6 Key Banking Technology Trends in 2025

Banking, a cornerstone of our economic fabric, has always been dynamic. But today, thanks to rapid advancements in technology, it’s evolving at an unprecedented pace. Picture the grand, marble-floored banking halls of the past. Now, compare them with today’s sleek, app-based, and online banking services – that’s how far banking companies have come.

For the past decade, we’ve witnessed a rapid tech revolution in the banking industry. It’s not just about moving money anymore; it’s about how smartly and seamlessly it’s done. Banks that catch this wave of change and ride it skillfully, stay ahead. Those that don’t? Well, they risk fading into irrelevance.

The key here is adaptability. With the development of the right financial tech, banks won’t be just financial centers anymore; they’ll become solution hubs, tailored to meet the evolving needs of their customers. We’re talking about a world where banking is not just a necessity, but a personalized experience, almost like a financial butler at your service.

The push towards digital is relentless. Customers today don’t just want services; they demand experiences – smooth, fast, and tailored just for them. The rise in digital and mobile banking is staggering. Digital banks hit a net interest income of US$1.50 trillion in 2024. This isn’t just a trend; it’s the new face of finance.

In this article, we’ll explore the top global banking technology trends for 2025. These aren’t just predictions; they’re the signposts of a journey already underway. Let’s dive in and see what the future of finance looks like.

Hyperautomation in banking: next-level of efficiency and customer experience

Hyperautomation is transforming banking operations. By combining technologies like Robotic Process Automation (RPA), Artificial Intelligence, and Machine Learning, banks can automate complex processes, reduce costs, and boost efficiency. For instance, the Commonwealth Bank’s AI integration has reduced call center wait times by 40% and halved scam losses.

The global hyperautomation market is anticipated to reach USD 118.66 billion by 2030. As technology advances, hyperautomation will play a pivotal role in banking, driving innovation and operational excellence.

Streamlining back-office operations

Back-office tasks are often repetitive and time-consuming. Hyperautomation addresses this by automating processes such as data collection, analysis, and document processing. This reduces errors and accelerates operations. For instance, automating accounts payable can lead to faster invoice processing and improved accuracy.

Moreover, hyperautomation enables banks to better focus on developing customer relationships and improving the entire customer experience. Through intuitive, low-code solutions like Business Process Management (BPM), banks can easily apply hyperautomation to their complex back-office processes.

Fixing tedious customer onboarding

Customer onboarding is crucial but can be cumbersome. Hyperautomation simplifies this by integrating AI, RPA, and biometrics to handle data entry, verification, and compliance checks. This results in a smoother onboarding experience and faster account activations.

By employing hyperautomation, banks can streamline Know Your Customer (KYC) processes, automating data extraction, document verification, and risk assessment for compliance. This not only enhances efficiency but also ensures regulatory adherence.

Improving compliance and operations

Banks face strict regulatory requirements. Hyperautomation helps by continuously monitoring transactions and flagging suspicious activities. This proactive approach enhances compliance and reduces the risk of financial penalties.

Additionally, hyperautomation can reduce operational costs by up to 30%, which is critical in a competitive market. Conducting a cost-benefit analysis can help identify automation opportunities, further strengthening compliance and risk management efforts.

The surge of AI in banking technology in 2025

While hyperautomation focuses on automating processes, AI brings intelligence to banking interactions. AI enables banks to understand and anticipate customer needs, offering personalized services and proactive solutions. It’s not just about efficiency; it’s about creating smarter, more responsive banking experiences. In 2025, AI stands as a key trend, reshaping how banks engage with customers and manage operations.

Enhancing customer experience with AI chatbots and virtual assistants

Personalized customer experience in retail banking is a big thing. So, would you fancy a virtual assistant that fits your various banking habits? As of 2025, this is not just possible, it’s happening. Generative AI is reshaping the banking customer experience, making it more intuitive and friendly. Banks are now using it to deliver hyper-personalized banking, suggest relevant products, and even anticipate customer needs before they surface. The numbers tell a compelling story: personalized user experience can boost customer satisfaction by a notable 20%. Judging from this number, there’s likely to be a significant increase in the adoption of personalized financial services.

