Understand gamification in banking: 2025 insights for your fintech app

Gamification is the use of game-like mechanics in non-game contexts. You’ve probably heard of it in the context of Duolingo, a giant education app for learning foreign languages – but gamification doesn’t limit to just education.

Though still a rather niche topic, gamification in finance was slowly getting bigger and bigger… to the point researchers are now predicting the so-called omnipresent gamification in finance and banking.

Gamification is not a catchphrase, but a serious strategy to implement into your banking app. In this guide, we’ll discuss how and why you should do this, and share best practices and gamification trends we can expect to observe in the coming years.

Banking app development services

What is gamification?

Gamification, in simple terms, is taking elements from games and applying them to non-game situations. It’s about making a process more interactive and fun by incorporating elements like points, badges, leaderboards, challenges, and rewards into web and mobile banking. But why does it actually work this way?

The mechanics behind games and gamification rely on psychology:

- Dopamine release: Completing tasks and earning rewards in gamified activities release dopamine. It’s pleasant, so we’re more motivated to continue.

- Loss aversion: The use of points or progress bars plays on our dislike of losing progress. Suppose there’s a progress bar in your banking app that shows you how far you are from reaching your goals. You don’t want to stop if there’s just a 13% saving gap between you and your dream holiday in Acapulco.

- Flow state: Gamification can induce a “flow” state of deep immersion, making activities more enjoyable and focusing our attention.

Is it worth it? The benefits of gamification

Why should you consider gamifying your product? Incorporating game-like elements into your banking app offers several benefits:

- Increased customer engagement: Gamification spices up regular tasks with challenges and rewards, making the app way more interesting. The result’s simple: users spend more time inside the app.

- Improved retention: Earning rewards and progressing through levels can motivate users to continue using the app. Adding gamification is one of the most effective customer retention strategies in banking.

- Enhanced financial literacy: Educational quizzes, challenges, and simulations within the app can gamify financial learning. Through this, customers gain a better understanding of financial concepts like budgeting, saving, and investing, as well as develop positive financial habits. This comes with two more benefits.

- Firstly, you establish your product as a reliable source of finance information.

- Secondly, you create more opportunities for upselling – financially literate customers are better equipped to understand the benefits of premium features and services.

- Promoting new services: Gamification (especially the “reward” part of it) might be one of the best ways to encourage users to try out new features.

- Data collection and insights: Finally, gamification can provide valuable data on user behavior and preferences. By analyzing how users interact with game elements, banks can gain insights into their customers’ financial goals and needs, and better tailor their products and services. LEARN MORE: Data science in finance: use cases, trends, and considerations

Now, let’s back it up with some numbers. You probably recognize Mint, a budget tracker & planner. It’s not exactly a banking app, but since financial management is the most suitable “aspect” of banking apps in terms of gamification (more on this later), what I’m about to discuss will apply as well.

A 2021 study by Zaguan University analyzed data from 208 users of the Mint app to explore how gamification increases users’ motivation and intention to use personal financial management (PFM) apps, and how it facilitates their adoption.

Here’s a breakdown. You can clearly see gamification does improve user engagement and the overall satisfaction of using the app.

- Thanks to gamification, 47.4% more users are motivated to use the app without feeling forced.

- 27.3% of feeling independent is due to gamification.

- 31.5% of feeling skilled comes from these features.

- With gamification features, the app seems 28.9% easier to use and 53.4% more useful.

- People’s positive view of the app improves by 54.9%.

- 62.2% more users plan to keep using the app because of these game elements.

As a side note, ensuring regulatory compliance is crucial in implementing these innovations. For example, gamification should not mislead users or encourage irresponsible financial behavior. RegTech solutions can be integrated with gamification to streamline the compliance process, ensuring all legal requirements are met.

What are the key principles of gamification?

- User engagement through game-like elements: Incorporating game mechanics to make mundane tasks more engaging and enjoyable for users.

- Clear objectives and goals: Setting specific targets that users can aim for, providing direction and purpose.

- Immediate feedback: Offering instant responses to user actions to reinforce positive behavior and guide improvements.

- Progression and achievement: Allowing users to see their growth over time through levels, badges, or milestones.

- Challenge and competition: Introducing challenges that are neither too easy nor too hard, sometimes involving competition with others to motivate users.

- Rewards and incentives: Providing tangible or intangible rewards to encourage continued participation and effort.

- Social interaction and community building: Fostering a sense of community through features that allow users to interact, collaborate, or compete with others.

- Personalization: Tailoring the experience to individual user preferences to enhance engagement.

- Fun and enjoyment: Ensuring that the gamified elements add an element of fun to the user experience.

When does gamification not work?

Top 5 reasons

- Mismatch with user interests

- If the game elements don’t align with what users care about, they won’t engage.

- Example: Offering badges for tasks users find boring won’t motivate them.

- Confusing or unfun game design

- If the gamification is complicated or not enjoyable, users will lose interest.

- Example: A points system that’s hard to understand will frustrate users.

