Embedded finance vs banking as a service: here’s the difference

In the financial world, two trends are reshaping the landscape: embedded finance and banking as a service. These innovations are not just buzzwords; they’re revolutionizing how we interact with financial services. Gone are the days of traditional banking models holding sway. Today, embedded finance and BaaS are blurring the lines, integrating financial services into our daily digital experiences. This shift is significant. It reshapes how financial service providers operate and how custom fintech software is built. Numbers are staggering: Global venture capital investments in embedded finance soared to $4.2 billion a couple of years ago and the estimated global value of embedded banking services is projected to hit $7.2 trillion in the next decade.

The aim of this article is to demystify these two powerhouse trends and compare them. I’m here to break down what embedded finance and BaaS really mean. Beyond that, I want to explore how they’re different, and why those differences matter to you. Whether you’re a business looking to innovate or a consumer curious about the future of finance, I’ve got you covered. Let’s dive in and make sense of these game-changing developments.

What is Embedded Finance?

So, what exactly is embedded finance? Picture using a travel app and, with a few taps, paying for your tickets, getting a loan for your next big voyage, or insuring your trip—all without leaving the app. That’s embedded finance. It’s about bringing financial services to where customers already are, on non-financial platforms. This approach is winning hearts for a simple reason: it enables seamless experiences. Customers love the convenience of embedded financial products and services. For businesses, it’s a way to keep users engaged, increase loyalty, and open new revenue streams.

Embedded Finance in action: banking solutions in modern apps

Let’s look at some examples of embedded finance and see how firms offer financial products to become more competitive.

Klarna

Take Klarna, for instance. This Swedish powerhouse is changing how we shop. Offering point-of-sale financing and installment plans, Klarna lets shoppers buy now and pay later. It’s not just about delaying payment; it’s about convenience and flexibility, making big purchases less daunting.

Booking

Then there’s Booking.com, the giant in online travel. It’s much more than a place where you can find hotels nowadays. With access to financial services in its offerings, Booking.com is making travel smoother. Booking your trip and getting travel insurance or flexible payment options is now a thing. It’s loved by customers, and it’s incredibly convenient.

Bolt

Bolt, Europe’s answer to ride-hailing, is also on the move. With operations across over 45 countries, Bolt isn’t just about getting you from point A to point B. It’s about creating a seamless experience, integrating payments, and, in some markets, even offering financial services directly within the app.

Amazon Prime Rewards Visa Signature Card

Amazon is an interesting use case as well. With the Amazon Prime Rewards Visa Signature Card, shopping on Amazon and Whole Foods comes with benefits. Cashbacks, no annual credit card fee, and more—all seamlessly integrated into the Amazon customer experience.