Revolutionizing risk management and fraud prevention with AI

In the world of finance, risk is a constant. But with AI, banks are becoming more adept at managing it. Machine learning algorithms analyze vast amounts of data to identify patterns, helping banks mitigate risks in real-time. And when it comes to fraud, Artificial Intelligence is a game-changer. It monitors transactions 24/7, detecting anomalies that signal fraud, significantly reducing false positives. A recent Mastercard and Fintech Nexus survey underscores this trend. It reveals that 93% of financial institutions plan to invest in AI-based fraud detection within the next 2-5 years. Not surprising, given the industry’s ongoing push for process automation and the integration of RegTech solutions to ensure compliance and regulatory adherence.

Navigating ethical considerations

The integration of Artificial Intelligence in the financial services industry isn’t without its quandaries, particularly ethical ones. Unchecked algorithmic bias could lead to unjust practices. Moreover, as robots assume more roles, concerns about job displacement grow. Regulators are actively addressing these challenges, committed to responsible AI use. They’re establishing new standards in ethics, striving to ensure that technology benefits everyone equitably.

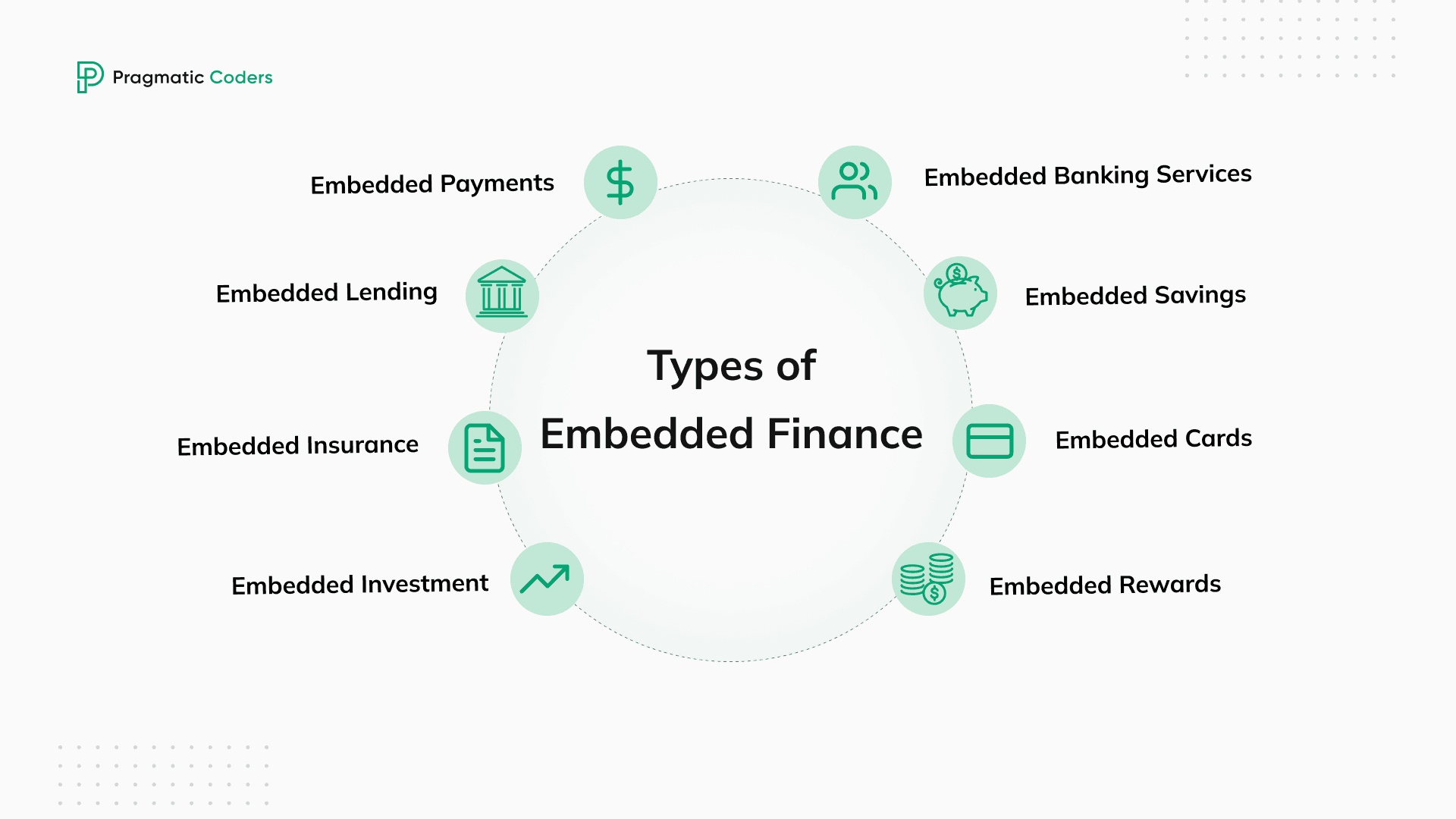

Embracing open banking and embedded finance

Embedded Finance and Open Banking stand out as banking technology trends in 2025. The two are closely linked in the financial services sector, so I’ll be covering them together. With them, new products and services can spread rapidly and omnichannel banking becomes a reality.

Open banking and embedded finance explained

Open Banking involves sharing of financial data between banks and third-party providers through APIs, with the customer’s consent. It’s not just a buzzword; it’s a revolutionary idea. Open Banking is about breaking down walls, enabling a flow of information that was once locked away in banking silos.

Embedded finance weaves financial services into everyday apps and platforms, even those not traditionally related to finance. Picture buying a car and getting a loan in the same online process, without ever visiting a bank. This integration is becoming more common in 2025, making financial services more accessible and convenient.

The impact of open banking and embedded finance in 2025

For consumers and businesses alike, these trends are game-changers. They bring ease, personalization, and efficiency. Customers enjoy a smoother user experience, while businesses can offer more tailored financial services. Open Banking and Embedded Finance are transforming expectations and experiences in the financial world.

Then there’s financial inclusion and credit access. Open Banking and Embedded Finance have the potential to level the playing field. With them, we can bring modern financial services to those previously excluded. And they have the power to shrink the financial inclusion gap. Think about this: in 2023, the gap in the Global Financial Inclusion Index between developing and developed countries was a hefty 20.5. That’s a big difference that embedded banking can help reduce.