- Too much focus on rewards

- Relying only on prizes or points can lead to short-term engagement.

- Example: Users might stop participating once the rewards stop if they don’t find the activity itself enjoyable.

- Ignoring the main product value

- Gamification can’t fix a product that isn’t useful or interesting on its own.

- Example: Adding leaderboards won’t help if the app doesn’t meet users’ needs.

- Feeling forced or manipulative

- If users feel they’re being tricked or pushed into something, they’ll resist.

- Example: Mandatory gamification elements can make users uncomfortable and disengaged.

How to implement gamification?

Step 1: Define the Five Key Elements

- App Goals (Business Metrics)

- What do you want to achieve?

- Examples: Increase user sign-ups, boost app downloads, and get more users to upgrade to premium.

- Set measurable targets that you can test and track.

- What do you want to achieve?

- Users (Players)

- Who are your users?

- Understand who will be using your app.

- Know their motivations so you can tailor the experience to them.

- Who are your users?

- Desired Actions

- What do you want users to do?

- List all the actions you want users to take, in the order they would naturally happen.

- Stages of User Journey:

- Discovery: Download the app, sign up, explore features.

- Onboarding: Set up their profile, complete a tutorial, use the app for the first time.

- Scaffolding: Regular use, like completing tasks or participating in challenges.

- Endgame: Achieve long-term goals, contribute to the community, upgrade to premium.

- What do you want users to do?

- Feedback Mechanics (Triggers)

- How will you communicate with users?

- Use notifications, messages, or visual cues to show users that their actions matter.

- Choose your communication channels:

- In-app messages, emails, social media, etc.

- Implement feedback tools:

- Points, badges, progress bars, leaderboards, and more.

- How will you communicate with users?

- Incentives (Rewards)

- What rewards will you offer?

- Provide something valuable when users complete desired actions.

- Examples of Rewards:

- Achievement badges, extra features, discounts, recognition in the community.

- What rewards will you offer?

Step 2: Make the App Fun and Engaging

- Focus on Intrinsic Motivation:

- Instead of relying on external rewards or punishments, make the app enjoyable in itself.

- Use the 8 Core Drives from the Octalysis Framework:

- Epic Meaning & Calling: Make users feel they are part of something bigger.

- Development & Accomplishment: Let users see their progress and achieve goals.

- Empowerment of Creativity & Feedback: Allow users to be creative and get immediate feedback.

- Ownership & Possession: Let users own or collect items.

- Social Influence & Relatedness: Encourage social interaction and competition.

- Scarcity & Impatience: Use limited-time offers or exclusive content.

- Unpredictability & Curiosity: Surprise users to keep them interested.

- Loss & Avoidance: Motivate users to keep what they have earned.

Check: Learn how to feasibly implement game-like mechanics into your product with our 5-part guide on gamification in business.

How to implement gamification in banking and financial industries

Once we’ve got through the theory, let’s move on to the nitty-gritty of gamification. In this paragraph, we’ll explore the gamification techniques and discuss how you can apply them to various aspects of your banking app.

