MiCA Regulation: Insights and Impact on Crypto Assets in The EU

Cryptocurrencies and blockchain technology have taken the world by storm. They’ve introduced decentralized solutions and innovative financial tools that were unthinkable a decade ago. But with this rapid growth comes uncertainty. The lack of clear regulations has left investors exposed to fraud, market manipulation, and insufficient oversight.

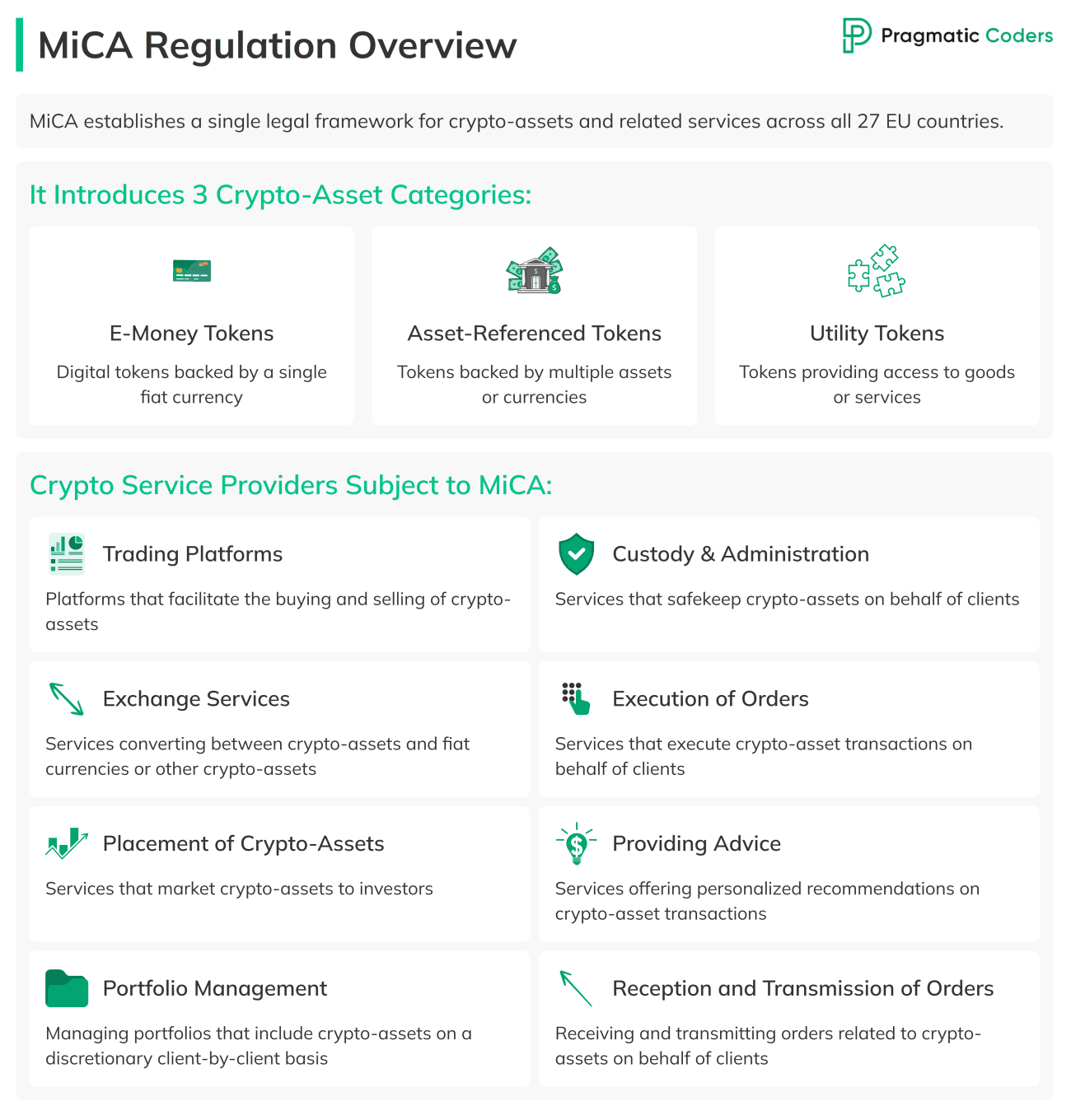

That’s where the Markets in Crypto-Assets Regulation, or MiCA, comes in. It establishes a single legal framework for crypto-assets and related services across all 27 EU countries. By standardizing business rules and clearly defining the management of crypto-assets, MiCA aims to provide the clarity necessary for effective regulation and oversight within Europe’s crypto industry.

