Top 10 most inspiring startups to watch in 2025 [MARCH UPDATE]

What is the tech startup industry up to in 2025?

What types of initiatives are investors interested in funding?

What specific features and functionalities are users looking for?

We’re sharing the top 10 operational startups launched in 2024 with the highest Dealroom Signal score to give you an idea of what’s trending in the industry and what ideas are going to gain the most traction in 2025.

| Have a startup idea? Then here’s something you must check out. Our AI-driven Market Research Tool can quickly validate and perform market research for your business concept. It offers comprehensive market analysis, competitor insights, and potential revenue opportunities. Who knows, you might be featured in the next edition of our list? |

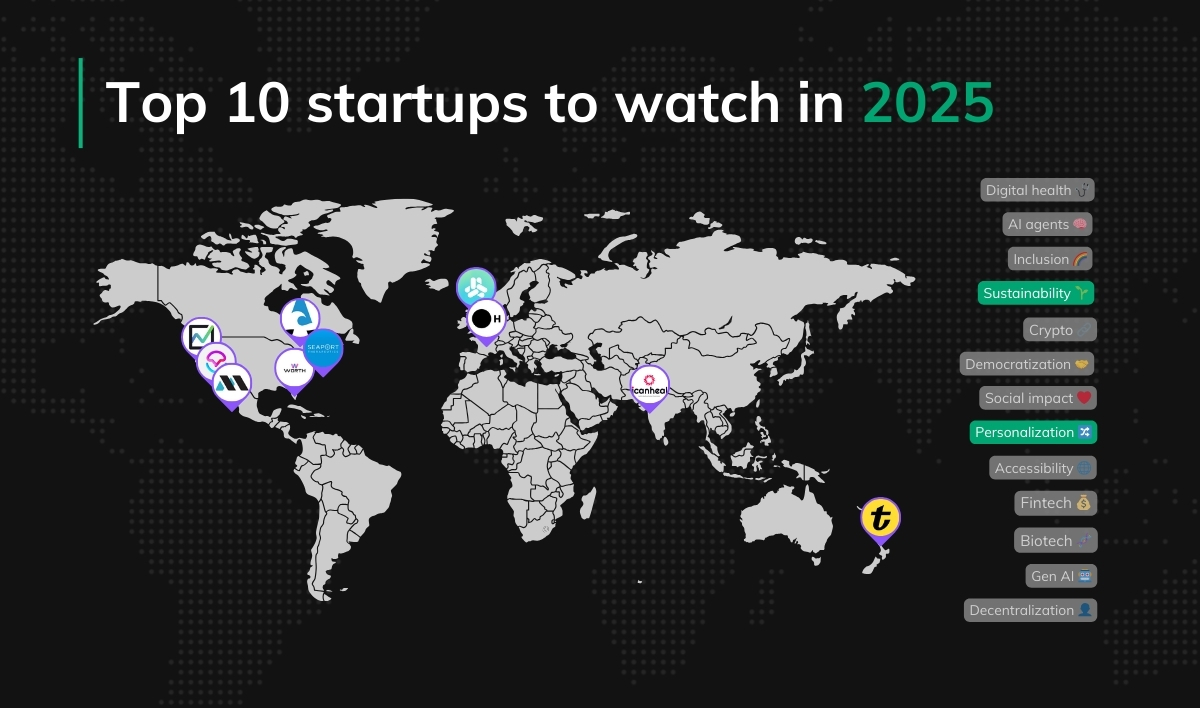

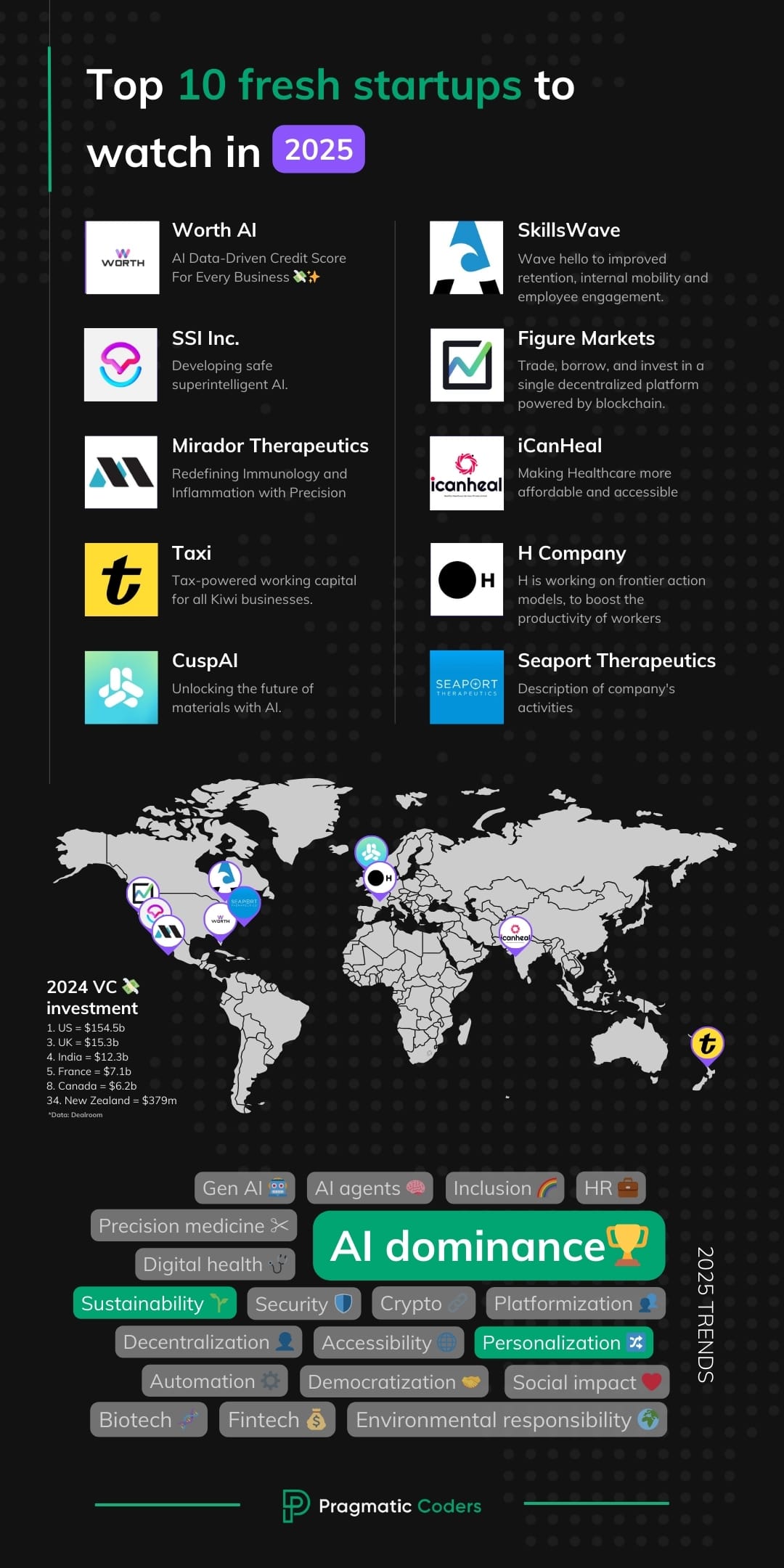

Top 10 startups to watch in 2025

1️⃣ Cover AI: Always-on weapon detection

Cover AI creates AI-driven security systems that detect concealed weapons in real-time. Their technology helps protect public spaces like schools, airports, and event venues by identifying threats before they become dangerous.