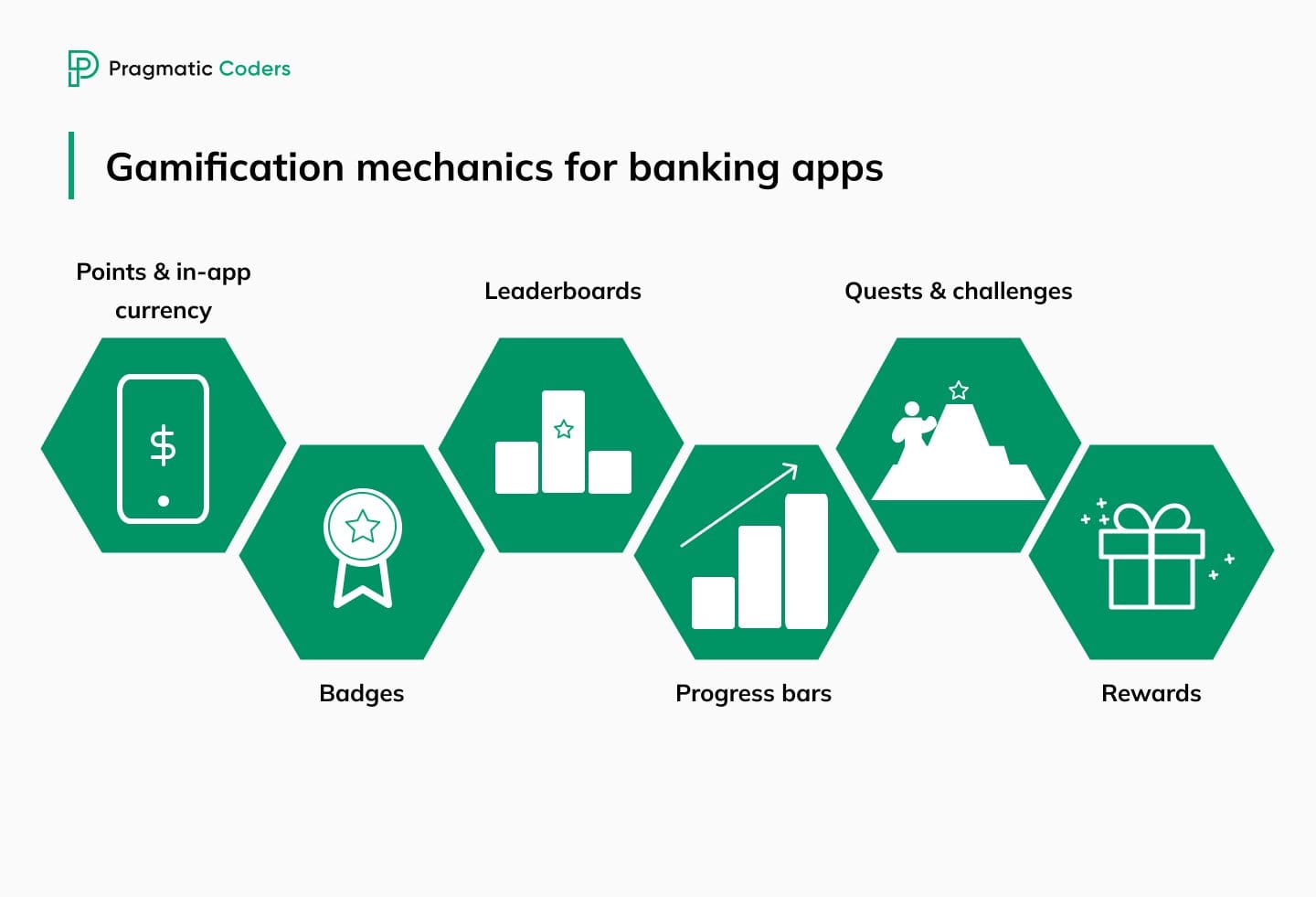

Top gamification techniques and how they’re used in mobile banking apps

Gamification comes with a set of proven mechanics. Whatever game you play, be it something as simple as Tetris, you’ll come across at least one of them. The list is long, and it includes various techniques, for example:

- Points

- Badges

- Levels

- Leaderboards

- Challenges

- Quests

- Avatars

- Virtual goods

- Feedback

- Storytelling

- Unlockables

- Progress bards

In the table below, you can see the most common gamification mechanics along with descriptions.

