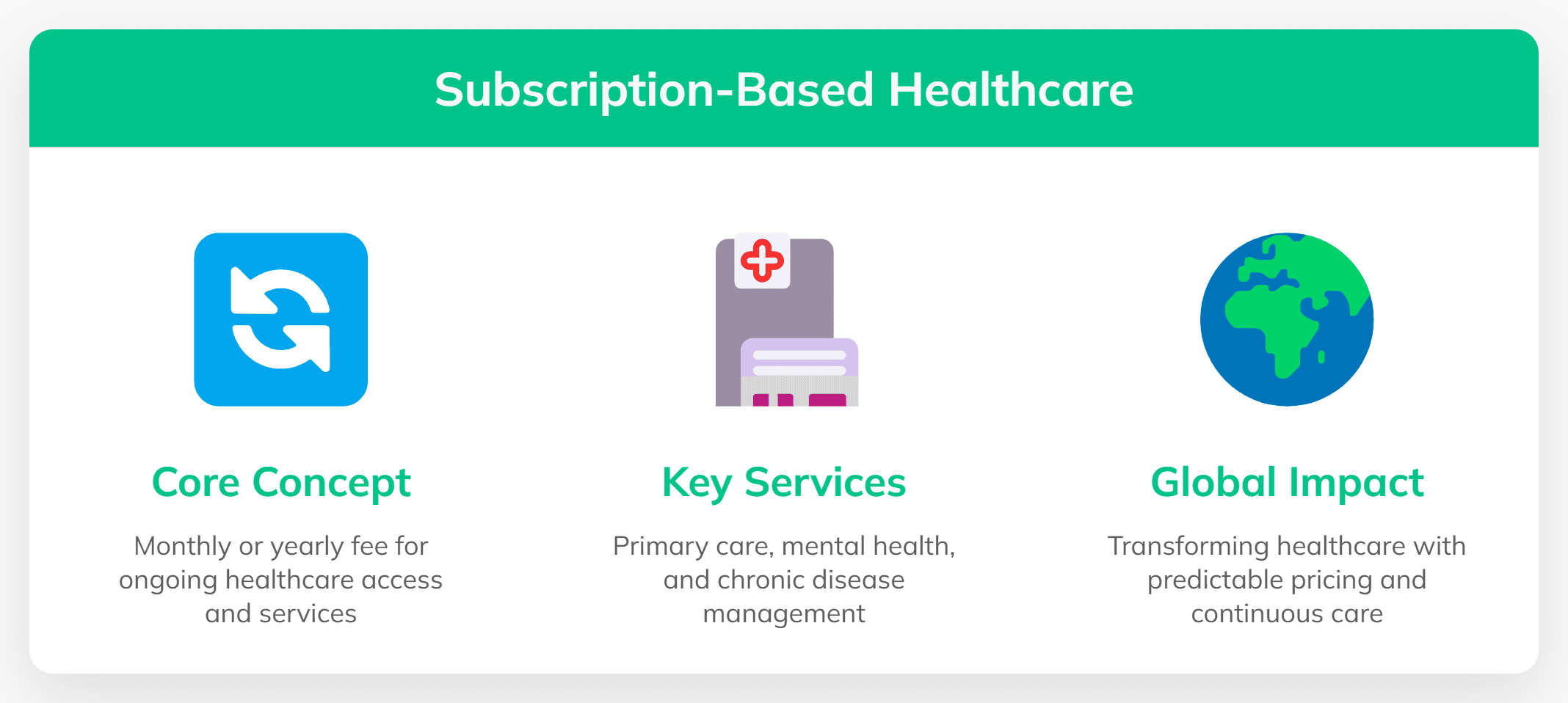

Subscription-based healthcare (healthcare memberships)

The subscription model is perhaps the purest expression of “Healthcare as a Service. Here, patients or employers pay a monthly or yearly fee for ongoing access to healthcare services. It’s growing fast in primary care, mental health, and chronic care.

Direct primary care & concierge: In the US, clinics charge $30–$100/month for unlimited primary care. Startups like Gold Direct Care offer tiered memberships. One Medical (now owned by Amazon) charges an annual fee for fast access, with Amazon Prime members getting it for just $9/month – an interesting blend shopping, television, and… healthcare.

Virtual care: Platforms like Babylon Health in the UK offered unlimited virtual GP visits for a flat monthly fee. Mental health services like BetterHelp and apps like Calm also use subscription models.