Website: https://www.cover.ai/

Location: Palo Alto, United States

Founders: Brett Adcock

Problem They Solve:

Traditional security screening methods, like manual checks and metal detectors, can be slow, intrusive, and inefficient. Evidence? According to the Gun Violence Archive, there have been 503 mass shootings across the US in 2024. Cover AI offers a seamless, AI-driven solution that scans individuals discreetly while maintaining high accuracy in detecting concealed weapons.

Key Features

- AI-Enhanced Detection – Uses deep learning models to identify weapons without physical pat-downs.

- Real-Time Alerts – Instantly notifies security personnel when a potential threat is detected.

- Seamless Integration – Can be embedded in existing security systems at venues, airports, and government buildings.

- Privacy-Focused – Avoids invasive scanning while ensuring accurate threat detection.

- Scalable Deployment – Works across multiple environments, from small businesses to large public spaces.

With increasing concerns about public safety and the demand for more effective security solutions, Cover AI is well-positioned to disrupt the security industry. The company has raised $10 million in seed funding and is expected to expand its technology into major security infrastructure in 2025.

2️⃣ Frankenburg Technologies: Tech to win the war

Frankenburg Technologies is a European defense technology company specializing in rocket science. Their mission is to equip the free world with the technologies needed to win modern conflicts.

Website: https://frankenburg.tech/

Location: Tallinn, Estonia

Founder: Kusti Salm (CEO) – Permanent Secretary, the highest-ranking civil servant, of the Estonian Ministry of Defence 2021–2024

Problem They Solve:

Traditional missile systems are often expensive, slow to produce, and limited in quantity, hindering rapid response to emerging threats. They focus on developing missile systems that are ten times more affordable, a hundred times faster to produce, and in quantities far exceeding current industry capabilities.

Key Feature: AI-Powered Targeting. Utilizing artificial intelligence to enhance situational awareness and threat anticipation.

3️⃣ Mirador Therapeutics: Precision medicine for inflammatory and fibrotic diseases

Mirador leverages the latest advances in human genetics and cutting-edge data science to rapidly advance new precision medicines.

Website: https://miradortx.com/

Location:

Founder: Mark C. McKenna (Chairman and CEO), a biotech leader with a proven track record in delivering results for patients and investors.

Problem They Solve: Current treatments for immune-mediated inflammatory and fibrotic diseases don’t always work well. These conditions can be complex and challenging to manage. Mirador Therapeutics is tackling this by creating precision medicines that target the root causes of these diseases.

Features:

- Mirador360™ Precision Development Engine: This proprietary platform harmonizes millions of patient molecular profiles to discover and validate genetic associations with immuno-fibrotic diseases. It identifies novel therapeutic targets and elucidates optimal target pairs for potential combination therapies.

The company is led by several former executives of Prometheus Biosciences, which was acquired by Merck in 2023 for $10.8 billion. This team brings a proven track record in precision immunology. In March 2024, Mirador secured over $400 million in financing led by ARCH Venture Partners, with participation from other premier life sciences investors. This funding supports the rapid advancement of multiple therapeutic programs.