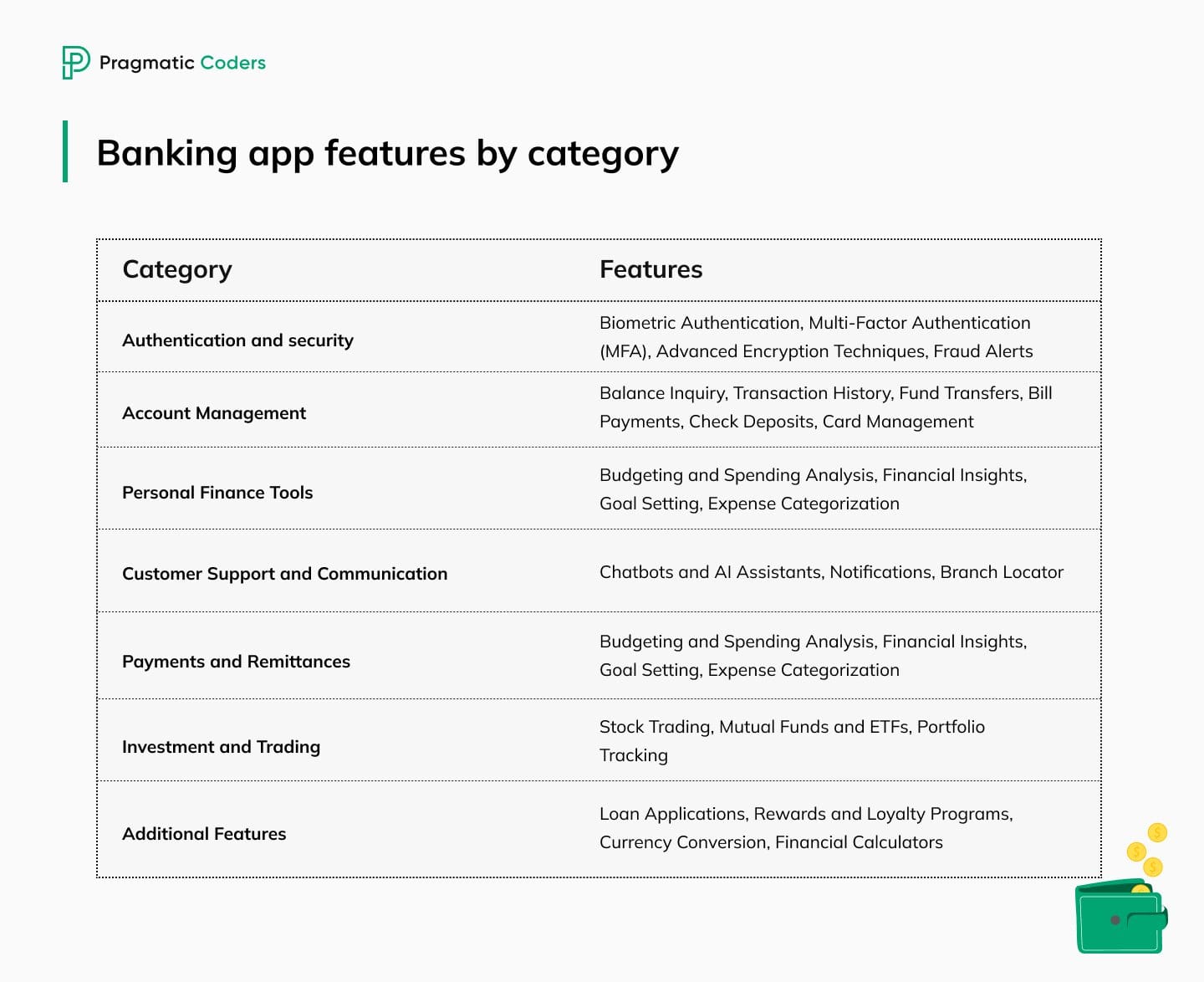

What banking app features can be gamified?

If probably every aspect of an app can be gamified, and it can be a powerful engagement-boosting tool, some make more sense to be turned into a game than others.

There is no definitive ranking of the most frequently gamified features in banking apps. However, based on the examples I drew in the following section and general observations, we could assume financial management tools are generally considered the category most often targeted for gamification strategies.

It makes sense for a couple of reasons:

- It’s easy to gamify wealth management tools. Financial management activities like goal setting, budgeting, and expense tracking can be easily translated into points, badges, progress bars, and other gamification elements.

- They pose minimal risk to core functionalities. Unlike other categories, gamifying financial management features doesn’t pose a significant risk to the core functionalities like account management or transaction processing. Instead, it can actually enhance user experience and encourage responsible financial behavior.

The second “best” area for gamification in banking apps would then be financial education features. Gamified quizzes, challenges, or rewards for completing educational modules can increase user knowledge and awareness.

Examples of gamification in banking. Case studies of gamification in finance

Here’s a several gamification examples from leading banking apps.

Achievements and badges

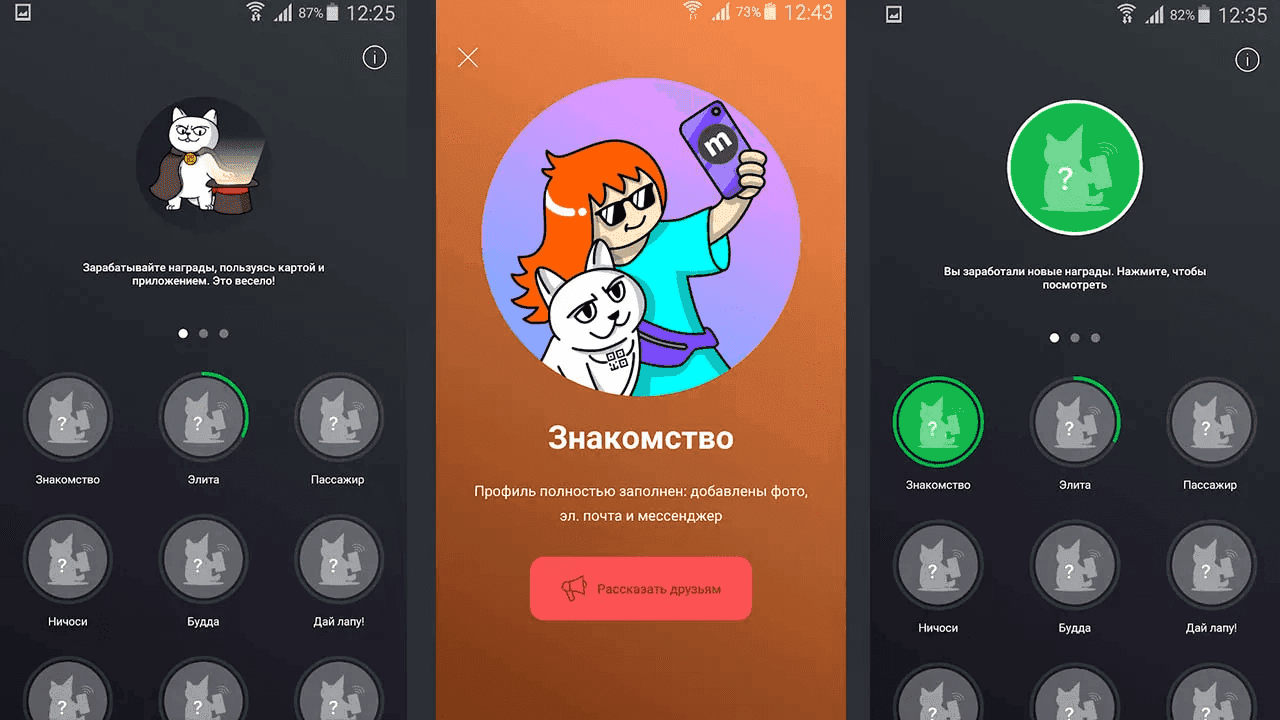

Monobank is a Ukrainian banking app that lets users get achievements for various in-app activities such as completing their profile information.

