How to approach investors now? Startup fundraising in 2025

Superheroes are made, not born. Startup founders such as yourself are one of those rare breeds whose perseverance and multitasking abilities are among the best developed. Apart from setting up the company’s vision, growing the team, and devising marketing and sales strategies, founders are fundraising all the time during the startup’s lifetime.

We’re not gonna lie. Fundraising is a time-consuming experience. As you can see in the chart below, entrepreneurs typically spend more than 4 months in fundraising mode… or even longer.

There are no shortcuts. Nevertheless, we will show you tips and tricks on how to fundraise for a startup so as not to waste time during the process and increase the likelihood you’ll raise the money.

These are our effective strategies for attracting investors in 2025.

Fundraising consulting

TL;DR – tips and tricks on how to fundraise

|

1. Know your enemy. VCs vs. angels: Define who you are raising funds from

There’s a difference between pre-seed/seed funding and later A/B/C… rounds. There are many options to get startup funding. Here’s a short comparison between VCs and Angels/3F’s (Family, Friends, and Fools):

| VCs | Angels | |

| Money | LPs | Their own |

| Objective | Returns | Experience / Returns |

| Decision making | Partners / Investment committee | “Checkbox” |

| Timescale | Months | Weeks |

| Investment strategy | Defined | Flexible (& typically local) |

When there’s no universal advice on approaching both groups, the Founder must know the advantages and disadvantages of VC and Angel fundraising.

- Founders need flexibility and speed when starting with a fresh project; thus, Angels/3F are a much better match than VCs. They typically invest in a matter of weeks, with far easier legal structure (e.g., convertible notes) and different motives. Angels generally are people who are both financially and career-wise successful – they often value the experience, the thrill of joining an early-stage venture rather than expecting pure returns from their investment.

- VCs are different kinds – they expect founders to meet their KPIs / milestones and have a much more complex legal and funding structure. The fundraising process with VCs can take months and could as well lead to failure in negotiations, thus hampering startup growth or even means its death if handled incorrectly.

In 2025, the VC market is going to take a unique shape – it’s becoming more and more polarized. Medium-sized funds might find it hard to carve out a niche, leaving founders with two primary targets: small funds for agility and risk-taking, or large funds for stability and resources. Understanding the dynamics of the fund you’re pitching to—what works for a small fund might not resonate with a large one.

One starting point for the investors

Here’s a tip if you’re just starting to contact investors: take control of the process! By creating the same starting point for multiple investors, you force them to act in parallel, limiting the time they have to share information. This pushes them to decide independently and quickly, assuming the market is moving fast—because if they don’t, they risk losing out to someone else.

Show investors the progress

Investors want to see if you can deliver on your promises, so start building relationships early. If I’m a VC meeting you for the first time, you’re just a single data point—I can’t tell if you’ve made progress or predict where you’re heading. That makes it hard to commit.

To fix this, tell investors what you plan to achieve before your next meeting. Then, follow up with updates on key hires, customers, or innovations. Keep these check-ins simple—quick coffees, newsletters, etc. It helps build trust and shows how you handle challenges.

2. Get introductions to relevant investors

In 2025, the ‘flight to quality’ will continues, which means investors are more selective than ever. They prefer to put larger amounts to fewer, more promising startups. You can clearly see how important it is that you tailor your outreach to investors who have a strong focus on your sector and stage. A scattergun approach won’t work—investors will expect detailed, well-researched pitches that align with their investment theses.

So, to build a relationship, you need to get introduced to the right investors first. There’s no better way to approach your potential investors than getting that warm, fuzzy introduction from mutual contacts.

You can download a VC database from Techstars. Alternatively, you can effortlessly search through LinkedIn Sales Navigator (or even use tools like Skrapp.io to have a complete CSV list generated from Sales Navigator).

So, let’s go over the process in more detail:

- Go to LinkedIn Sales Navigator and buy a Premium account. This is where you can filter a list of all VC’s existing in Europe and the United States.

- Download Skrapp.io Chrome add-on and then you can export all your LinkedIn prospects with a simple click: you’ll get their email address, company name, position, website and so on. It’s easier to prepare a funnel when you have a CSV list.

- Upload them into your CRM or email marketing software to run it through. Now you can manage your automated campaign and measure the results!

Identify investors who are:

- Actively investing (if they fully deployed fund).

- Investing in your area of expertise – their investment focus should match the startup’s vertical.

- Matched based on geographical focus, stage/ amount of investment.

Build your ecosystem

As you know for sure, relationships play a very important role in fundraising. It is not only about keeping them with current and potential investors but also about the network of contacts. Try to build an ecosystem that also includes mentors, advisors, promoters, partners, supporters, journalists, etc. Why is it crucial? Not only because of mutual help opportunities, exchange of knowledge, but also because of the fact that investors check who you cooperate with. This way you can point out and make them look at you more favorably.

3. Move them through the pipeline

The fundraising pipeline should be approached in the same way as a Sales Pipeline. A “No” doesn’t always actually mean “No” forever; keep the investor in the loop and build long-term relationships, but be decisive about when to close the round (remember, the longer your runway, the better you can fundraise). Try to qualify or disqualify as quickly as possible and try to move them through the pipeline swiftly.

4. Automate the fundraising tools – your weapons in fundraising

Your best tools are the ones automated. Be prepared with:

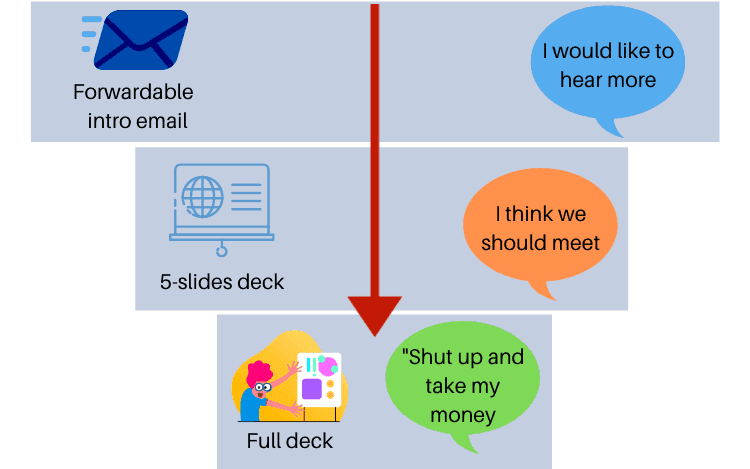

- A forwardable intro email

- 5-slide teaser deck

- A full-slide pitch deck

Step 1: Send an intro email

Why email? – you ask. It’s for one simple reason only – the guys you want to reach are very busy and don’t have time to read the long brochures, presentations, not to mention meetings. Something different when it comes to reading a short email. So, what should you include in it?

First of all, you should write max. 2 paragraphs about your startup and its product or service. It must be briefly like an elevator pitch. Then, present a relevant statement. Show recipients why it’s relevant for them, what are the main arguments in favour of you, and at what stage is your product (if you have an MVP it’ll be your great leverage). Another important thing is a simple question, for example:

- Can we have a quick call?

- Do you want to know more?

- Can I send you more information about the product?

Step 2: Show your 5-slides deck

Be ready when investors answer so you can send them a teaser in the form of the so-called 5-slides deck. In that short presentation showcase 5 main issues; investors want to see clarity here.

- Problem – why people/users need your product.

- Solution – how it resolves the above problem.

- Market – who are your future clients and how big the market is.

- Traction – what is your business traction. The higher the traction, the more investors are attracted to the organization.

- Team – present your team, their competencies, and experience in what your startup does. This is very important and can determine whether you will be considered a credible startup.

What is the desired reaction for that teaser deck?

Step 3: Full deck for a meeting

Whether you meet face to face or online, you have to be well-prepared. We advise you to create a full deck in which you include the following 10 positions:.

- Team – team background with logos, what you did, why did you start this?

- Vision – why do you exist?

- Problem – what problem do you solve and why?

- Demo – show how you product work.

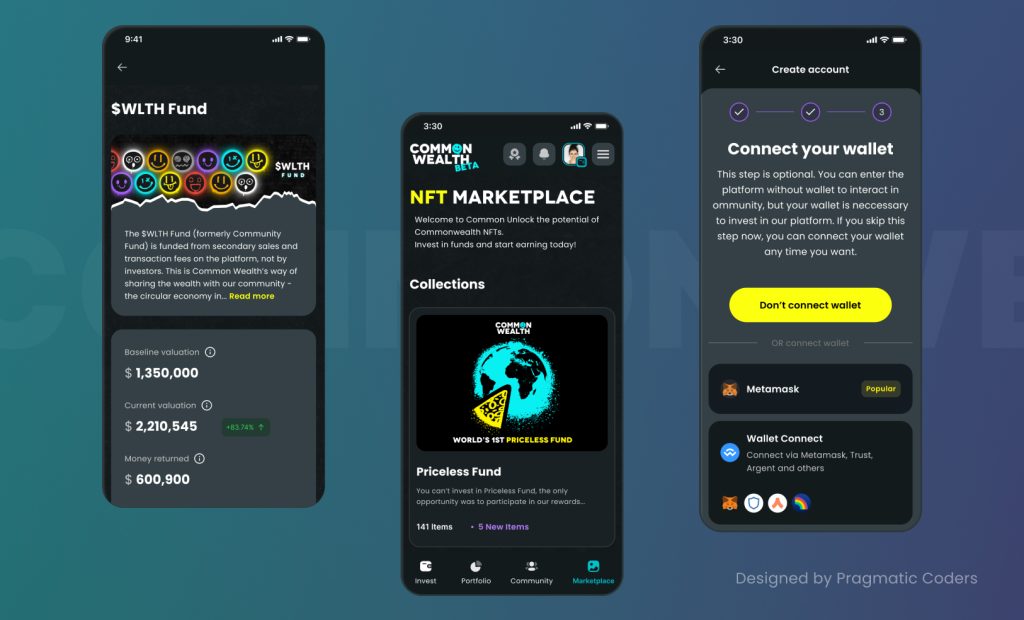

- Traction – customer / user / revenue growth. When they see your business growing – like how Common Wealth got over 60,000 users in their first month – they’ll be more likely to invest.

- Marketing / Sales – how are you selling / intend to sell, what are your metrics?

- Business Model – how do you make / intend to make money?

- Differentiation – how are you better from your competitors? Investors want to see a clear advantage.

- Opportunities – market & growth potential in $$.

- Funding – milestones in the next 18 months and how much you raising.

Preparing for the meeting, put yourself in the role of an investor. Think about what and why is interesting for them. Talking about an idea, vision, problem and its solution is important because it shows that you have learned your lesson and can be taken seriously. But don’t be under any illusions that the idea is more important than the ability to execute it. The most significant thing, however, is the money and opportunities that your startup offers in this aspect.

Common Wealth: Building a successful all-in-one Web3 investing platform, attracting 63k users in its first 3 weeks

Common Wealth came to us with a vision: a user-friendly crypto product that even beginners could navigate. Here's how we created it.

Learn MoreTell your story – get the excitement!

So, you have a meeting… During or right after that the investors will have to answer 3 seemingly uncomplicated questions:

- Do I understand that idea?

- Am I excited by it?

- Do I like the team?

Do you want the answers to be favorable to you? Hard selling is not an option! Remember one thing: it’s easier if you could build your pitch deck as a narrative. Use the fact that people love to hear stories! And the more interesting your deck, the higher chance there is you’ll get an investor’s attention and secure funding. Moreover, there’s no definite guide on how to build a pitch presentation – you can freely arrange all these topic areas in a different manner. The most important thing is that you should feel comfortable telling your story.

What’s more important during the meeting? Stick with the script and your story which you prepared, but be flexible. Let the audience ask you questions. And it’s ok to share things that you don’t know. It’s ok! Just be honest and do not lie. Lying will put you out of the current investment and potentially other investors.

Questions you should ask!

You finished your pitch and answered all the questions. Now, it’s your turn! After all, you want to know what impression you have made, right? So, what are the questions to ask investors?

- What are the next steps? – you have to know when you could expect an answer from them.

- What concerns do you have? – this will give you a hint of what they’re thinking.

- Do you lead or follow? – so it’s a tricky question and will determine the time spent with that investor – if someone’s saying they’re leading, make sure that they have an early commitment and push for a termsheet right away.

- How do you think you can help our company and how does your firm think about following investments? – funds that can follow on with the next rounds will generally support you through the next rounds or even lead the next rounds, the really great ones will have their own team supporting you through the journey.

Be patient

Remember not to be discouraged!

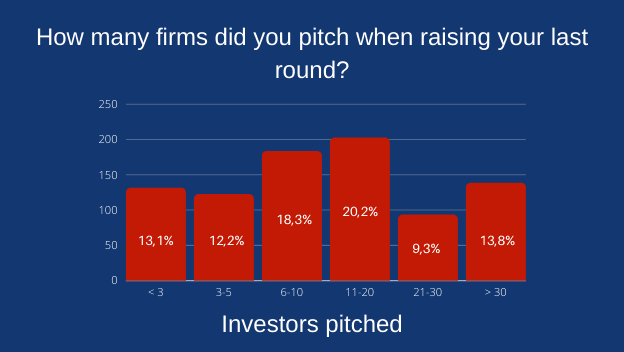

According to data most of you will have to pitch more than 11 investors (which isn’t bad at all) during a single fundraising round. Consider it as a great number of opportunities to establish business contacts and substantial, valuable feedback.

Know your market. Do not exaggerate with the valuation

Last but not least – always start lower with your valuation. It’s not like it’s gonna be set and stone during the whole time of your fundraising process – all the big headlines of multiple investors, large round size, incredible roster of business angels, and sky-high valuations are just the after-effects of the ability of the founder to control the process and create FOMO (fear of missing out).

Determine the round size early – you may set your round size to $1M but depending on the demand and FOMO skills – it may rise to $1,5 or $2M.

What are the factors that affect demand and FOMO in your case?

- Outstanding team with strong product sense

- Strong domain expertise

- Excellent, convincing founders

- Product loved by early adopters

- Strong engagement.

5. Close the deal!

Startups’ valuations can vary greatly depending on the timing. Once you have your first termsheet – use it as a FOMO (Fear-Of-Missing-Out) weapon. This is the time to close and onboard as many investors as possible. The ones that said “No” will eventually come back and ask you for a slice of the pie if they see that other well-known investors are involved. Use it as your negotiation edge and leverage your startup’s valuation.

Kitopi: Building one of the fastest-growing unicorns from scratch in just a few years

We helped Kitopi, a kitchen-as-a-service platform, scale its software development team for ongoing and future product development needs.

Learn MoreYou have the funding – what’s next?

You have the money – now you need to deliver what you promised. And what better way to achieve your milestones that with someone who’ve done it multiple times before?

We’ve worked with various startups around the globe. We’ve even built one unicorn.