In this article, we’ll dive into MiCA’s structure, purpose, and implementation timeline. We’ll also explore what it means for everyone involved in the market.

Key Points

|

The Existing Regulatory Landscape for Crypto Assets

Before MiCA, each EU country handled cryptocurrencies differently. This patchwork of rules led to confusion and oversight gaps. For instance, a crypto user in one country could access services that were restricted or regulated differently in another. This made cross-border transactions and investments difficult.

Anti-Money Laundering (AML) and Counter-Terrorism Financing

AML and counter-terrorism financing laws existed but were mostly adapted from traditional finance. They didn’t fully address the unique challenges of decentralized technologies. This allowed criminals to misuse crypto-assets for money laundering, tax evasion, and even funding illegal activities.

MiCA builds on these frameworks by introducing stricter AML provisions tailored specifically for crypto markets. For example, crypto-asset service providers (CASPs) now must maintain strong internal controls to detect and prevent illicit activities, similar to traditional financial institutions.

Market Abuse and Insider Trading

Regulations against market abuse and insider trading weren’t consistently applied to crypto-assets. This left markets open to manipulation. High-profile cases, like pump-and-dump schemes on unregulated exchanges, highlighted these enforcement gaps. MiCA addresses these issues by requiring disclosures and implementing safeguards to monitor trading activities across all EU jurisdictions.

Consumer Protections and Complaints Handling

Consumers faced significant risks due to limited ways to seek recourse in cases of fraud or insolvency. Some member states had complaints-handling procedures, but these were neither standardized nor enforceable across borders. MiCA mandates clear, consistent processes for handling consumer complaints, ensuring greater accountability for CASPs. These processes include:

- Establishing Complaints-Handling Procedures: CASPs must develop effective procedures to address complaints promptly and fairly, ensuring transparency and consistency in their responses.

- Informing Clients: Clients should be informed about the complaints-handling process, including how to file a complaint and the timeframe for resolution.

- Providing Accessible Complaint Channels: CASPs are required to offer accessible channels for clients to submit complaints, ensuring that the process is straightforward and free of charge.

- Maintaining Records: CASPs must keep detailed records of all complaints received and the measures taken in response, facilitating oversight and continuous improvement.

The Timeline of MiCA

The Development Phase of MiCA

MiCA’s development reflects a coordinated effort by the EU to balance innovation with regulation:

- 2020: MiCA was introduced as part of the EU’s Digital Finance Package, emphasizing the need for a comprehensive approach to crypto regulation.

- 2021-2023: The legislative process involved extensive consultations. Stakeholders provided feedback on draft proposals. Key contributors included the Economic and Monetary Affairs Committee, the European Commission, and the European Parliament.

- April 2023: The final regulation was approved by the European Parliament, signaling a unified commitment to reform.

- June 2023: MiCA was published in the Official Journal of the EU, marking the start of its phased implementation.

MiCA Implementation Timeline

MiCA’s implementation will happen in phases, with key milestones:

- June 2023: MiCA enters into force following its publication.

- June 2024: Rules for stablecoins (EMTs and ARTs) become enforceable.

- December 2024: Full compliance required for all provisions.

- 2025-2026: Transition periods for CASPs, allowing gradual adaptation to licensing and operational standards.

The regulation’s swift progress underscores the EU’s focus on financial stability and investor protection in the face of evolving technologies.

MiCA Regulation: An Overview

MiCA is one of the most comprehensive crypto regulations introduced globally. It covers a wide range of entities, assets, and activities. The goal is to provide legal certainty for businesses while ensuring strong protections for consumers and investors.

