How to raise money through equity crowdfunding?

What comes to your mind when you hear “startup funding”?

I bet the terms “venture capitalists,” “angel investors,” or “bootstrapping” are the first to pop up.

That’s fine; in the end, these are the most common business funding alternatives out there. But if these methods fail, what will you do?

There’s a less popular financing option not all entrepreneurs know about – equity crowdfunding.

In this article, I’ll give you a general overview of this financing alternative in the US. Keep reading to discover what it is, how it works, and if this funding method is a right-swipe for your startup 👇

Types of crowdfunding

Donation-based crowdfunding

This is probably the most basic type of crowdfunding, a kind of whip-round on a larger scale. Here, contributors donate money to a project or campaign without receiving anything tangible in return. It’s often used for charitable causes.

Example: A family that has been affected by Florida flooding raises money to rebuild their house.

Rewards-based crowdfunding

This type of crowdfunding involves offering a reward to people who contribute to a project or campaign. The reward could be a tangible item, such as a product or service related to the project, or it could be an intangible item (e.g., recognition or access to exclusive content).

The most popular reward-based crowdfunding platforms are Kickstarter, Indiegogo, and GoFundMe.

Example: a comic book author rewards their backers with branded stickers, digital copies of the book, or private chats with them (depending on the funding tier).

Rewards-based crowdfunding is primarily dominated by individualists (not organizations) with innovative ideas. For startups, or businesses in general, this type of crowdfunding is a way to validate side projects or ideas.

Peer-to-peer lending (debt crowdfunding, loan-based crowdfunding)

Peer-to-peer lending (P2P) is a type of crowdfunding where investors lend money to a company or individual and receive interest on their investment. It’s often used by small businesses or individuals who need to raise capital but have difficulty obtaining loans from traditional lenders.

Example: A woman entrepreneur from Peru is raising capital to open a local beauty salon. You invest in her business venture. Then the entrepreneur makes you monthly installments of around 10% of the principal + interest.

Equity crowdfunding (investment-based crowdfunding)

Equity crowdfunding (ECF) involves raising funds from investors in exchange for equity in the company.

The three most common types of crowdfunding used by profit-making small and medium-sized enterprises and startups are peer-to-peer, equity, and reward crowdfunding.

What is equity crowdfunding?

As I mentioned above, equity crowdfunding is a type of fundraising where anyone can invest money in exchange for ownership in new businesses. Instead of receiving a reward or product for their contribution, investors get shares or equity in the company.

It’s worth noticing that ECF is open to everyday people. Me, you, your mom, your dog – anyone can participate because you don’t need to have your business to invest.

How is equity crowdfunding different from VC funding? Rather than relying on a one-to-one relationship, as it is with venture capital, equity crowdfunding provides access to a large pool of potential investors.

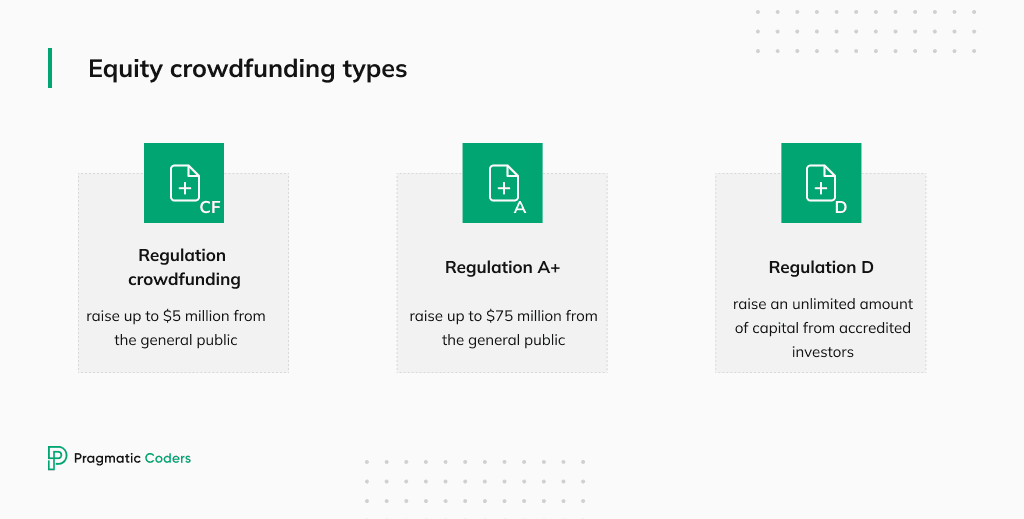

Types of equity crowdfunding

If you’re a startup founder operating in the US, these types of equity crowdfunding might apply to your business:

Regulation Crowdfunding (Reg CF)

Regulation Crowdfunding allows private companies to raise up to $5 million from the general public.