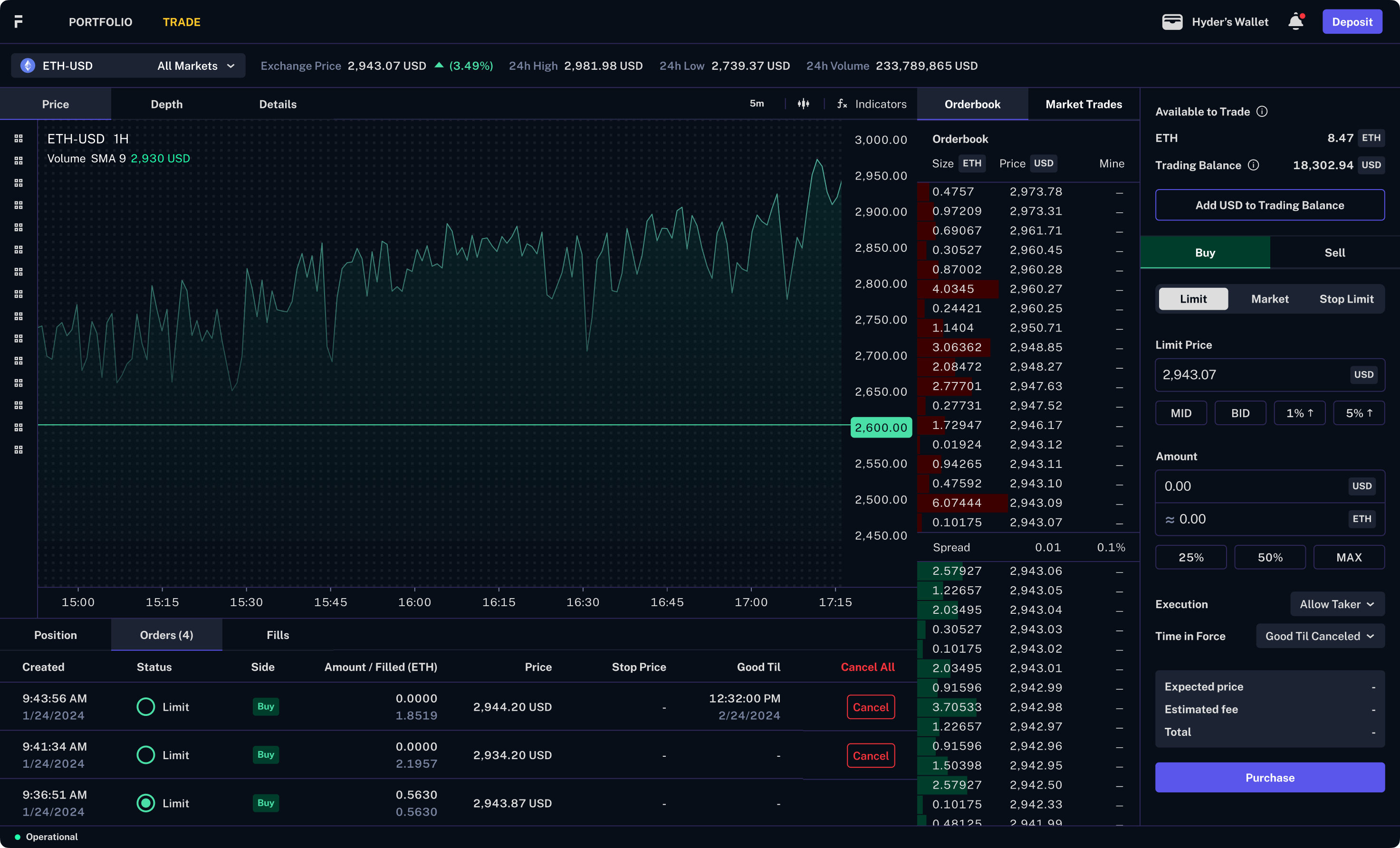

4️⃣ Figure Markets: Decentralized trading

Figure Markets is building a decentralized custody marketplace where investors can trade a wide range of blockchain-native assets, including cryptocurrencies, stocks, bonds, and credit

Website: https://www.figuremarkets.com/

Location:

Founders: Figure Markets was founded by Mike Cagney, who also co-founded SoFi and Figure Technologies.

Problem They Solve:

Traditional financial markets often face issues like centralized custody risks, limited asset accessibility, and inefficiencies in trading various asset classes. Figure Markets addresses these challenges by offering a decentralized platform that enhances security, broadens asset accessibility, and streamlines trading processes.

Features:

- Decentralized Custody: Instead of holding all your assets in one place, Figure splits keys across a network. This reduces the risk of hacking or loss.

- All-in-One Trading Platform: You’ll be able to trade cryptocurrencies, stocks, bonds, and more in one spot.

- Crypto-Backed Loans: Need cash but don’t want to sell your crypto? Figure lets you borrow against it.

5️⃣ The Bot Company: Automating Household Chores with Robotics

The Bot Company builds affordable robots that handle household chores like cleaning and organizing. Their goal is to make life easier by using AI-powered automation for everyday tasks. Unfortunately, you can’t see how they’re going to make the vision come true yet (they have a fun landing page tho). However, it’s not surprising they’ve managed to raise $150m in (early VC funding) taking into account their team. ⬇️

Website: https://www.bot.co/

Location: San Francisco, United States

Founders

- Kyle Vogt: Co-founder and CEO, previously co-founded Twitch and Cruise.

- Paril Jain: Co-founder and CTO, formerly led the AI tech team at Tesla.

- Luke Holoubek: Co-founder, former Cruise software engineer

Household chores take up time that could be spent on more important things. The Bot Company creates robots to do these tasks so people can focus on work, family, or relaxation.

Key Features

- AI-Powered – Uses artificial intelligence to complete chores efficiently.

- Easy to Use – Designed for everyday households with simple controls.

- Customizable – Users can adjust settings to fit their needs.

- User Feedback – Plans to improve robots based on customer input.

6️⃣ Eon: AI-Powered Cloud Backup

Eon automates cloud backups with AI, making data recovery faster and easier. Their Cloud Backup Posture Management (CBPM) system keeps backups organized and accessible without manual work.

Website: https://eon.io/

Locations: New York, United States (Headquarters); Tel Aviv-Yafo, Israel (Founding Location)

Founders

- Ofir Ehrlich: Chief Executive Officer (CEO)

- Ron Kimchi: Chief Technology Officer (CTO)

- Gonen Stein: Chief Revenue Officer (CRO)

Problem They Solve

Traditional cloud backups are messy and hard to manage. Eon’s system automatically organizes and protects backups, reducing errors and improving compliance.

Key Features

- Auto-Tagging & Organization – AI scans cloud storage and organizes backups automatically.

- Self-Driving Backup Policies – Ensures data is stored properly and meets security rules.

- Instant Search & Restore – Quickly find and recover lost files without restoring everything.

- Database Explorer – Lets users run queries on backups without full recovery.

7️⃣ Seaport Therapeutics: Treating anxiety and depression

Website: https://seaporttx.com/

Founders:

- Daphne Zohar: Co-founder of Karuna Therapeutics and founding CEO of PureTech Health.

- Dr. Steven Paul: Former CEO of Karuna Therapeutics and former Executive Vice President for Science and Technology at Eli Lilly and Company.

- Dr. Michael Chen: Former Head of Innovation at PureTech Health.

Problem They Solve: Seaport Therapeutics addresses the limitations of current neuropsychiatric treatments, such as poor oral bioavailability and significant side effects. By leveraging their proprietary Glyph™ platform, they aim to develop novel antidepressants and anxiolytics that are more effective and have fewer adverse effects.

The startup raised $100 million in Series A financing in April 2024 and an additional $225 million in an oversubscribed Series B round in October 2024 to advance their clinical-stage pipeline and Glyph™ platform.

8️⃣ Candid Therapeutics: Targeted Autoimmune Treatments

Candid Therapeutics develops T-cell engager antibodies that target and eliminate disease-causing B-cells in autoimmune conditions.

Website: https://candidrx.com/

Location: San Diego, United States

Founder: Ken Song, MD – CEO, previously led RayzeBio through a $4.1B acquisition.

Problem They Solve

Current autoimmune treatments suppress the immune system broadly, causing side effects. Candid aims to target only the harmful cells, reducing risks and improving treatment effectiveness.

Key Features

- T-Cell Engager Antibodies – Designed to kill specific B-cells linked to autoimmune diseases.

- Lead Drug: CND106 – Previously tested for cancer, now repurposed for autoimmune disorders.