Chronic disease care: Programs for diabetes or hypertension often include coaching, devices, and monthly supplies under a flat-rate subscription. For example, a diabetes care program might ship you test strips monthly and include dietitian consults, all under a flat subscription fee.

Why it works:

For patients — predictable pricing and easier access.

For providers — recurring revenue and longer relationships.

Doctors focus on keeping patients healthy, not booking more visits.

Global traction:

In the US, Iora Health used this model for seniors and was acquired by One Medical.

In the UK, Babylon partnered with insurers like Bupa.

In Europe, Sweden’s Kry (Livi) combines public funding with subscriptions and has delivered over 200 million digital consultations.

These examples show subscriptions can scale: they stickiness (patients stay because they value ongoing care) and can attract big investment. The metric that matters is lifetime value – and in healthcare, a well-served patient can stay subscribed for years, leading to strong ROI if you keep them healthy at reasonable cost.

Outcome-based and value-driven models

Perhaps the most ambitious HaaS model ties revenue to actual health outcomes or value delivered rather than services rendered. In an outcome-based model, providers get paid more (or exclusively) when patients get healthier, avoid complications, or are satisfied with their care. This flips the traditional volume-based mentality on its head:

Value-based contracts (US): Hospitals and clinics earn bonuses for lowering readmissions or hitting health targets (e.g. controlled blood pressure or A1C). It’s pay-for-performance — better outcomes mean better pay.

Shared savings: In models like ACOs, providers take on risk. If they cut costs and improve patient health, they keep part of the savings. Oak Street Health used this approach with Medicare patients — and was acquired by CVS for $10B+.

Performance-based pricing: Some digital health platforms adjust pricing based on results — like discounts if a patient’s weight or blood sugar improves. Others use “money-back” guarantees or only charge when AI tools deliver correct diagnoses.

This was highlighted by Simon-Kucher & Partners, noting that outcome-based contracts “align the provider’s incentives with the customer’s goals… both parties are interested in achieving outcomes”.

Challenges? Measuring outcomes isn’t easy, and many factors are outside the provider’s control. But with better data and AI, tracking real health results is getting easier. In the UK, NHS groups are testing outcome-based payments. Across Europe, there’s momentum to link reimbursement to patient improvement — especially for digital tools.

Outcome-based HaaS models are still evolving, but they represent the endgame of HaaS – getting paid for keeping people healthy. For entrepreneurs, it’s a space to watch: startups that can reliably improve outcomes (using data and AI) can write their own ticket in these models.

Blended and hybrid models

Many HaaS companies mix models to stay flexible. A common setup: low-cost subscriptions for basic care, with extra fees for home visits or specialists. It keeps services affordable while still making money on higher-touch care.

Another blend is insurance-integrated models – where a digital health service partners with employers or insurers who pay the subscription on behalf of users.

We see this in the US with insurers covering telehealth platforms and in Europe where national systems integrate approved apps (e.g., Germany’s DiGA program that prescribes digital health apps through insurance).

Key takeaway: HaaS business models are flexible. The most successful companies often mix and match these models to optimize accessibility and profitability. The unifying theme is focusing on long-term value and relationships over one-off transactions.

Trends in patient experience and digital service delivery

No business model succeeds without a great customer (patient) experience, and here HaaS really differentiates itself. The patient experience in HaaS is designed to mimic the best of consumer tech – convenient, personalized, and often delightfully simple.

A few major trends illustrate how digital service delivery and automation are elevating patient experience.