Crypto-Asset Categories

MiCA categorizes crypto-assets into three main types:

- E-Money Tokens (EMTs): Digital tokens backed by a single fiat currency, like the euro. These are subject to strict requirements, including full reserve backing and regular audits.

- Asset-Referenced Tokens (ARTs): Tokens backed by one or more assets, such as currencies, commodities, or a combination. These tokens must meet specific transparency and liquidity requirements.

- Utility Tokens: Tokens that provide access to goods or services without being classified as financial instruments. They’re often used in decentralized applications or blockchain ecosystems.

By clearly defining these categories, MiCA removes ambiguities that previously caused confusion.

Service Providers

Under MiCA, CASPs must meet strict licensing and operational standards to offer services within the EU. These services include:

- Trading Platforms: Facilitating the buying and selling of crypto-assets.

- Custody and Administration: Safekeeping of crypto-assets on behalf of clients.

- Exchange Services: Converting between crypto-assets and fiat currencies or other crypto-assets.

- Execution of Orders: Acting on behalf of clients to execute transactions involving crypto-assets.

- Placement of Crypto-Assets: Marketing crypto-assets to investors.

- Reception and Transmission of Orders: Receiving and transmitting orders related to crypto-assets on behalf of clients.

- Providing Advice: Offering personalized recommendations on crypto-asset transactions.

- Portfolio Management: Managing portfolios that include crypto-assets on a discretionary client-by-client basis.

Key Components of MiCA

MiCA is structured into several titles, each focusing on a critical aspect of crypto regulation.

Markets in Crypto-Assets Titles

- Title I: General Provisions

- Establishes the scope, definitions, and objectives of MiCA. It outlines the primary categories of crypto-assets and defines which entities must comply.

- Title II: Crypto-Assets Other Than EMTs and ARTs

- Focuses on rules for issuing and trading general crypto-assets. This includes requirements for crypto-asset whitepapers and issuer transparency.

- Title III: Asset-Referenced Tokens

- Sets strict provisions for ARTs, including reserve backing, liquidity management, and redemption plans.

- Title IV: E-Money Tokens

- Establishes standards for issuing and managing EMTs. Issuers must ensure 1:1 reserve backing and maintain at least 30% of funds in liquid assets.

- Title V: Obligations of Crypto-Asset Service Providers (CASPs)

- Details licensing, operational, and governance requirements for CASPs.

- Title VI: Market Abuse Regulation

- Introduces rules to prevent insider trading and market manipulation.

- Title VII: Cooperative Framework and Enforcement Instructions

- Outlines the roles of regulatory authorities and mechanisms for cross-border collaboration.

Significance of Title VII

Title VII fosters cooperation between the European Securities and Markets Authority (ESMA), the European Banking Authority (EBA), and national regulators. This ensures:

- Uniform enforcement across member states.

- Reduced regulatory overlap.

- Clear accountability for regulators and market participants.

Scope and Application of MiCA

Entities Covered

MiCA applies to a wide range of participants in the crypto market, including:

- Crypto-Asset Issuers: Those responsible for creating and issuing tokens.

- CASPs: Entities offering trading, custody, and portfolio management services (detailed list here).

- Exchanges: Platforms facilitating transactions between crypto and fiat currencies.

Asset Classes Regulated

MiCA governs most crypto-assets, with specific rules for stablecoins, NFTs, and utility tokens. Notably, it includes provisions for emerging technologies while excluding certain decentralized systems from its scope.

Practical Impacts

One of MiCA’s most significant contributions is its harmonized approach to regulation. It enables cross-border operations under a single EU license. This reduces administrative burdens for businesses and fosters a more competitive market.

Know Your Transaction (KYT) and MiCA

MiCA isn’t just about knowing your customers—it’s about understanding their actions. KYT focuses on tracking transactions in real time. It’s a proactive way to spot risks like money laundering or fraud before they escalate. This complements KYC by addressing not just who but what clients are doing.