Progress bars

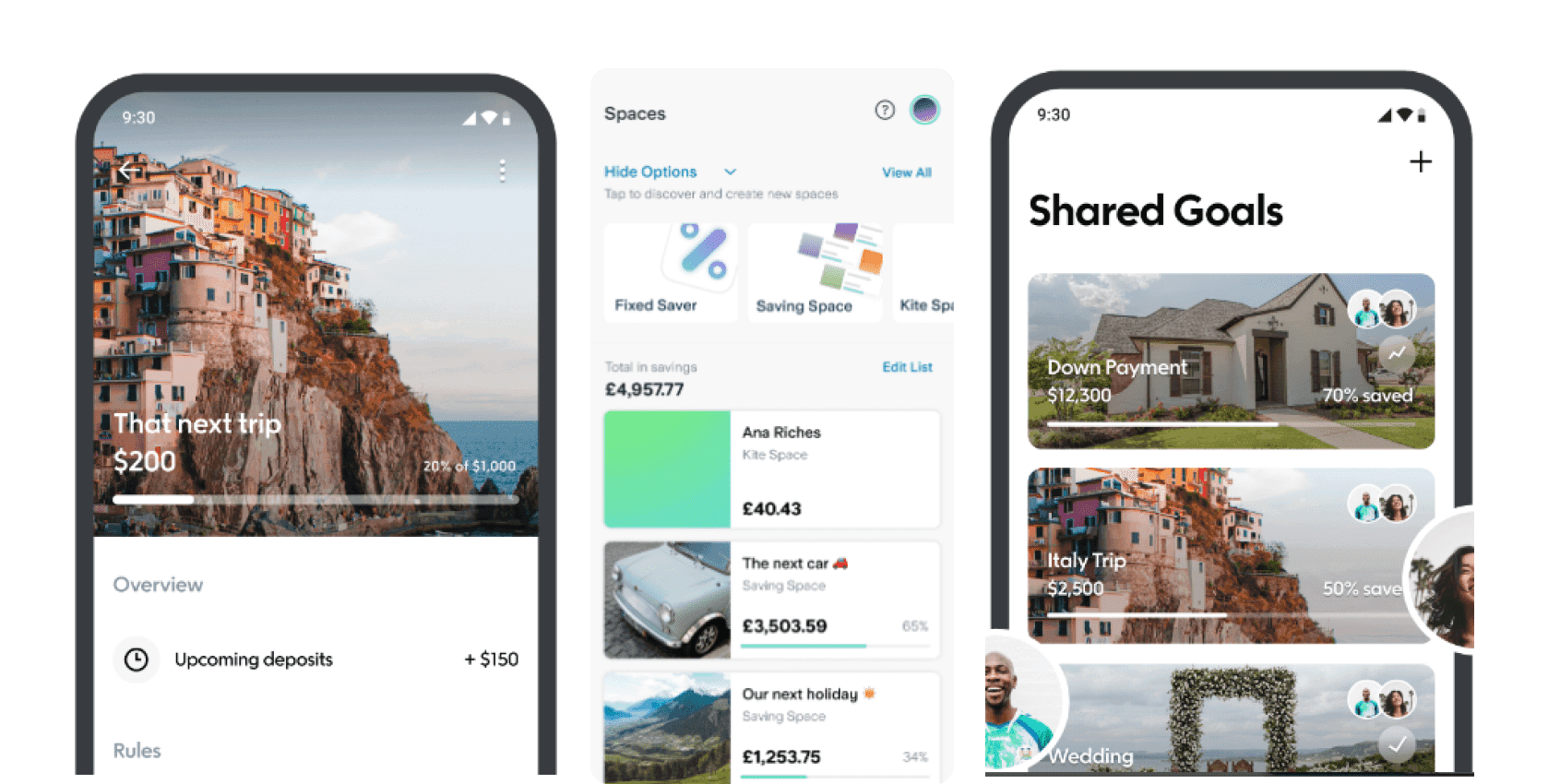

With Starling Bank and Qapital, you do not simply set up a virtual piggy bank. They go a step further and help customers visualize their progress towards saving goals with progress bars. Interestingly,

Qapital also leverages social sharing by offering a “Shared Goals” feature. This feature allows users to share their saving goals with others, potentially motivating them to reach their goals faster.

Image source: Google Play

Leaderboard

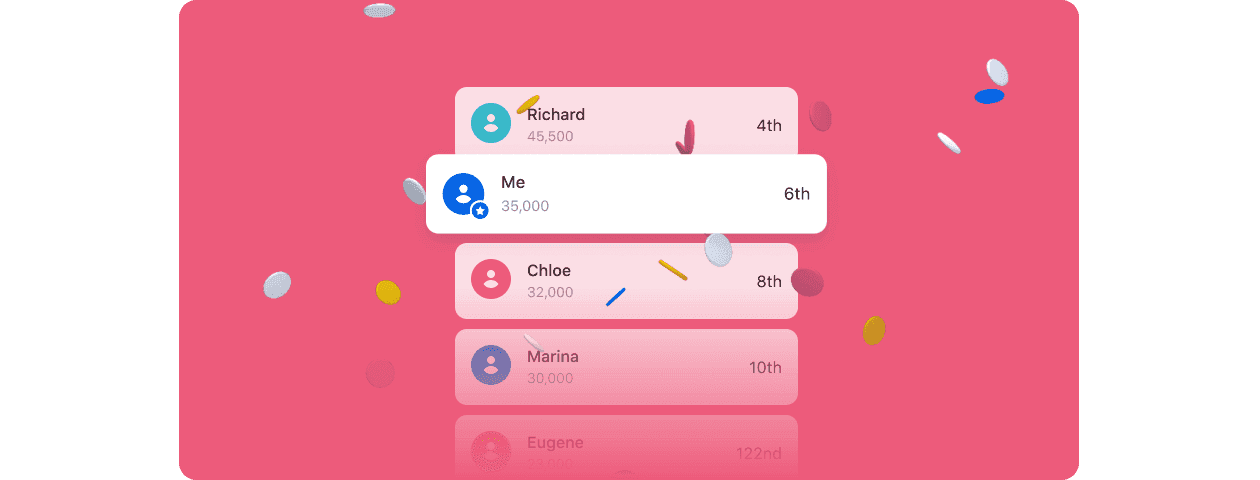

In 2021, Revolut would attract new customers through weekly lotteries. Users could collect points (=entries) and check the leaderboard to see how they stacked up.

Quests and points

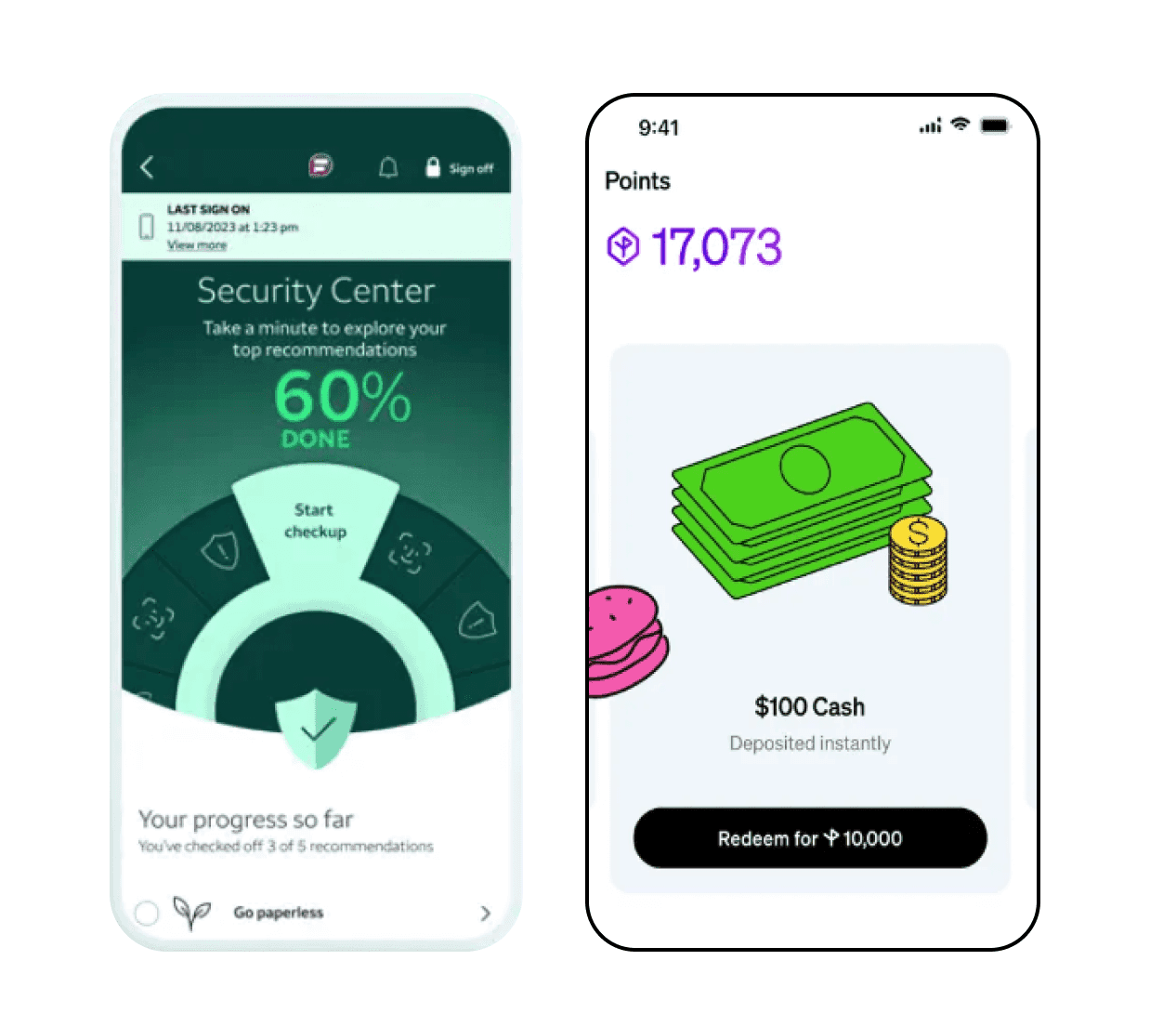

Checklists are a common and effective way to design simple quests in games, and Wells Fargo Mobile gives you a list of security recommendations to check off. On the other hand, Current encourages users to earn points for cash back.

Image source: App Store

Image source: App Store

Rewards, scores

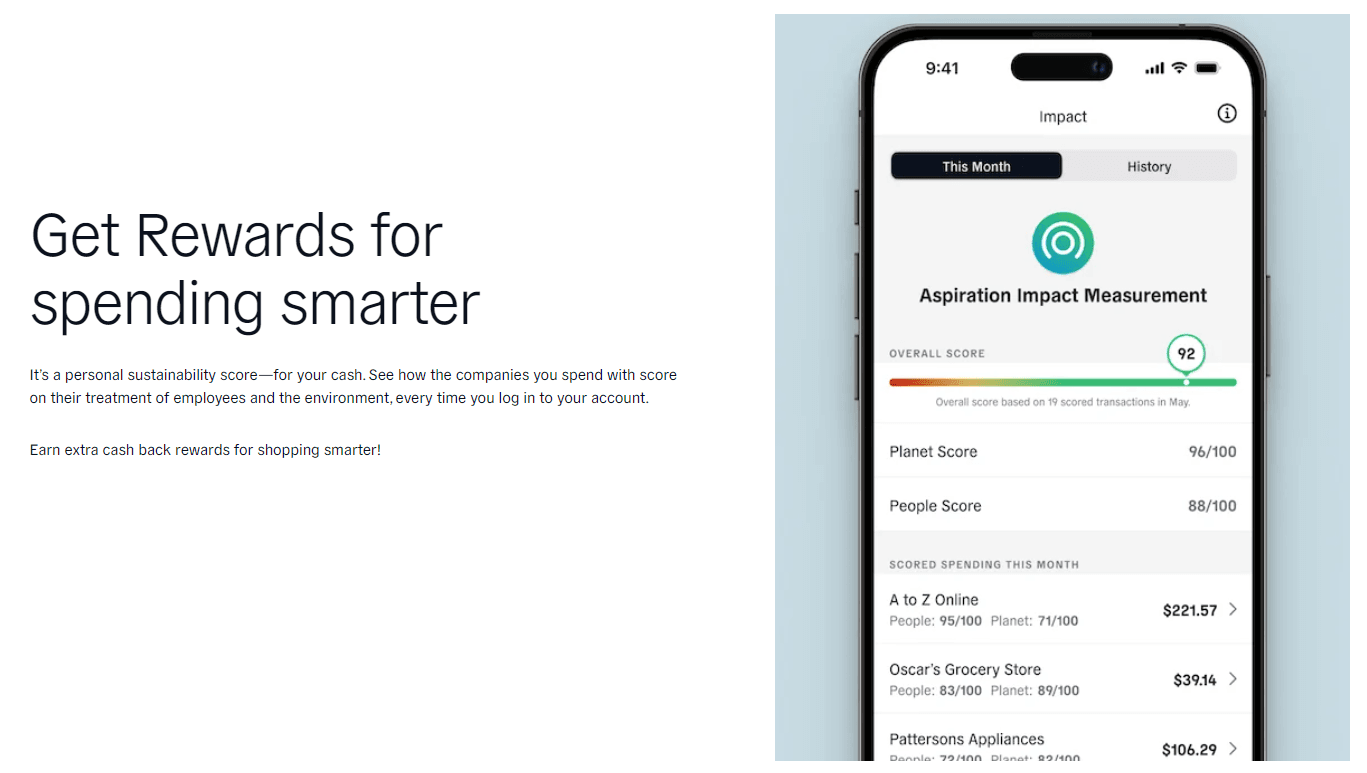

Sustainability in banking is a big trend. More and more banks are adopting green practices to attract eco-conscious customers. One of them is Aspiration–a US-based neobank promoting itself as climate-friendly.