Learn more: 19 must-know digital health trends for 2025 and beyond

On-demand, omnichannel care

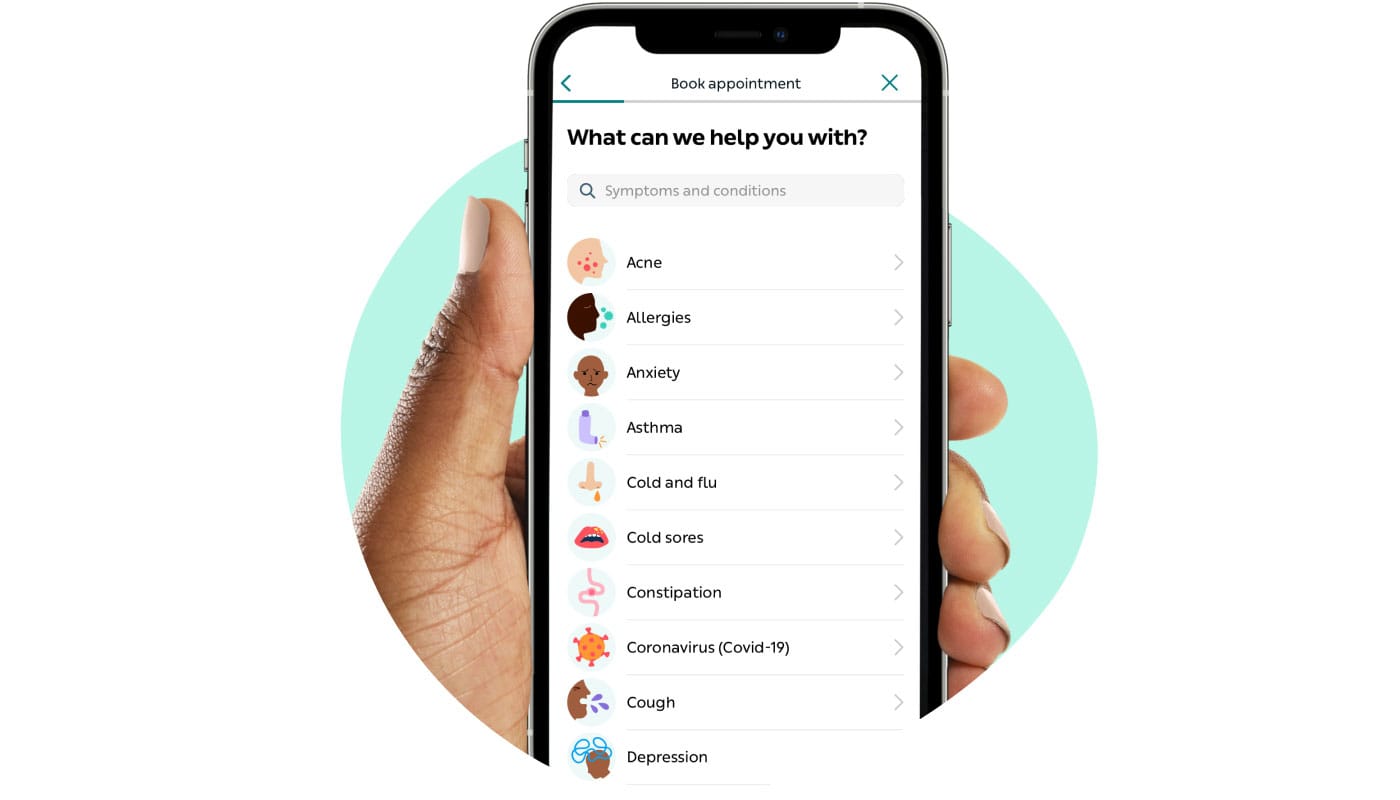

Livi app

HaaS means patients can access care anytime, anywhere. Telehealth and virtual visits are now mainstream, letting patients consult doctors via video at midnight or on a lunch break. In 2020, telehealth usage spiked dramatically (78× higher in April 2020 vs. pre-pandemic) and has stabilized at a vastly higher baseline than before (Healthcare Drive).

This normalized the idea that the doctor’s office can be your smartphone. In 2025, patients expect a seamless blend of virtual and in-person options. UK’s NHS, for example, now offers digital “GP at Hand” services via app, and providers like Livi (Kry) deliver GP appointments within minutes online. The result: convenience is becoming a standard feature of healthcare.

Consumer-grade user experience

Successful HaaS platforms invest heavily in UX/UI, knowing that patients will compare the experience to Netflix or Uber.

Scheduling appointments online, 24/7 chat support, instant prescription refills via app, and home delivery services are increasingly common. In the EU and US, pharmacy chains and startups alike offer medication delivery so that after a virtual visit, the prescription shows up at your door. This end-to-end service increases satisfaction and loyalty. A Press Ganey 2024 survey found that over half of healthcare providers believe patient access has improved with these digital tools, up sharply from a couple years prior (Feedtrail) – meaning the industry recognizes the payoff of better access.

Personalization and preventive engagement

Health ring-compatible patient portal for a US clinic network | Pragmatic Coders

Digital HaaS platforms often come with personalized health content, reminders, and tracking that keep patients engaged between visits.

Mobile apps can track your steps, diet, or symptoms and ping you (or your doctor) if something looks off. Patients are taking a more active role in their care: studies show outcomes improve when patients feel involved . HaaS leverages this by giving patients portals and dashboards to see their health data, set goals, and get nudges.