For businesses, KYT is a critical part of compliance. It helps protect against illegal activities and ensures transparency. Integrating KYT into your compliance strategy shows regulators you’re serious about market integrity. It also builds trust with customers and stakeholders.

MiCA’s Exemptions and Exclusions

While comprehensive, MiCA carefully defines its scope to avoid overregulation.

Key Exemptions Include:

- NFTs: Generally excluded unless they resemble financial instruments or are issued in large, fungible series.

- Decentralized Applications (dApps): Fully decentralized systems with no identifiable intermediary are not subject to MiCA.

- Certain Blockchain-Based Assets: Private or limited-use tokens may qualify for exemptions.

These exclusions highlight the EU’s commitment to encouraging innovation while maintaining regulatory oversight.

Key Provisions of MiCA Regulation

MiCA introduces robust rules to enhance transparency, accountability, and market integrity.

- Licensing and Authorization: CASPs must secure authorization from national authorities. They need to demonstrate compliance with governance, security, and operational standards.

- Whitepaper Requirements: Issuers are required to publish comprehensive whitepapers detailing the risks, mechanics, and functionalities of their tokens.

- Market Abuse Prevention: Measures include monitoring for insider trading and price manipulation.

- Stablecoin Regulation: EMTs and ARTs must maintain sufficient reserves to meet all claims by token holders and ensure at least 30% of funds are held in liquid assets. They must also undergo regular audits to verify liquidity.

These provisions aim to make the crypto market more transparent and fair for everyone involved.

Regulatory Impacts on the Market

The introduction of MiCA is expected to have far-reaching implications:

- Consumer Confidence: Improved transparency and standardized disclosures will boost trust in crypto markets.

- Operational Efficiency: A unified licensing framework reduces the administrative burden for CASPs.

- Global Influence: MiCA may serve as a model for other jurisdictions, encouraging similar regulatory approaches worldwide.

MiCA also opens doors for future growth:

- Attracting Institutional Investment: Clear regulations make it easier for big investors to enter the crypto market. This promotes stability and growth.

- Enhancing Market Stability: Clear guidelines create a safer and more predictable environment. This encourages more people to participate.

- Fostering Innovation: A clear framework supports the creation of new crypto products and services.

However, adapting to MiCA will be challenging, especially for smaller businesses.