- Clinical Pipeline – Multiple drugs in development for various autoimmune conditions.

Candid Therapeutics raised $370 million in 2024 from top biotech investors. Estimated valuation: $1.5–$2.2 billion.

9️⃣ SKROL: AI Solutions for SMBs

SKROL develops AI-driven tools to modernize small and medium-sized businesses (SMBs), focusing on automating critical yet often overlooked workflows.

Website: https://skrol.com/

Location: Miami, United States

Founders:

- Michael Cassau – Founder & CEO, previously founded Grover.

- Christopher Silva – Co-Founder & CTO, with 18 years in technology leadership.

- Mitja Sadar – Co-Founder & CFO, with over 15 years in finance.

Problem They Solve: SKROL develops AI-driven tools to modernize small and medium-sized businesses (SMBs), focusing on automating critical yet often overlooked workflows.

Key Products:

FlowSign: A free, web-based PDF signing tool that allows users to sign documents online without downloads. Features include real, handwritten signatures and an upcoming AI lawyer to analyze contracts.

Invoice Guard (Coming Soon): An upcoming tool designed to enhance invoice management and security for SMBs.

SKROL AI: An AI-powered platform that automates workflows, unlocks insights, and empowers businesses to operate more efficiently. skrol.ai

SKROL AI Search: A platform that connects users to thousands of business listings for sale in the US, allowing them to find, evaluate, and track deals efficiently. Features include powerful search tools, sophisticated filters, and AI-enhanced deal information. searchfunder.com+1search.skrol.com+1

SKROL secured $1.2 million in pre-seed funding led by Magnetic Capital to support its mission of modernizing SMBs

🔟 Humanity Protocol: Secure Digital Identity

Humanity Protocol develops a decentralized system that uses palm scans to verify online identities, ensuring privacy and security.

Website: https://www.humanity.org/

Founders: Yat Siu, Mario Nawfal, and Yeewai Chong

Location: Central and Western District, Hong Kong

Problem They Solve: Online platforms often struggle with bots, fake accounts, and identity fraud. Humanity Protocol’s technology ensures that only real people can participate.

Key Features:

Palm Recognition: Uses palm scans for secure identity verification.

Zero-Knowledge Proofs: Ensures user privacy by verifying identities without revealing personal information.

Sybil Resistance: Prevents fake accounts and bots from infiltrating platforms.

Funding:

May 2024: Raised $30 million, valuing the company at $1 billion. (source: pymnts.com)

January 2025: Secured an additional $20 million, increasing valuation to $1.1 billion.

Conclusion. Startups to watch in 2025

While AI, personalization and sustainable tech dominate headlines, success depends on pragmatic implementation that solves actual business problems. The winners will be those who cut through the hype to build solutions that work.

Be sure to check out fintech, digital health, an AI trends for 2025:

- Banking technology trends 2025

- Fintech trends 2025

- 19 digital health trends for 2025

- AI in 5, 10, and 15+ years

- AI trends for 2025

Here's what has changed in the list

Here’s the first version of the list. As you can see, only 3 startups made it to the update: Miradot Therapeutics, Seaport Therapeutics, and Figure Markets.

How did you choose the companies for your list?

All data about the startups comes from Dealroom’s company database and the listed startups’ websites or social media profiles.

The startups in this list are characterized as follows:

- Launch date: 2024

- Status: Operational

- Dealroom signal: Have the highest Dealroom signal* out of all the startups meeting the above criteria.

- Social media activity: Have been active on LinkedIn or another social platform within the last 3 months as of December 2024.

- Webpage status: Active

*Dealroom signal is Dealroom’s predictive algorithm that identifies and ranks the most promising upcoming funding opportunities in the fintech sector. It analyzes various factors, including a company’s growth metrics, hiring activity, fundraising timing, and team composition.

Guys, how can I keep up with your content?

Be sure to follow us on LinkedIn. Or, even better, subscribe to our newsletter.