These securities offerings are available to U.S. non-accredited and accredited investors (accredited investors are individuals with a net worth of at least $1 million or income of at least $200,000 per year).

Non-accredited investors are restricted by investing limits. An accredited investor, however, has no restrictions on investing limits in either Regulation A+ or Regulation Crowdfunding offerings.

Regulation A+ (Reg A+)

Companies can raise up to $75 million. The requirements are more stringent than Reg CF (when companies are raising money through Regulation A+ campaigns, they have to share more detailed and frequent updates with their investors).

These securities offerings are available to U.S. accredited and non-accredited investors.

Regulation D (Reg D)

This type of equity crowdfunding allows companies to raise an unlimited amount of capital. There are no limits on the number of accredited investors a company can have.

These securities offerings are *only available to U.S. investors who are “accredited investors.”

(Actually, you can raise capital from unaccredited investors using this exemption, BUT then you cannot advertise your funding. Let’s not get into much legal detail here, though; I’ll provide you with recommended further reading at the end of this article).

How does equity funding work?

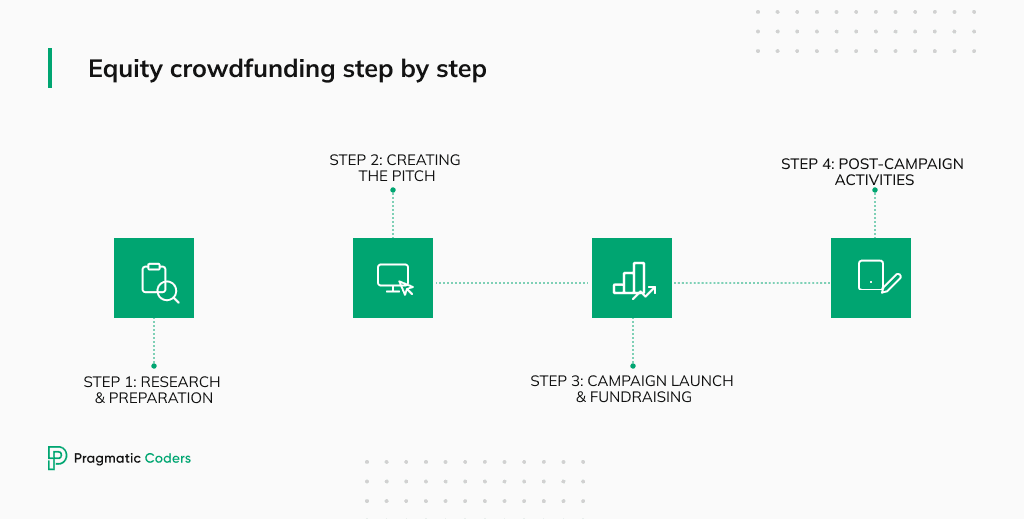

Once you’ve decided to raise funds through equity crowdfunding, here are the steps you’ll need to take.

STEP 1. Research & preparation

I know it seems like an obvious step, but it’s also the most essential. So before you launch the fundraising campaign or even create the pitch, you need to:

- Research the potential crowdfunding platforms, their features, terms, rules, and legal requirements (more on it below).

- Conduct market & competition research to explore the fundraising strategies of fellow startups. See how other businesses are advertising themselves, what their pitches look like, how they’re trying to convince investors, and if it works.

- Review past campaigns. Check if anyone hasn’t tried to fund a similar product. If there was such a crowdfunding campaign, explore if it succeeded or not. You want to make sure you won’t make the same mistakes.

- Build your website & start building your audience on social media. The thing with crowdfunding is that the bigger audience you have, the more capital you’ll be able to raise, so start gathering people around your ideas as soon as possible.

- Gather the necessary financial statements & apply them to the crowdfunding platform. Most of them will run due diligence to check if your startup is a good fit for them. To start the process, you’ll need to provide them with high-level information about your company and your financial history. For example, Republic wants startup founders to share with them their balance sheets, income statements, and cash flows.