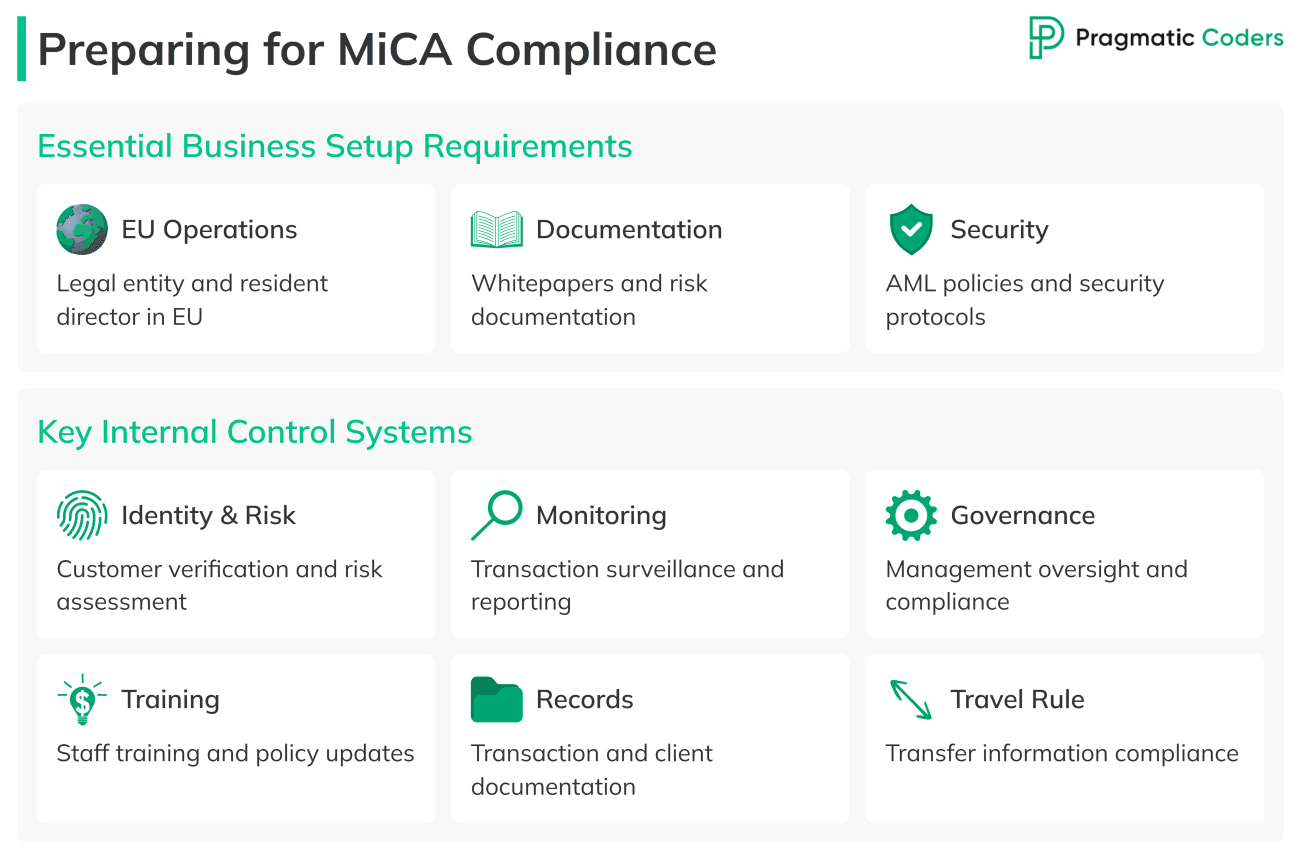

Preparing for MiCA Compliance

Compliance with MiCA involves comprehensive planning and execution:

- Establishing EU Operations: Businesses must have a legal entity and at least one resident director within the EU.

- Drafting Whitepapers: Detailed documents outlining token risks and functionalities must meet MiCA’s specifications.

- Implementing Security Measures: Robust AML policies, data security protocols, and governance frameworks are essential.

- Stakeholder Engagement: Engaging with regulators and participating in consultations can streamline compliance efforts.

Strengthening Compliance with Robust Controls

It also involves implementing robust internal controls. These include:

- Customer Due Diligence (CDD): Verify client identities and assess associated risks, ensuring transactions align with client profiles.

- Suspicious Activity Reporting: Identify and promptly report transactions indicative of money laundering or terrorist financing to relevant authorities.

- Record-Keeping: Maintain detailed records of transactions and client information for a specified period, ensuring accessibility for regulatory review.

- Risk Assessment: Regularly assess and mitigate potential money laundering and terrorist financing risks within the organization.

- Employee Training: Provide ongoing training to ensure staff are knowledgeable about AML regulations and internal policies.

- Independent Audit Function: Conduct regular independent audits to evaluate the effectiveness of AML controls and ensure compliance.

- Governance and Oversight: Engage senior management in overseeing AML efforts, including appointing a dedicated compliance officer.

- Policies and Procedures: Develop and maintain comprehensive AML policies, updating them regularly to reflect regulatory changes and emerging risks.

- Transaction Monitoring Systems: Utilize advanced systems to monitor transactions for unusual patterns indicating illicit activities.

- Compliance with the ‘Travel Rule’: Ensure required originator and beneficiary information accompanies crypto-asset transfers, in line with regulatory expectations.

Businesses that proactively align with MiCA’s requirements will gain a competitive edge in the regulated EU market.

Conclusion

MiCA represents a monumental shift in the regulation of crypto-assets. It provides clarity, consistency, and enhanced protections across the EU. By addressing the risks associated with unregulated markets, MiCA aims to foster innovation while ensuring financial stability.

As the deadlines approach, crypto businesses must act decisively to align with the new framework. With proper preparation, MiCA has the potential to elevate the EU as a global leader in digital finance.