How to make sense of banking personalization in 2026: 8 key insights

More than 70% of consumers expect personalized interactions from businesses. When they don’t get them, nearly 80% feel frustrated. In banking, personalization isn’t just a nice-to-have anymore—it’s a must.

But here’s the challenge: a simple “Hello, [NAME]” in your banking app isn’t enough. Customers now expect AI-driven hyper-personalization, where banks anticipate their needs, offer real-time financial insights, and tailor services to their unique situations.

So, how can banks deliver? Here are 8 key insights on how AI-powered personalization is reshaping banking—and how to use it to build customer loyalty.

AI PERSONALIZATION FOR FINANCE

1. Personalization is not about sales—it’s about service

Many banks see personalization as a way to sell more products. But that’s the wrong mindset.

💡 To be sure, personalization in banking is not primarily about selling. It’s about providing service, information, and advice, often on a daily basis or even several times a day.

Boston Consulting Group found that successful personalization in banking happens when banks help customers manage their finances better—not when they bombard them with offers.

- Supporting stat: 76% of customers are more likely to choose a bank that offers personalization in financial services, and 71% already expect it as a standard. (TSB)

- Example:

- Pain point: Sarah, a college student, keeps accidentally incurring overdraft fees due to forgetting about upcoming bills and keeping a low balance.

- Personalized banking solution: Sarah’s bank analyzes her spending habits and notices a pattern of overdrafts around the time her phone bill is due. The bank can:

- Proactively send Sarah a notification a few days before the due date reminding her about the upcoming bill and her current balance.

- Offer a small, personalized overdraft buffer (say, $10-$20) to cover the bill if her balance falls short, avoiding the overdraft fee.

- Recommend a budgeting tool to help Sarah better track her finances and avoid future overdrafts.

- How to apply it: Focus on proactive financial support (budgeting insights, bill reminders, spending alerts) rather than aggressive sales tactics. AI-powered financial coaching can help customers make informed decisions without feeling pressured.

2. Hyper-personalization = real-time + AI + context

Basic personalization uses broad categories—like offering credit cards to all users with high income. Hyper-personalization, however, goes much deeper. It relies on real-time data, machine learning, and individual context to predict and serve each customer’s unique needs.

“We want to use AI and ML to identify key events in the customer’s life that might necessitate financial support and use that response to help customers ultimately achieve their life ambitions.” – Kavin Mistry, Head of Digital Marketing and Personalization at TSB Bank.

Samantha Searle, director analyst at Gartner, in a video-conference for ZDNET, explains that personalized banking initiatives should do two things:

- Firstly, a hyper-personalized banking service should assist customers in achieving their financial objectives, such as saving for a down payment on a house or managing their budget more effectively.

- Secondly, such a service should focus on a customer’s life stages and provide support during major life events, such as marriage. This might include providing information on relevant financial products like mortgage options or home and life insurance.

Research shows companies experiencing faster growth generate 40% more revenue from personalization compared to those with slower growth rates. (McKinsey)

- How to apply it: Use AI-driven behavior analysis to personalize messages, recommendations, and financial advice on a per-user basis. AI and machine learning allow banks to identify key life events, like moving to a new home or starting a new job, and offer relevant financial products in real-time.

3. Customers want banks to be proactive and advisory

What do people actually want from their banking apps?

If you want to successfully implement personalization in a banking app, you first need to understand what it’s really about – and it’s not about sales.