Apart from planting trees with your spending and avoiding investments in fossil fuels, they enable their users to earn cashback points by using their Aspiration debit card for purchases at merchants with a high Aspiration Impact Measurement (AIM) score. AIM is the feature on their mobile app that shows users their sustainable impact score and the score of many of the places they shop.

Image source: Aspiration

Image source: Aspiration

BTW, if you want to see how game elements are implemented into digital health, check our guide on gamification in healthcare. You might also be interested in learning more about climate fintech.

The future of gamification. The 3 key trends

The key three trends for gamification in banking are:

- Integration with AI

- Cloud-based gamification solutions

- Development of mega financial platforms

Let’s start with a few insights on the gamification market, according to Precedence Research’s report.

If you’ve been following tech trends, you’ll likely find them quite familiar, but their implications are still worth exploring. As we’ve discussed it in our previous article on banking technology trends, Gen Z banking, or the future of artificial intelligence in banking, the key factors to shape the banking and financial sectors in the nearest future are AI and cloud solutions.

- MARKET VALUE: The gamification market was worth USD 10 billion in 2022 and is expected to grow to USD 116.68 billion by 2032, with a compound annual growth rate (CAGR) of 27.9%. Solutions in gamification, which include game-design elements for engagement and motivation, are expected to grow at a CAGR of 21.5% from 2023 to 2032.

- LEADING REGION: North America is a leading region in gamification, valued at USD 3.8 billion in 2022. The retail industry is a significant adopter, with a 28.5% revenue share in 2022.

- AI FOR BACK-OFFICE: Artificial Intelligence-based gamification solutions are becoming increasingly important for understanding and motivating staff, leading to more effective goal achievement. Businesses are turning to AI-powered games in marketing, HR, and sales to get employees more involved and make their work connect better with the company’s goals.

- CLOUD: The cloud-based deployment model is growing due to its benefits like easy installation, maintenance, and lower upfront costs. It’s especially appealing to small and medium-sized enterprises (SMEs) for its security and reliability.

Gamification in banking: the story of three waves

Now, before we look into the future, let’s take two steps back and examine how we’ve got to the point we’re now. According to The Gamification of Banking, a recent research by University of Illinois, we’re currently experiencing the third wave of gamification in banking – the Mega Financial Platforms era. Never heard of that before? Read on.

1st wave: Bank-fintech partnerships

In this initial phase, banks started collaborating with fintech (financial technology) companies. These partnerships allowed banks to use innovative, game-like elements to engage customers, often without the fintechs becoming banks themselves.

The idea was to use technology to make banking more interactive and appealing, especially for tasks like learning about finances or saving money.

Fintechs benefitted by being able to offer their services to a broader customer base without needing to navigate the complex regulations that banks face.

2nd wave: Special bank charters

The second wave is about creating special licenses or charters that let companies have some banking abilities without being full-fledged banks.

This move was mainly to accommodate fintech companies wanting to perform bank-like activities (such as lending or accepting deposits) without taking on the full burden of banking regulations.

This wave was marked by regulatory adjustments to make it easier for non-traditional banking and financial services to operate in the banking sector, aiming to foster innovation while still protecting consumers.

‼️ 3rd wave: Mega financial platforms

The future, or third wave, seems to be heading towards the creation of large, platform-based ecosystems where financial services are integrated with technology at a much larger scale.

Big tech companies, especially those with cloud computing capabilities, are expected to play a significant role. They’re likely to offer gamification tools and technologies to banks and other financial institutions. This could lead to a more engaging and interactive financial services landscape, where everything from payments to investments is gamified.

Gamification is not just a passing fad. Quite the contrary, it could be one of the biggest factors to influence what the banking and financial industries look like:

We predict that these factors, in combination with increasing partnerships between cloud service providers and banks or trading exchange groups, point towards a future in which a small number of consolidated, data-driven, cloud-based financial market ecosystem intermediaries with game technology platforms emerge, leading to omnipresent gamification in banking and financial markets.

Gamification in banking services. Conclusions

Gamification in digital banking blends entertainment with financial management to improve user engagement, retention, and spending habits. By leveraging psychological triggers, it can transform mundane banking tasks into more appealing and rewarding experiences. The future holds promise for gamified banking, with potential to utilize AI, cloud solutions, and mega platforms to create entirely new levels of user experience.

However, it’s essential to remember that gamification is not a one-size-fits-all solution. Its effectiveness hinges on its ability to align with users’ unique needs and motivations.

That’s why, while gamification is a powerful tool to elevate the banking experience, it must be deployed with a clear purpose—meeting genuine user needs—to truly resonate and yield lasting benefits. If done poorly, gamification risks becoming a cheap trick that doesn’t actually help users or the bank in the long run.

Build a gamified banking app with our banking software development services

Need help designing and developing a banking mobile app with game-like features? Integrate with a third-party gamification platform through API? Or, maybe you need to implement gamification into your existing product?

Reach out to us – we can help.