For example, many patients now use wearables and smartphone apps to monitor chronic conditions; this data flows into HaaS platforms to trigger timely interventions. Greater patient involvement isn’t just feel-good – it’s linked to better self-management and even lower costs (one study cited a 9% drop in doctor visits after implementing patient portals and EHR connectivity, as patients handled more on their own (First Line Software).

- Learn more: Personalization in healthcare

Automation and AI-driven service

Babylon’s AI bot. Source: FirstWord HealthTech

Automation is a backbone of scaling HaaS while keeping quality high.

AI chatbots and symptom checkers often handle the first line of triage, answering common questions or guiding patients on whether they need a doctor at all. For example, Babylon’s AI bot (before a live doctor chat) could assess symptoms and provide suggestions, improving efficiency.

In mental health, apps use AI to check in on patients daily, flagging humans if intervention is needed. Automation also extends to administrative tasks: scheduling, appointment reminders, and follow-ups are increasingly automated through apps and messaging. This reduces staff workload and ensures no patient falls through the cracks. On the clinical side, advanced HaaS providers use AI for decision support – e.g. an algorithm monitoring vital signs in a tele-critical care setting to alert specialists of deterioration early (Philips).

- Learn more: How AI agents can cut costs in healthcare

Remote monitoring programs use connected devices (blood pressure cuffs, glucose monitors) that automatically send data to providteers; if a reading is abnormal, an automated alert can trigger a telehealth call. All of this creates a more responsive system that can act in real-time, which is a huge leap from the old model of “patient waits weeks for an appointment while condition silently worsens.”

Retail and home-based care

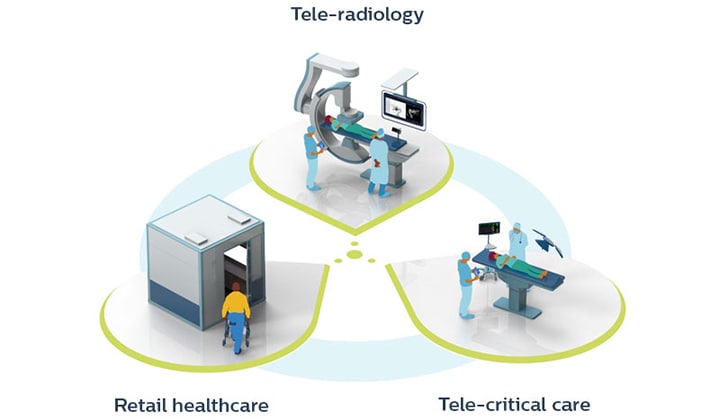

Source: Philips

Another trend is bringing healthcare to where patients already are.

Retail clinics and kiosks (inside pharmacies, malls, or even employer campuses) offer walk-in services, often backed by a telehealth connection to a provider network. Philips, for instance, has envisioned “wellness pods” in shopping centers that link to a central hub for remote exams (Philips).

In the US, retail giants like CVS, Walgreens, and Walmart once aimed to bring healthcare into stores — but many of those efforts are now scaling back. Walmart shut down all 51 of its clinics and virtual care services, while Walgreens and CVS are also cutting back due to high costs and operational challenges (CNBC).

Home-based care is also rising – not just traditional home nursing, but hospital-level care at home through remote monitoring and tele-visits. This Hospital-at-Home movement turns acute care into a service delivered in your living room, heavily reliant on IoT devices and a responsive service team. It’s HaaS in the literal sense: the hospital comes to you as a service, billed perhaps per day of home care but far cheaper than an ICU bed, and often with equal or better outcomes for suitable patients.

Conclusion: Why HaaS makes business sense

For startup founders and product teams, HaaS is a clear opportunity. The playbook:

Use tech to cut costs or improve care, not for show.

Build models that share risk and reward.

Put the patient experience first — and remember, the “customer” could also be the provider or payer.

HaaS won’t replace all of healthcare overnight, but it’s gaining ground in primary care, mental health, and chronic care. Companies embracing this shift — offering care that’s on demand, easy to use, and tied to results — will lead the next decade of healthcare.

The message is clear: adapt now or get left behind. Whether you’re a startup or an established provider, HaaS offers a practical, profitable way forward — one built around better health, lower costs, and real impact.

Ready to build your own HaaS solution?

Whether you’re a startup founder with a big idea, a product owner modernizing healthcare delivery, or a traditional business leader looking to automate and scale — we can help you build faster and ship smarter.

At Pragmatic Coders, we’ve helped companies design and launch AI-powered healthcare apps, patient platforms, internal tools, and automation systems that actually deliver ROI.

No fluff. Just business impact.

👉 Let’s talk about your HaaS vision — and make it real: