What is sustainable banking? Startup guide

Have you noticed there are a lot of banking apps nowadays that make sustainability their selling point?

The tendency is huge: in fact, out of 360 companies in the banking industry I analyzed, 62 have something to do with being “eco-friendly”*. That’s 17.2% of all of them, or slightly less than 1 in 5–quite a lot.

Is sustainability the future of banking or just a fad? Why do banks even want to be green? Is every sustainable finance initiative successful? (It’s not). And, finally, what can YOU learn from them to build YOUR fintech app?

Let’s find out.

*On June 12-13, 2024, I researched companies listed on Dealroom. I used the following search filters: founded between 2020 and 2024, industry: fintech, subindustry: banking.

What is sustainable banking?

Sustainable banking is a way of banking that considers the environmental, social and governance (ESG) impact of its practices.

This means making their core business plans, choices, financial actions, and investments all work towards achieving the UN’s Sustainable Development Goals and international agreements like the Paris Climate Agreement. Sustainable banking–along with ESG reporting, carbon tracking & offsets, natural capital accounting and more–is a subset of the climate fintech (green fintech) market.

I’ll delve deeper into what banks do to achieve sustainability in detail later on. First, let’s establish: Why are they even doing this?

Why do banks go for sustainability?

If I were to generalize the reasons behind bank’s drive towards sustainability, I would narrow them down into one key driver: pressure.

A wave of pressure from customers, employees, and regulators is pushing banks to prioritize sustainable finance. This trend aligns with the growing importance of ESG factors in finance.

The impact of ESG on the finance industry

ESG performance is a major force in the financial sector’s shift toward sustainability. Studies show that good ESG performance is linked to higher equity returns and lower downside risk–but that’s not the only benefit that comes with commitment to sustainability.

Here’s how ESG is impacting the finance industry:

- Improved brand reputation: Companies prioritizing ESG are seen as more responsible and ethical.

- Access to capital: Investors are looking for ESG-friendly organizations to invest in, giving companies that focus on ESG better access to capital. Assets under management in ESG-focused institutional investments are projected to reach a staggering $33.9 trillion by 2026. That’s an 84% increase from 2022.

- Competitive advantage: Integrating ESG principles creates a key differentiator that fosters trust and loyalty, often leading to higher customer retention.

Pressure from customers

Customers are becoming more environmentally and socially conscious and prefer to align their financial activities with institutions that share their values (see, for example: r/ClimateOffensive, Recommendations for more sustainable banking?).

People are increasingly holding banks accountable for their environmental and social impact. For example, a Kearney survey revealed that young adults (18-24 years old) are significantly more likely to switch banks based on ESG credentials–but there’s more research that proves sustainability is an opportunity, not concession.

- Market potential: A significant portion (nearly 40%) of US consumers are interested in climate-linked financial products, with two-thirds willing to dedicate a substantial amount of their savings or spending towards them.

- Premium willingness: Notably, there is strong interest in green savings accounts, even if it means accepting a lower annual percentage yield (APY). Up to 40% of consumers surveyed would choose a green savings account with a 20% lower APY compared to traditional savings accounts, and a quarter would accept a 60% lower APY.

Pressure from regulations

As the world sets its sights on net-zero emissions, financial institutions are adapting their practices to reflect this global goal.

For instance, the European Banking Authority has mandated climate disclosures starting in December 2023. Financial institutions are gearing up for ESG regulations: they develop comprehensive risk management frameworks invest in data analytics platforms to collect and analyze ESG data, ensuring they can comply with reporting requirements.

In addition to these pressures, the emergence of industry frameworks such as the Principles of Responsible Banking and the Net-Zero Banking Alliance, both initiated by the United Nations, are encouraging banks to align their operations with global sustainability goals.

How do green banks work?

Banks function as intermediaries between savers and borrowers.

There are many types of banks: retail (individuals/small businesses), commercial (businesses), investment (capital raising), central (government-controlled), or credit unions (non-profit, member-owned).

Deposits allow them to offer various services (savings accounts, credit cards, online banking, etc.), with the main source of income for banks being loans. Apart from loans, banks make money through net interest margin, fees, investment banking, and wealth management.

In these terms, sustainable banks are no different; the core of their functioning remains the same. What changes is their focus and priorities.

What do green banks do differently? Sustainable banking practices

Regular banks focus on making the most profit possible.

Sustainable banks (ideally) take a different approach. They consider not just their financial gain, but also the so-called Triple Bottom Line–the social and environmental impact of their decisions.

1. Offering sustainable financial products

Banks are increasingly integrating sustainability principles into their products and services. Examples include:

- Green living

- Green car loans: Offering favorable terms for purchasing electric or hybrid vehicles.

- Green mortgages: Lower interest rates or other benefits for homes with energy-efficient features.

- Residential-solar lending: Supporting customers in financing the installation of solar panels on their homes.

- Responsible investing

- Green savings and bonds: Providing investment options that support environmentally friendly projects.

- Climate-screened index funds: Investment products that align with a climate-conscious investment approach.

- Tracking & monitoring: Carbon impact calculators, sustainability calculators, sustainable shopping recommendations.

- Donations and rewards: Cashback and discounts at sustainable businesses, donations for sustainable activities, such as tree planting and carbon offsetting

- Banking cards: Cards made from sustainable materials, digital-first cards, card recycling

2. Reducing investments in harmful sectors

Banks are shifting their investment strategies away from industries that negatively impact the environment–sectors like mining, which are known for their environmental damage.

3. Increasing support for sustainable sectors

Banks are actively increasing their support for industries and initiatives that promote sustainability. They increase investments in renewable energy production and consumption.

This also involves providing financing for green projects and businesses working towards sustainable development.

4. Implementing internal sustainability practices

Banks are also adopting sustainable practices within their own operations

- Tech: Reducing their carbon footprint and emissions through measures like using cloud-based IT infrastructure.

- Team: Promoting sustainable practices in the workplace.

Challenges of ESG implementation in banking

One key challenge in implementing sustainability, particularly in banking, is the lack of a uniform industry framework for measuring sustainability. Existing frameworks, such as the Business Environment Index (BEI) and the Task Force on Climate-Related Financial Disclosures (TCFD), are not universally adopted. Unlike financial reporting, which uses standardized parameters like assets, liabilities, and net profit, ESG reporting lacks a standardized mechanism. This lack of uniformity creates variability in approaches across the banking sector–and this makes it harder to assess a bank’s true commitment to ESG goals.

Consumer education is another challenge. Although consumer interest in climate-linked financial products is growing, their understanding of these products and their impacts remains low. Without this education, consumers may struggle to see the value of these products, and give up on them entirely.

- In the McKinsey study, when presented with four distinct value propositions related to a green savings account, consumer responses were almost evenly distributed. While the even spread could reflect genuine indifference, it’s also possible consumers didn’t grasp the product details well enough to form a clear preference.

Another challenge for financial institutions is the need to differentiate themselves in the sustainable banking market. Despite years of promoting eco-friendly practices, like paperless billing, financial institutions haven’t convinced a majority of consumers they are truly committed to the climate transition. In the above-mentioned survey, no bank scored higher than 59% on any question regarding green efforts. (The average score across all questions was a low range of 24% to 42%.) In simpler terms, consumers aren’t buying what banks are selling when it comes to sustainability. While banks might be taking some eco-friendly steps, it’s not enough to convince a majority of people that they’re genuinely committed to making a positive environmental impact. Or, maybe, they’re not promoting their green efforts enough.

As consumers’ understanding of climate-linked financial products remains low, they may not differentiate between genuine efforts and misleading marketing tactic: greenwashing.

Greenwashing is a deceptive practice of making a bank appear more environmentally friendly than it actually is. Such a “tactic’ is risky in a couple of ways: it can damage their public image and cause stakeholders and customers to lose trust. If caught, banks could face lawsuits, regulatory investigations, and fines.

Product examples & market insight

This section delves into the world of sustainable finance within global banking.

We’ll dissect how established banking leaders are integrating sustainable practices into their strategies. We’ll also explore the innovative approaches of fintech neobanks and discover the spectrum of sustainable banking products currently available.

Traditional banks

Banks are taking a multi-pronged approach to sustainability. They offer financial products like Green Bonds that support renewable energy projects, as seen with HSBC’s issuance for renewable energy initiatives. Additionally, Citibank finances large-scale renewable energy projects like wind farms.

Sustainability-Linked Loans with incentives for businesses that meet eco-friendly goals are another offering. For example, Bank of America has issued several corporate green bonds to date, raising funds for renewable energy projects.

Many banks have pledged to achieve net-zero emissions by 2050, not just in their own operations but also in their investments. The Net-Zero Banking Alliance is a group of banks working together towards this goal.

Financing a greener future extends beyond renewable energy. Banks like JPMorgan Chase are adopting green building practices, such as using LEED-certified materials in their buildings. They’re also reducing waste and using renewable energy in their operations.

Banks are also committed to supporting communities. Wells Fargo, for example, invests in community development, affordable housing, and small businesses. They, along with many other banks, promote diversity and inclusion within their ranks.

Finally, some banks offer investment options that consider environmental, social, and governance (ESG) factors. Morgan Stanley is an example of a bank that uses ESG ratings to inform their investment decisions.

Neobanks

Neobanks (or challenger banks) are financial institutions that offer online banking services but aren’t traditional banks with physical branches.

Here are a few examples of how neobanks from around the world are (or were) trying to make banking and finance greener.

Tandem

Founded: 2014

Country: UK

Tandem targets eco-conscious homeowners seeking mortgages or loans that promote sustainable living.

- Green lending: Tandem’s core sustainability strategy revolves around green home improvement loans. These loans make it easier for homeowners to invest in energy-efficient upgrades like solar panels or improved insulation.

- EPC discounts: By offering lower rates on mortgages for energy-efficient homes (A, B, or C EPC ratings), Tandem incentivizes purchasing or renovating properties with a lower environmental impact.

- Tandem marketplace: This platform goes beyond their financial products. It offers resources and information to help users make their homes more eco-friendly and reduce energy bills.

Tomorrow Bank

Founded: 2018

Country: Germany

Tomorrow Bank targets environmentally conscious individuals who prioritize sustainability in their financial choices. It addresses the need for transparency (check their Your bank vs. Tomorrow tool) and sustainability in banking.

- Green investments: Uses customer deposits to fund sustainable projects through Green Bonds, focusing on areas like renewable energy and housing solutions.

- CO2 footprint tracking: Their Zero account lets you track the carbon footprint of your spending habits.

- Climate impact with payments: Each time you use your Tomorrow card, a portion of the interchange fee goes towards environmental projects.

Aspiration

Founded: 2013

Country: US

Aspiration focuses on socially-conscious, sustainable banking with features like “Pay What Is Fair” and fossil fuel-free investments.

- Plant your change: This program rounds up your debit card purchases to the nearest dollar and uses the extra change to plant trees.

- AIM feature: Shows you your own personal sustainability score based on your purchases—and the People and Planet scores of the places you’re shopping—so that you can make more sustainable purchase decisions.

- Pay What is Fair: Ten percent of the monthly Pay What is Fair amount you choose to pay for your Spend & Save account is donated to nonprofits that support climate action.

- Climate action on auto-pilot: Aspiration calculates the carbon output and mitigates the carbon dioxide emissions from every gallon of gas you purchase using your Aspiration Plus debit card.

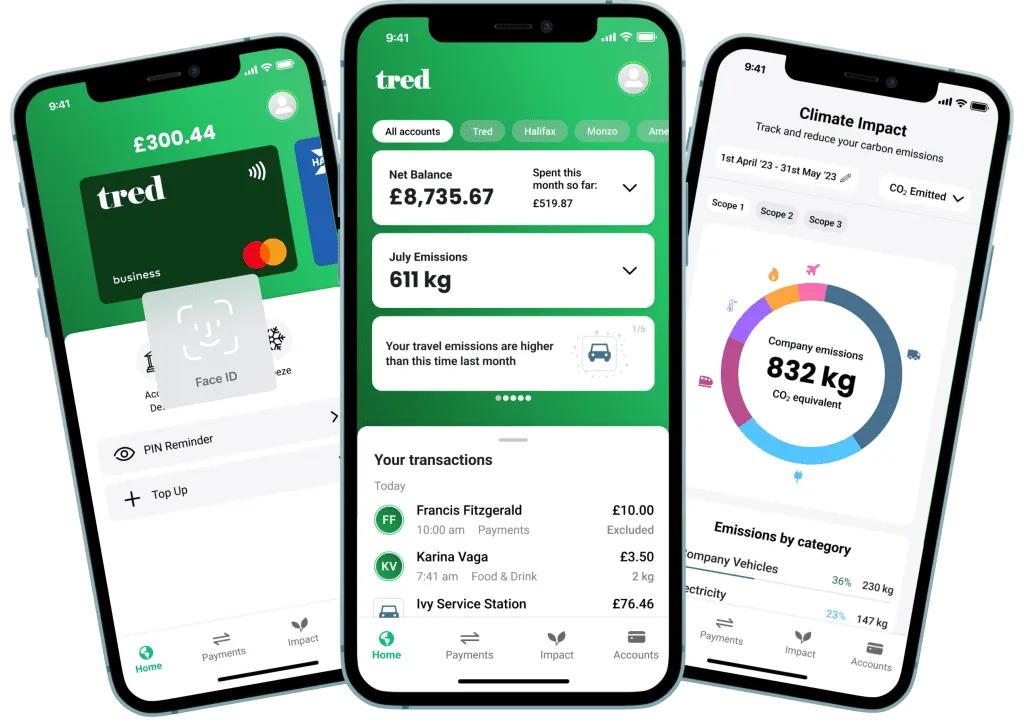

Tred

Founded: 2019

Country: UK

Traditional banking does not typically provide tools for understanding and mitigating carbon footprints. Tred solves this by offering a platform that tracks, reports, and helps reduce the carbon emissions associated with everyday spending and business activities.

- Carbon reports: Tred automatically calculates your business’ footprint based on your detailed transaction data from all your accounts.

- Every transaction helps: With every transaction on your Tred business debit card, they donate money to environmental restoration projects, either local to them in Yorkshire, or around the world.

bunq

Founded: 2012

Country: The Netherlands

bunq targets digital nomads and people who travel frequently across Europe, as well as those who want more control and flexibility over their finances. They offer services in 30 European countries.

- Tree planting: Bunq’s users have already planted over 19 million trees across various planting sites in Kenya and Madagascar. For every €1,000 spent by a bunq user (€100 for Easy Bank Pro XL), their partner veritree plants one tree. They’re fighting deforestation, stabilizing coastlines, and nurturing marine life while creating jobs and supporting local livelihoods.

- Socially responsible investing: We avoid sectors such as fossil fuels, tobacco, and gambeling, aligning our portfolio with practices that foster environmental preservation and social well-being. (bunq’s 2023 ESG report)