STEP 2. Creating the pitch

The pitch is how you’re going to convince potential investors to back your product. It’s the story about you, your product, the problem it solves, and why it’s worth investing in it. The crucial questions you want to answer are:

- How big is the market my startup seeks to capture?

- Do my startup team members have the experience that proves you’ll be able to deliver on your goal?

- How am I going to monetize my business?

Here the guidelines are similar to those that apply to crafting investor pitch decks. For more information on this topic, check out this article 👉 How to create a pitch deck

Most, if not all, equity crowdfunding sites run due diligence to make sure you’re startup idea has a chance to succeed in the market. If they accept your application, it means your financial calculations, business model, and general business idea is feasible to them, so potential investors will probably find it reasonable as well.

So, the moment you “go live” on the platform, you don’t care that much about the business side of your project – you care about your marketing: how compelling your story is, and how big an audience you’ve managed to gather. But that’s a topic for a separate article.

STEP 3. Campaign launch + fundraising

Once the equity crowdfunding campaign is launched, you’ve got to do everything you can to make a buzz around it. Motivate the crowd, be active on social media, respond to questions, and advertise your business everywhere it’s possible. Often, if not always, ECF platforms provide campaign promotion, so you might find investors on the platform itself.

The first days and the early outreach are crucial. Campaigns that achieve over 20% of their target goal within the initial days have a higher probability of achieving success.

STEP 4. Post-campaign activities

When the campaign is over, you need to handle all the administrative procedures, such as registering new ownership and changing the company’s status.

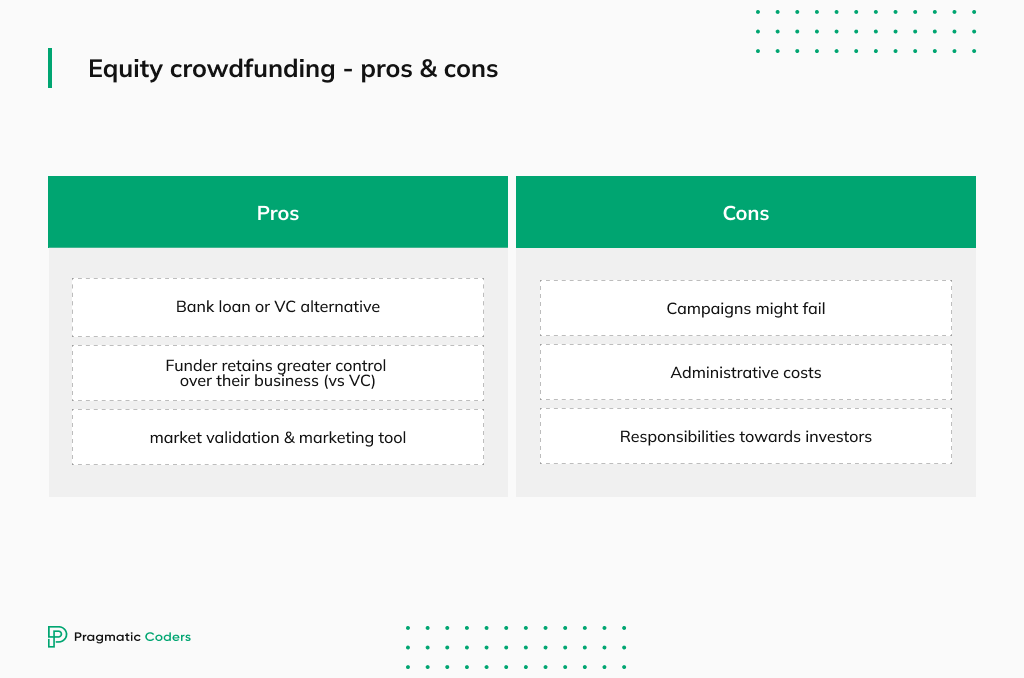

Pros and cons of equity crowdfunding

Benefits of equity crowdfunding for startups

ECF comes with a few advantages specific to this type of fundraising.

- Equity crowdfunding provides a solution for numerous small startups that are unable to secure funding from banks or venture capitalists or do not have the opportunity to go public through an IPO.

- In comparison to being funded by VCs, founders can retain greater control over their businesses with equity crowdfunding, as the money comes in small sums and is split between many investors rather than one or two big venture capitalists.