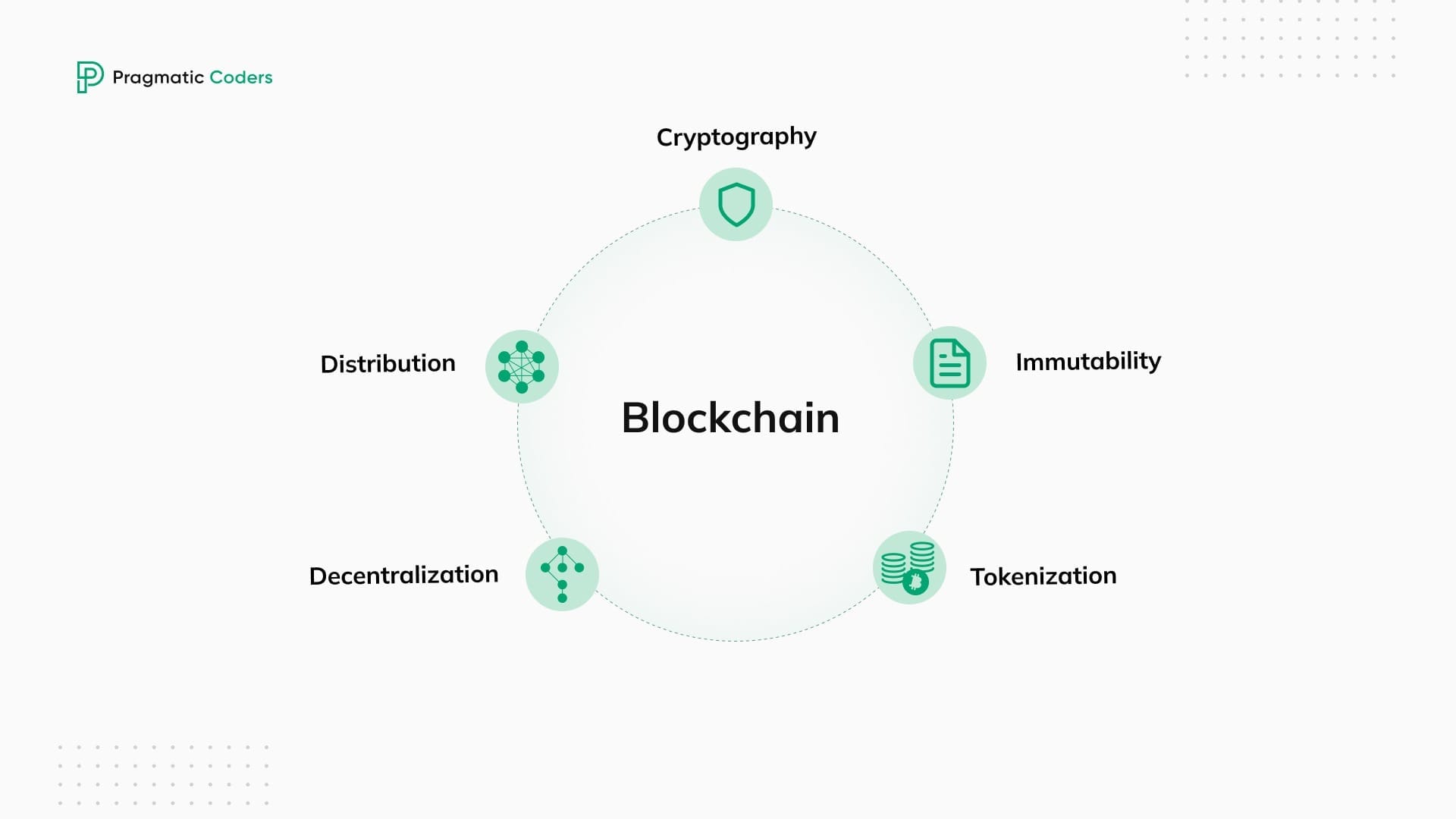

Blockchain and cryptocurrencies: disrupting the financial landscape

2025 will see the return of blockchain technology to center stage. Its ability to revamp traditional banking processes is remarkable. Blockchain brings a kind of security and efficiency we haven’t seen before. It makes transactions simpler and much clearer to see.

The rise of cryptocurrencies in the banking industry

Cryptocurrencies were once viewed as a niche digital asset. Now, they are gaining ground in the banking sector. Their use marks a big shift in how we view and do banking transactions. This trend is changing the banking world, providing a different option to the usual money systems. A key moment in crypto adoption was at the World Economic Forum 2024 in Davos. There, Jeremy Allaire, CEO of Circle, suggested the possibility of U.S. legislation for stablecoins.

Central Bank Digital Currencies (CBDCs) have become a focal point in discussions about the future of money. These digital versions of national currencies are issued and overseen by central banks, blending traditional banking with digital innovation. This fusion aims to streamline transactions while maintaining governmental control.

As of September 2024, 134 countries, representing 98% of the global economy, are exploring CBDCs. Notably, China’s digital yuan has seen transactions nearly quadruple to 7 trillion yuan (approximately $987 billion).

However, enthusiasm varies. A recent survey indicates that only 13% of central bankers view CBDCs as the most promising solution for cross-border payments, down from 31% the previous year.

Cloud-based banking: powering agility and scalability

As we delve deeper into 2025’s banking tech trends, cloud-based solutions emerge as a key player. Moving to the cloud is a smart strategy that enables banks to achieve greater flexibility, growth, and cost savings. It’s not just an upgrade; it’s a cornerstone for innovation and adaptability in banking operations.