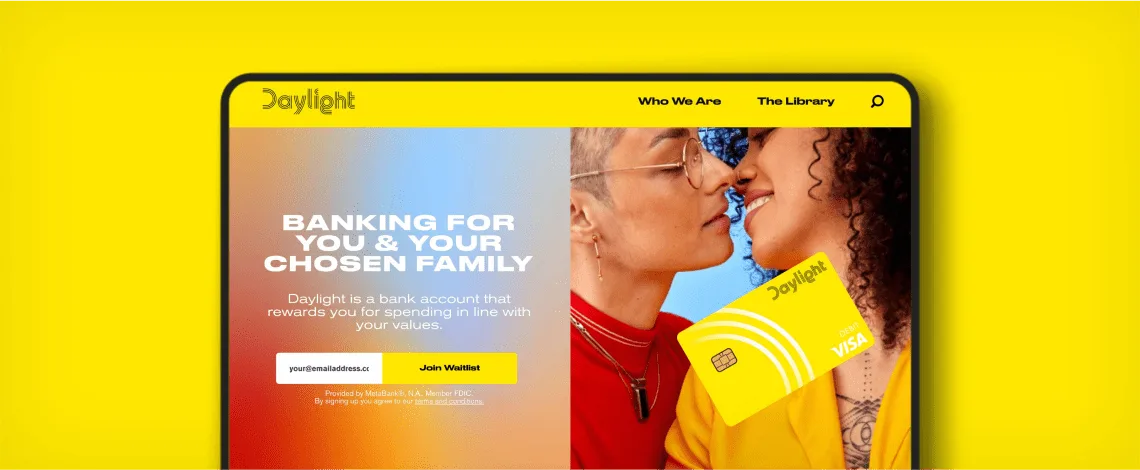

Daylight

Founded: 2020

Closed: 2023

Country: US

Daylight is an interesting case. While the product primarily focused on inclusivity rather than environmental sustainability, their commitment to social sustainability was significant.

Daylight was a digital banking platform specifically designed to meet the needs of the LGBTQ+ community. It offered traditional banking features such as checking accounts, but with unique add-ons tailored to its target audience. This included the ability to have a debit card with a preferred name different from the legal name, financial coaching, and resources for navigating life events unique to the LGBTQ+ community, such as adoption, surrogacy, and gender transition.

Why did they fail? According to TechCrunch:

- Difficulty achieving profitability: Daylight apparently struggled to find a business model that worked for a small company targeting the LGBTQ+ community. Daylight’s CEO stated “we couldn’t provide these services in a way that covered our costs”. Banking thrives on economies of scale, and Daylight may not have had enough customers to cover its costs.

- Internal issues: The article mentions a lawsuit filed by former employees alleging discrimination and misconduct by CEO Rob Curtis. This controversy likely hurt Daylight’s reputation and potentially impacted its ability to raise funds or attract customers.

Other sustainable-banking products

Microfinance, sustainability reporting, CO₂ emission tracking, and more–explore how eco fintechs are disrupting the financial sector.

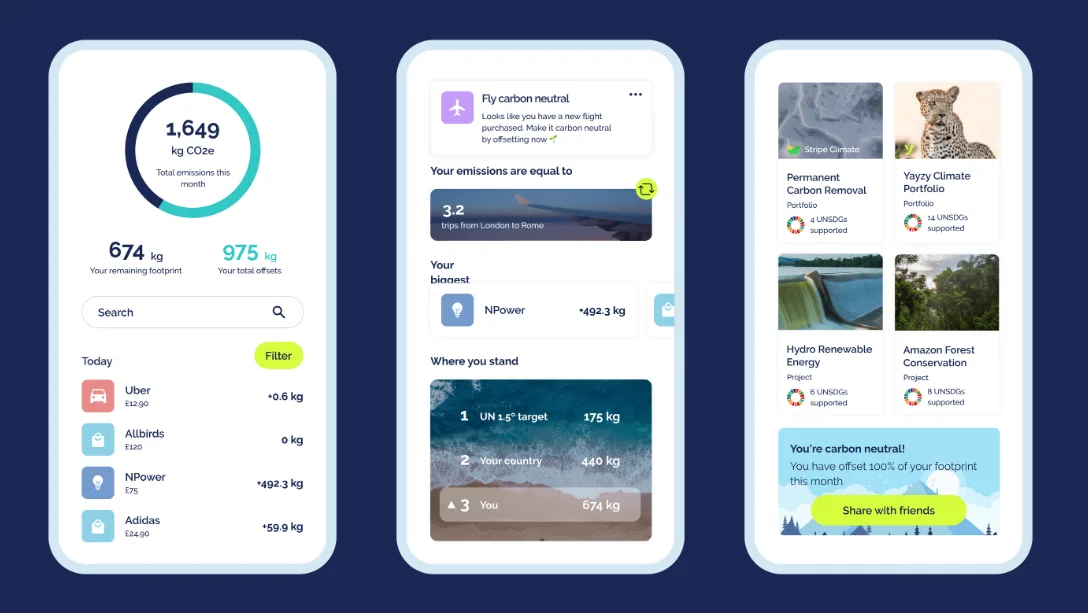

Doconomy

Doconomy provides a digital platform that tracks the CO₂ emissions of financial transactions using the Åland Index. Users can monitor their carbon footprint based on their spending and offset their impact by supporting environmental projects.

- Problem solved: The lack of awareness and tools to measure the environmental impact of daily financial transactions; promoting sustainable consumption habits.