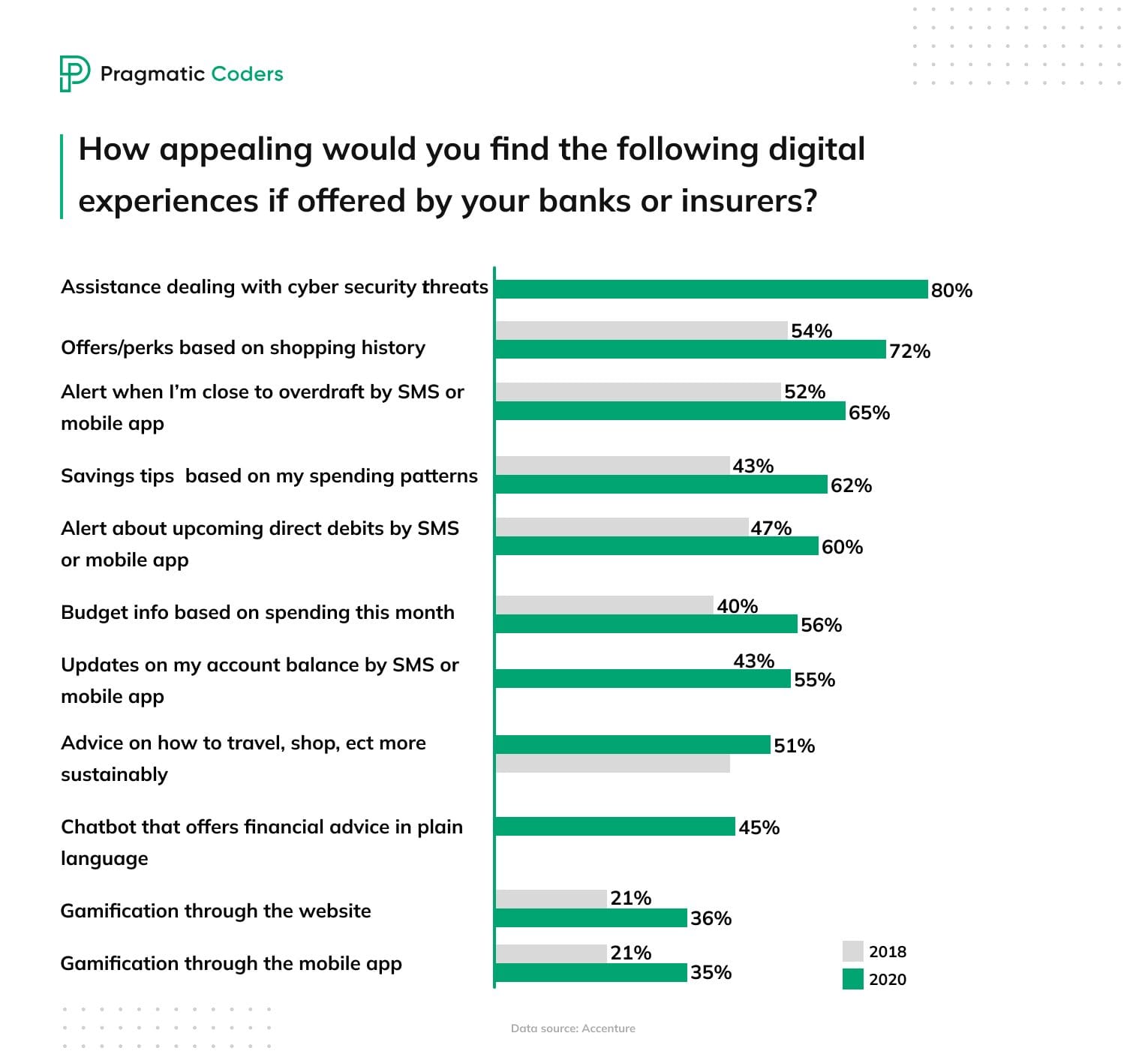

Take a look at the table above. Accenture’s research shows what people want their banks to provide them with.

Alerts, tips, updates, and advice based on their financial activity.

You can clearly see – even though the words “personalized” or “custom” didn’t appear at least once – that customers crave helpful services tailored to their needs with data about their past behavior.

Accenture’s research shows that customers expect their banks to notify them about key financial events—such as sudden changes in spending, bill due dates, or smart savings opportunities.

- How to apply it: AI-powered banking apps should provide real-time spending analysis, proactive savings recommendations, and financial coaching tailored to each customer’s goals and habits.

Also check: 12 (innovative) mobile banking features for 2025 you need to know

4. Personalization boosts revenue—if done right

Banks that personalize customer interactions see a $300 million revenue boost per $100 billion in assets (BCG). But bad personalization backfires.

💡 76% of customers are more likely to choose a bank that offers personalized experiences.

- Example: TSB Bank increased lead generation by 300% by personalizing loan offers based on real customer data instead of generic promotions:

We were on a mission to prove the concept and the value of the product. So, we focused on meeting customer needs. The first personalised communication that we did was around loans. Instead of generic information in a banner in an email around the amount a customer could borrow, we provided a realistic amount each individual customer could have. (source)

TSB also launched a credit card communication to help customers avoid unnecessary interest rate payments:

We’re giving them guided experiences to set up a direct debit to pay off their balance regularly. So, we’ve not only launched the communication and data that sits behind it, but also a personalized experience. And one in 10 customers that we’ve sent the communication to have now set up a direct debit. (source)

- Supporting stat: 78% of consumers that receive personalized messages are more likely to buy from a brand again. (McKinsey)

- How to apply it: Use personalized financial coaching instead of just pushing offers—users will naturally engage more (and buy more) when they feel understood. AI can track customer interactions and refine its personalization strategy over time.

5. The future of banking is adaptive and omnichannel

Personalization shouldn’t just happen in an app—it needs to work seamlessly across all channels.

The concept of omnichannel means banks will operate from a ‘jobs to be done’ perspective – help users achieve their goals in every way possible. This requires seamless integration of digital and physical services, along with core banking and related nonbanking products.

The concept ensures a smooth customer experience across web, apps, call centers, and smart devices, allowing users to switch easily between them from digital onboarding onwards.

All touchpoints stay updated to meet user needs. For example, if a user has an issue in the app, call center representatives already know about it. A strong omnichannel strategy relies on cloud computing. Cloud-based solutions enable banks to centralize data, scale resources dynamically, and keep all channels in sync. This ensures a seamless user experience, enables real-time updates, and allows banks to analyze data for personalized services and faster responses.

💡 A customer who asks a chatbot about mortgage options should see relevant recommendations when they visit a branch—or talk to a human rep who already knows their inquiry.

- Example: Monzo uses real-time behavior tracking to help customer support reps anticipate and resolve 85% of user inquiries instantly.

- How to apply it: Create an AI-powered omnichannel experience where app, banking conversational AI (that is, chatbots), website, and human support all work together to personalize service. AI should integrate customer data across all touchpoints to ensure continuity and consistency.

6. Personalization can expand financial inclusion

AI-driven personalization is a powerful tool for expanding financial inclusion, bringing banking services to those who have historically been left out. Even today, 1.4 billion adults worldwide still lack access to basic banking services (World Bank). In developed economies, financial exclusion remains a significant issue:

- Higher credit denial rates for Black Americans compared to white applicants with similar financial profiles (McKinsey).

- 31.2% of Latino households in the U.S. are either unbanked or underbanked (FDIC).

- Immigrants often struggle with limited credit histories, making it harder to access loans

- As of mid-2024, there were 3,629 banking deserts and 3,094 potential banking deserts across the US. (Banking deserts are areas without a bank branch within a specific radius: 2 miles for urban areas, 5 miles for suburban areas, and 10 miles for rural areas.) (FedCommunities)

AI can bridge this gap by offering more personalized, data-driven solutions that recognize diverse financial behaviors and needs.

- Rethinking creditworthiness: Traditional credit scoring excludes millions of responsible individuals. AI changes that by analyzing alternative data sources such as rental and utility payments, income stability (not just income amount), or mobile bill payments and transaction patterns.

- Unique financial behaviors: Many underserved communities rely on informal financial networks that don’t fit into traditional banking models. AI could recognize, for example, seasonal income patterns, family-based lending and support systems, or cash-heavy financial habits.

- AI can adapt banking services to match cultural and economic realities: Faith-based banking options immigration-friendly account setups, or loan products designed for gig workers and small businesses.

Financial inclusion isn’t just a social good—it’s a $380 billion market opportunity for financial institutions. (Accenture, 2015)

7. Profile your customers…

Customer profiling helps banks classify people by interests, demographics, and behaviors for better marketing and personalized services.

William Trout, director of securities and investment at the consultancy Datos Insights, said for The Financial Brand:

It’s becoming more like a service concierge based on customer profiles and grouping customers as part of affinity groups, like health enthusiasts or sports fans, and marketing to them appropriately,” […] “It’s gotten really tactical.” […] The secret sauce is to enable AI to have the capability to find insights, and for that, you need robust data integrations.

The “customer genome” approach offers another pathway, classifying customers based on age, gender, ethnicity, and life stage. By developing models from this richer dataset, banks gain deeper insights and can better anticipate customer needs. Consider the popular buy now, pay later model—forward-thinking banks now evaluate not just traditional credit metrics, but also behavioral patterns, demographic factors, and social data to make lending decisions in minutes rather than days.

8. …just don’t be a creep

Over a decade ago, Target reportedly figured out a teenager was pregnant based on her shopping habits and sent her baby product coupons. Whether it really happened or not, the stry raises questions about when personalization crosses the line into creepiness.

Today, banks face an even bigger challenge: they have access to deeply personal financial data that could improve customer experiences but might also make people uncomfortable if used the wrong way.

Trust is key—customers won’t share financial data unless they believe it will be handled responsibly. Currently, only 35-40% of Americans are willing to share their financial information, according to Leslie Gillin, CGO at Pagaya (former CMO at JPMorgan).

So how should banks balance personalization with privacy? Leo Goriev from Alty argues that relevance—not rigid boundaries—should guide personalization efforts.

Financial data is undoubtedly personal, but I believe there shouldn’t be a strict line banks shouldn’t cross when using it for personalization. The key is relevance. (The Financial Brand)

A typical regional bank manages 1,500+ customer journeys; by applying thoughtful, well-governed personalization, banks can enhance customer satisfaction without triggering the “creep factor” that turns data-driven insights into privacy nightmares.

Conclusions

To sum up, personalized banking solutions are:

- Predictive – they anticipate the needs and intents customers have or might have in the near future based on their previous and current actions.

- Relevant – non-generic, closely relating to a customer’s individual context.

- Useful – they help users achieve their goals.

- Timely – they address the current situation of a user.

Personalized banking helps customers achieve their goals, whatever they are. It’s not about selling; it’s about creating a banking experience so custom and farseeing, and thus so good, users simply want to keep using it (and then – they want to buy what banks sell). A win-win scenario.

Personalized banking apps. Development services

Need help developing a hyper-personalized banking app? Or, maybe you want to design and implement personalization features into an existing product?

We can help with both. Check our mobile banking development services or reach out to us right now.