- Equity crowdfunding is more than just money. It gives you a reality check and can serve as a proof of concept and a validation tool. If people on these online platforms want to contribute, it’s a strong sign the market will approve it too.

- Crowdfunding websites can be powerful marketing tools and a great way to present your product and yourself to a huge audience of investors and potential customers.

Risk of equity crowdfunding for startups

Every coin has two sides, and so does ECF. Here are the risks of equity crowdfunding.

- Campaign failed. You might simply not reach your target, and all the money you’ve collected so far will be returned to investors.

- Administrative costs. This is not a risk but rather a reminder. When using equity crowdfunding, the costs of managing and handling shares can go up with each new issue of shares. This means that it may become difficult to manage new investors and provide them with updated information about the project.

- Responsibilities towards investors. Think carefully about any potential issues that may come up later on after you’ve given away some equity. You’ll need to offer investors certain rights to make the investment worthwhile, so make sure you understand what those rights mean for you.

- Investors want to exit. In the future, your investors might want to sell their shares or new investors might want to join your business. This could have a big impact on your company! Think about what might happen if your investors leave or if new ones come in. Before you even offer any equity to investors, it’s a good idea to get some legal advice.

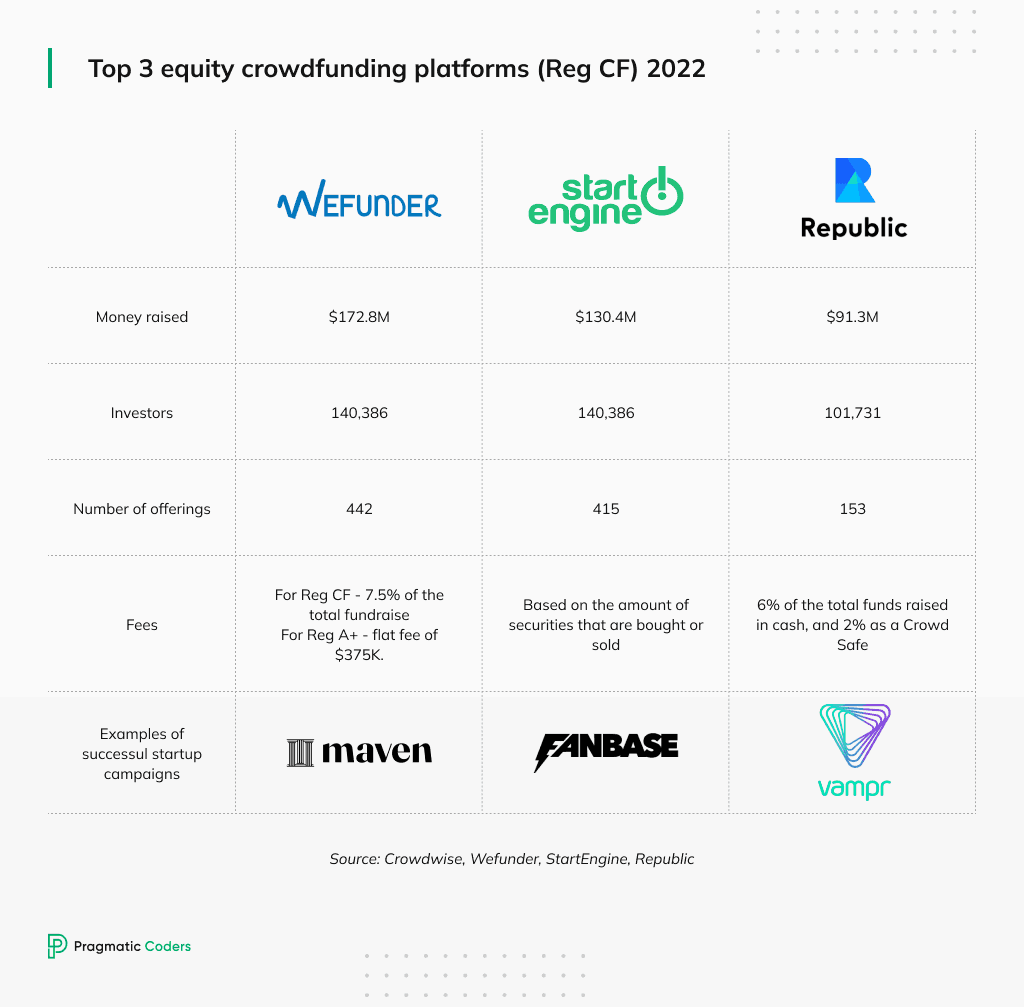

Equity crowdfunding platforms

Overview of popular equity crowdfunding platforms

The biggest equity crowdfunding platforms you must know are:

- StartEngine,

- Republic,

- Wefunder.