- Target user: Environmentally conscious consumers and financial institutions that want to integrate sustainability into their financial products.

Climate X

Climate X offers predictive data analytics to assess climate risks.

- Problem solved: The need for accurate, predictive climate risk data to inform strategic planning and investment, helping to prepare for and mitigate the effects of climate change.

- Target user: Businesses, governments, and policymakers focused on climate resilience and risk management.

Connect Earth

Connect Earth provides carbon intelligence solutions that help financial institutions measure and manage the carbon footprint of their financial products.

- Problem solved: The lack of reliable data on the carbon impact of financial products.

- Target user: Financial institutions looking to integrate carbon footprint analysis into their products and services.

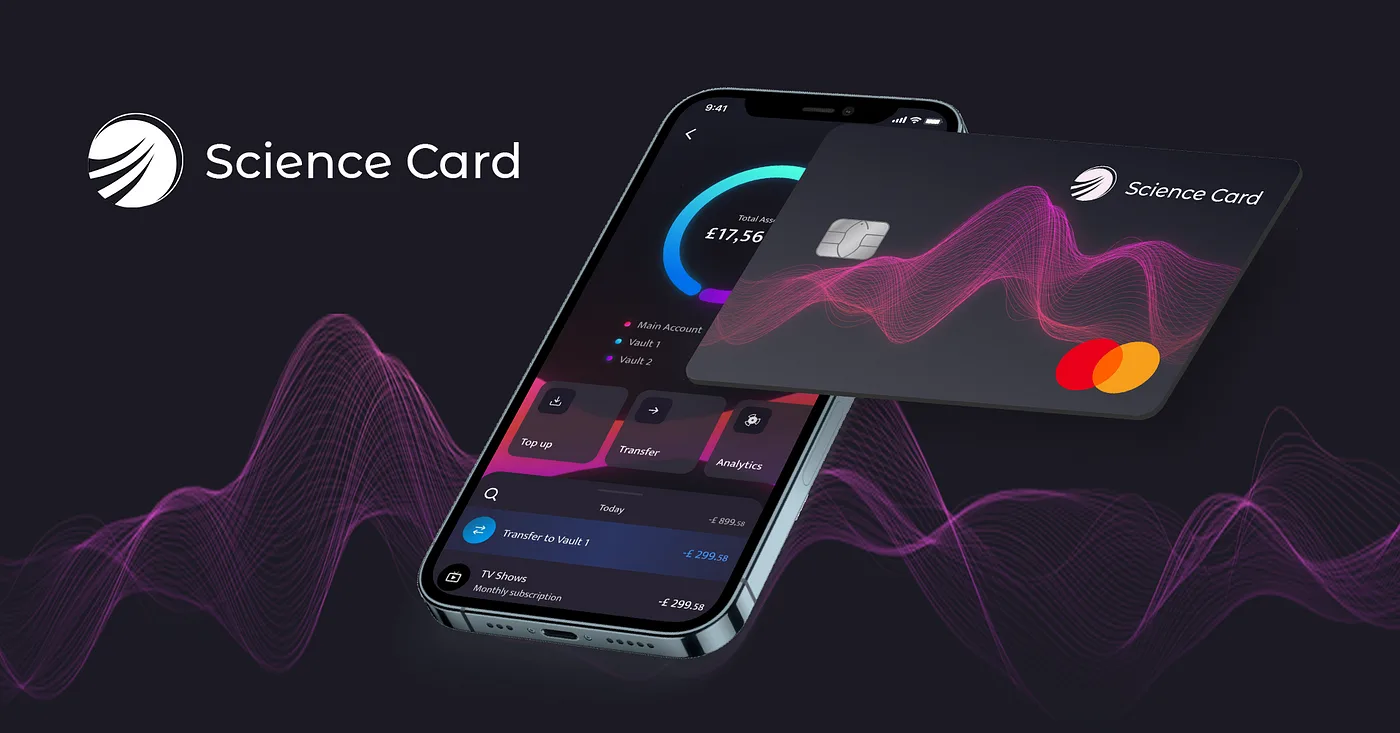

Science Card

The Science Card app functions as a regular e-money account. Now, here’s the twist: you can directly contribute to specific projects or choose to round up your everyday purchases with the extra funds going towards research (in areas like climate change, healthcare and computational power).