Overview of cloud computing in the banking industry

According to Allied Market Research, in 2022, the worldwide market for cloud computing in banking was worth $67.9 billion. It’s expected to soar to $301 billion by 2032, growing at a steady rate of 16.3% each year from 2023 to 2032. This suggests that in the next few years, we’ll see most legacy systems replaced by cloud solutions.

One noteworthy aspect of this shift is the adoption of cloud-based core banking systems. These systems are transforming how financial institutions operate, offering enhanced scalability, flexibility, and efficiency. For an in-depth look at how cloud-based core banking systems are revolutionizing the industry, check out our detailed article on core banking systems.

The advantages of cloud technology solutions are significant. For instance, it supports rapid deployment of new services. It helps scale resources up or down based on demand, leading to reduced operational costs. For a sector that thrives on innovation, the cloud is like a playground for new ideas. It allows banks to quickly test and roll out new features, staying ahead of customer expectations and market demands.

Cloud-based solutions also bolster disaster recovery and business continuity. In a time when any pause in service can lead to big losses, the cloud is a reliable solution. It keeps banking services going strong, even when unexpected problems happen.

Then there’s the integration of artificial intelligence and machine learning. These technologies are automating cloud-based operations, making banking smarter and more efficient. In 2025, AI will be the real game-changer in cloud solutions, from predictive analytics to automated customer service.

Key considerations for cloud adoption in banking

If you’re thinking there must be a catch, well, you’re right. Migrating to the cloud isn’t just a ‘click-and-switch’ affair. It requires careful planning and execution. Banks need to consider data migration, security protocols, and regulatory compliance. The successful transition to cloud banking hinges on balancing innovation with robust risk management.

Let’s not gloss over security concerns either. While the cloud offers many advantages, it also presents new security challenges. Banks need to use strong security steps and be always alert to keep customer data safe. Meeting regulations while adopting cloud solutions is paramount.

Cybersecurity: the cornerstone of trust in modern banking

As digital banking and AI grow, cybercrime becomes a major threat to financial institutions. In 2024, the average global cost of a data breach reached $4.88 million, marking a 10% increase from the previous year. This upward trend underscores the critical importance of robust cybersecurity measures in banking. Protecting customer data and securing financial systems are not just priorities—they are fundamental to maintaining trust and stability in the financial sector.

Strengthening defenses against evolving cyber threats

The banking sector is facing evolving cyber threats that demand equally dynamic responses. Cybersecurity measures have to be always one step ahead. The threats are becoming more sophisticated, and so must the defenses. Investing in state-of-the-art cybersecurity infrastructure is essential. It’s not just about having the right tools; it’s also about having a team ready to use them effectively.

The financial sector is increasingly targeted by sophisticated cyber attacks. These are not your run-of-the-mill phishing scams; they’re complex, well-planned operations that can breach even the most secure systems. The stakes are high, and so banks need to be prepared.

Banks must adopt a holistic approach to cybersecurity. This includes everything from data protection (via encryption or tokenization) and network security to employee training. Each aspect plays a vital role in creating a secure banking environment. Remember, a chain is only as strong as its weakest link.

Collaborative efforts in cybersecurity

The role of partnerships can’t be overstated. Collaborating with cybersecurity vendors and industry organizations to share threat intelligence and best practices is invaluable. It’s a shared battlefront, and collective wisdom is key. By working together, banks can stay ahead of threats and safeguard their systems and their customers’ trust.

Conclusion

In summary, the banking sector in 2025 is a vibrant mix of innovation, adaptability, and security. Institutions that embrace the latest banking technology trends are not just staying relevant; they’re leading the charge into a future where banking is more accessible, efficient, and secure than ever before.

Of course, these are by far not all finance trends out there. Check our articles on hyper-personalization, sustainable banking, gamification in banking, or super apps to gain more insights.

If any of those trends inspired you to establish your own fintech company, our guide on fintech software development is an excellent starting point for your product journey.