There are other platforms that allow raising capital online, but the discrepancy between what I called “the big 3” and other sites is huge. According to Crowdwise, there were over 100,000 investors in each of these platforms in 2022. Closest to them was MainVest, with less than… 11,000 backers.

Going into detail, each platform boasts its own unique offer and has specific fee rates.

StartEngine

StartEngine is currently the biggest equity crowdfunding platform. Just in Q3 2023, they managed to raise $35M. They offer a full-service experience, assigning you a dedicated team to help you, for example, file Form C and other documents.

However, when it comes to fees, the numbers are not clear. As they state in their Terms of Use:

StartEngine Primary LLC receives compensation calculated by reference to the purchase or sale of securities through the Site for services provided for offerings under Regulation A and Regulation D. StartEngine Primary LLC does not currently charge fees for companies that are “testing the waters” but may apply fees in the future.

Wefunder

Wefunder, being the oldest ECF platform (founded in 2012), claims that you can start raising capital in… 15 minutes.

They are pretty straightforward in terms of fees:

For Reg CF, Wefunder charges 7.5% of the total fundraise, only if successful. For instance, if a company raises $100,000, we charge $7,500 upon close. There are no other fees. If you find a better price, we will match it.

For Reg A+, we charge a flat fee of $375K. This is 7.5% on a $5M raise.

Republic

Republic endorses its teaser page feature, which, as they claim, is a fast tool for founders to raise capital.

How much does it cost to raise on Republic?

Companies pay only if they successfully reach their funding goal: 6% of the total funds raised in cash, and 2% as a Crowd Safe.

Note there might be additional costs associated with using the platforms, as most of them provide extra assistance (for example, Form C completing support or bookkeeping services).

Examples of successful startups that used equity crowdfunding

Here are a few case studies of businesses that managed to succeed with equity crowdfunding on these 3 platforms. Check them out for inspiration: Maven, Fanbase, Vampr.

ECF regulations

Is equity crowdfunding legal?

I wouldn’t even think about writing this article if it wasn’t, but just to make things 100% clear: yes, equity crowdfunding is legal in many countries, including the EU and the United States, where it is regulated under Title III of the JOBS Act.

The JOBS Act made changes to how companies can raise money from the public by introducing new rules for crowdfunding. These rules allow certain types of public offerings (Regulation CF, Reg A+, Reg D) to be made without needing to register with the SEC.

SEC regulations on equity crowdfunding

The Securities and Exchange Commission (SEC) has established regulations for equity crowdfunding in the United States.

Under these regulations, companies must use registered intermediaries, such as crowdfunding portals or broker-dealers, to offer and sell securities to investors. Companies are required to disclose certain information about their business and financials to potential investors.

The SEC regulations also set limits on the amount that individuals can invest in equity crowdfunding campaigns based on their income and net worth.

Is equity crowdfunding worth it?

Equity crowdfunding boomed through the pandemic and doesn’t seem to stop anytime soon.

As NEXT.Law reports, SeedInvest’s volume and number of investments exceeded all of 2019 just in the first half of 2020; other platforms also recorded an increase.

In 2021, people worldwide gave $13.64 billion to support projects through crowdfunding. Experts say that by 2028, this number will double and keep growing.

You can clearly see ECF is becoming more and more common. This growing popularity is correlated with the high success rates of equity crowdfunding sites (over 90% for StartEngine and over 80% in case of Republic, Wefunder, and Netcapital).

Further reading

The best source of information is simply crowdfunding sites. Here are the FAQs you should definitely give a big read if you want to raise money using an equity crowdfunding platform.

- Republic’s FAQ

- Wefunder’s FAQ (click here for Reg D rules I mentioned earlier: 1, 2)

- StartEngine’s knowledge base

Conclusions

That was quite a lot of information, but I believe you can now better understand what ECF is and whether it’s the right choice for you.

If you need help with raising funds for the world’s next unicorn (hopefully, your startup), don’t hesitate to reach out to us! 👇