- Problem solved: The limited access to investment options specifically targeting sustainable projects and technologies, promoting environmental responsibility through finance.

- Target user: Environmentally conscious consumers looking to support sustainable projects.

ecolytiq

ecolytiq offers a platform that provides digital infrastructure for green finance. Their technology enables financial institutions to offer products and services that promote sustainability and environmental responsibility.

- Target user: Financial institutions aiming to offer green finance products and services.

- Problem solved: The need for robust digital tools to integrate sustainability into financial products, helping institutions promote environmentally responsible financial behaviors.

YAYZY

YAYZY connects to users’ bank accounts to track the environmental impact of their purchases, providing insights and recommendations to reduce their carbon footprint.

- Problem solved: The lack of awareness and tools to measure and manage the environmental impact of individual consumption, encouraging sustainable consumer behaviors.

- Target user: Consumers interested in understanding and reducing their carbon footprint.

Finbox Solutions

Finbox Solutions offers ESG tools and solutions that help investors and financial institutions make sustainable investment decisions. Their platform provides assessments and insights into the ESG impact of various investments.

- Problem solved: The lack of reliable tools to assess and integrate ESG factors into investment decisions, promoting responsible and sustainable investing practices.

- Target user: Investors and financial institutions focused on ESG investing.

Microfinance & financial inclusion products

Microfinance and financial inclusion products empower people to build a better life, contributing to social sustainability. By giving access to financial tools like loans and savings, microfinance and financial inclusion products break the cycle of poverty and inequality, furthering social responsibility.

Product examples:

- Sindhuja Microcredit: Microfinance loans and insurance for financially excluded in India.

- Jefa: Financial services for women in Latin America.

- Khazna: Digital financial services for underbanked Egyptians.

How to build a sustainable banking app?

Finally, crème de la crème of the article: what can YOU need to do to build a green banking (or, in general, fintech) app?

Let’s discuss this word by word (literally), starting from the most general concepts:

- Build an app

- Banking

- Sustainable

How to build any app?

Nowadays, with AI and no-code, building an app is no longer that unachievable. However, the problem is: how do you do it right? How do you build a business (because an app is just its digital manifestation) that makes money?

If you need a guide to take from the entire path from analyzing market and competitors, validating your ideas, to crafting an MVP roadmap, download our free ebook How to start a startup. There, we’ve explained the business development process we’ve come up with, having built over 80 startup products.

You can also check if your business idea makes sense using our free AI market research tool.

How to build a banking app?

At its core, building a banking app doesn’t differ from starting any other endeavor. If you know the basics we’ve explored in our ebook, you know how to approach it.

On the other hand, of course, banking is a specific domain (we’ve built a few banks, so we understand this pretty well) with specific needs and requirements. For that, we recommend you check the FINTECH tag on our blog. Here are 6 of our most widely-read banking-related articles:

- Gamification in banking

- Banking technology trends

- Best mobile banking app features to retain users

- Top 5 challenges in banking

- Gen Z: The future of banking

- Future trends in mobile banking

How to build a sustainable app?

I believe this article gave you a glimpse into the various aspects of sustainability in the banking sector, from the challenges there are to seeing what others in the industry are up to.

If you wish to learn even more more about building green tech products, check this article: Sustainability, green tech & startups: A guide for aspiring entrepreneurs.

Conclusions. Is sustainability the future of banking or just a fad?

Sustainability is no longer a fringe concept in banking, it’s driving a major transformation. From surging green investments ($1.6 trillion in sustainable debt issuance in 2021!) to stricter regulations and customer demands, banks are taking action. While internal and external sustainability initiatives may currently appear as ‘nice-to-have’ options for many banks, they will almost certainly become a necessity in the years to come.

Want to build a sustainable banking app, integrate sustainability into your existing product–or maybe just build ANY type of app with a product development company that knows how to approach the business side of software development?

Contact us–we’ll help you craft your business strategy, design your product and build it right.