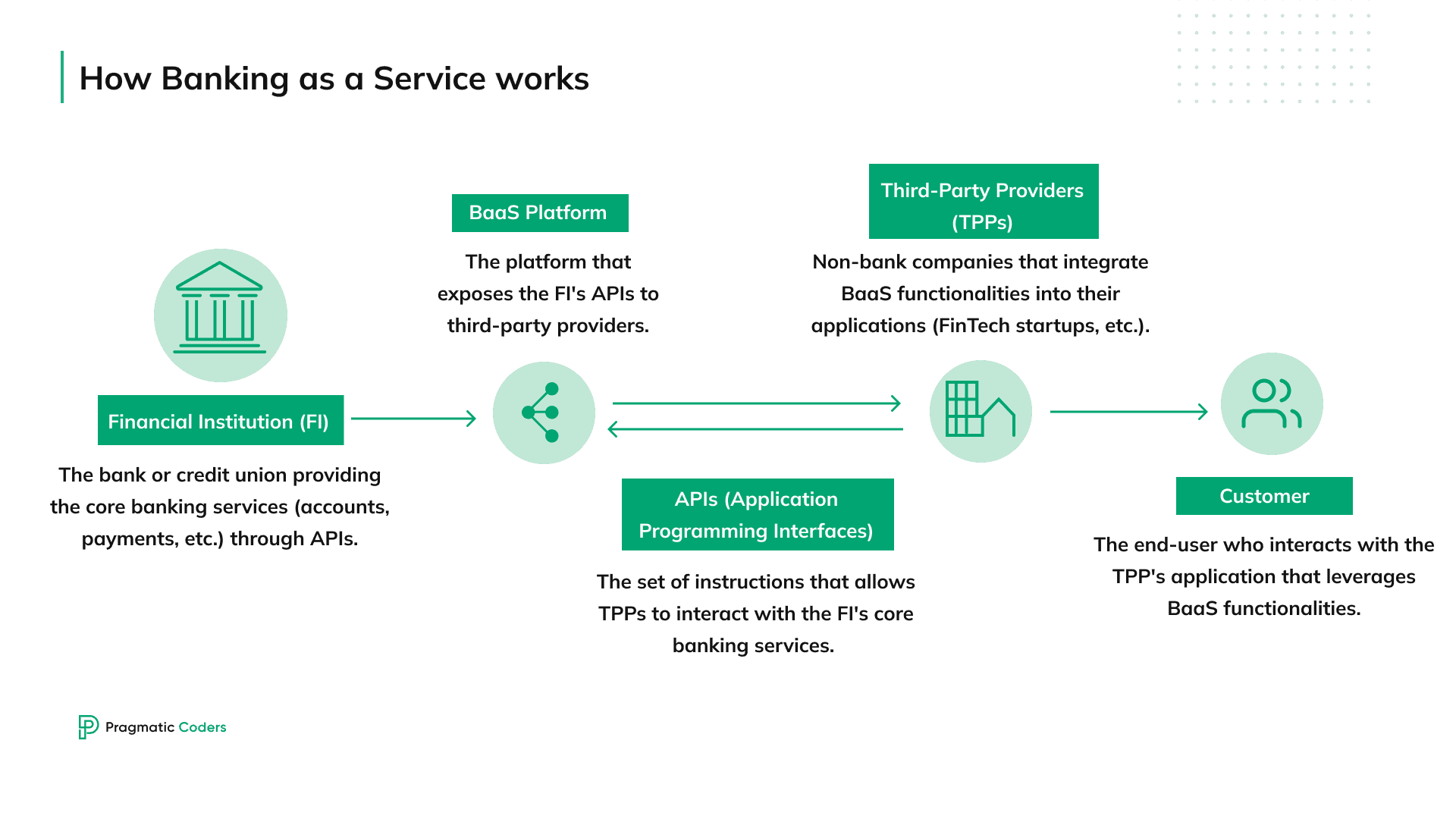

Banking as a Service (BaaS) explained

Now that we understand what embedded finance truly entails, let’s explore what’s operating behind the scenes. BaaS is how financial institutions offer their banking infrastructure to tech companies and other non-banks. This setup allows these companies to provide banking services without being banks themselves. How? By integrating bank APIs. These digital bridges let companies plug into third-party banking services directly, offering things like payments, lending, or account management within their platforms.

But it’s not all smooth sailing. When you blend finance and tech, risk and compliance are big deals. BaaS partnerships need to navigate these waters carefully. This includes adhering to anti-money laundering (AML) laws, the General Data Protection Regulation (GDPR) in Europe, and other local regulations. It’s about more than just technology. It’s about trust, security, and making sure everyone plays by the rules.

Examples of Banking-as-a-Service and open banking in action

Companies across various industries utilize banking infrastructure and services. Here are some examples of companies that made great use of BaaS APIs.

Shopify & Stripe

Shopify’s partnership with Stripe is a textbook case of BaaS in action. By integrating Stripe, Shopify Payments cuts down on transaction fees and streamlines the checkout process. This is a win-win for merchants and shoppers alike.

Slack & Stripe

Slack took a similar route. By integrating Stripe, Slack made subscription payments a breeze. This kind of seamless experience is key to keeping users around and boosting subscription rates.

Uber’s Instant Payments

Uber’s use of BaaS for instant payments to drivers and riders is revolutionary. It removes friction and makes the platform more attractive. This is BaaS making life easier in real-time.

Key differences between Embedded Finance and BaaS

So, what’s the difference between embedded finance and banking-as-a-service? Well, there’s more than one:

Flexibility and customization

Embedded finance shines with its flexibility. Companies can tailor financial services to fit their brand and user experience perfectly. Whereas BaaS, while offering a quick setup, often comes with more limitations. The services are more standardized, which can cramp your style if you’re looking to stand out.

Target audience

Embedded finance is all about the end-user. It’s financial solutions wrapped in non-financial products, making life easier for consumers. BaaS, on the other hand, is the backbone for fintechs, digital banks, and other non-bank entities. It’s a behind-the-scenes player making the magic happen.

Monetization models

When it comes to making money, embedded finance offers pay-for-use opportunities. It’s about adding value where users see it. BaaS operates on a high-volume, low-margin model. For banks, it’s about lending their infrastructure and making money off the sheer scale of transactions. They simply act as service providers as implied by the term ‘BaaS’.

Moreover, understanding different monetization strategies can help you optimize your business model in this evolving landscape. If you’re interested in exploring how various apps generate revenue, check out our article How Do Free Apps Make Money? Monetization Methods Ranked.

Embedded Finance vs Banking-as-a-Service: a detailed comparison

BaaS and Embedded Finance trends to watch

As we dive deeper into the fintech revolution, three trends stand out. First, customers are shouting loud and clear: they want integrated experiences. They crave the convenience of accessing financial products without switching apps or platforms.

Then, there’s the rise of nonbank companies stepping into the financial services arena. From tech giants to retail chains, businesses outside traditional banking are finding ways to offer loans, payments, and more.

Lastly, technology is the great enabler. Advances in cloud computing, AI, and APIs are making BaaS more accessible. These technologies allow for smoother integration of financial services and products into a wide array of platforms. The result? A seamless experience for users and a competitive edge for businesses.

Implications for financial institutions

Banks, take note. The rise of BaaS isn’t just an opportunity; it’s a wake-up call. Launching BaaS business lines can be a game-changer. It’s a chance to partner with tech companies and nonbanks, reaching customers in new ways.

But there’s a catch. The old ways won’t cut it. Overcoming legacy cost structures is essential. Digital transformation is the key. It’s about being agile, efficient, and ready for the future of banking.

And let’s not forget branding. In the BaaS world, banks need to think differently about their brand. It’s no longer just about being a trusted institution. It’s about being a forward-thinking, innovative partner for fintech and nonbank companies.

Conclusion

Let’s wrap this up. Embedded finance and BaaS are reshaping the financial landscape. They’re breaking down barriers, integrating financial services into our daily lives, and opening up new possibilities.

For businesses, the message is clear: adapt or be left behind. The ability to offer seamless financial services can set you apart. For banks, the rise of BaaS is both a challenge and an opportunity. It’s a chance to reinvent themselves, to become indispensable partners in the fintech revolution.

In this ever-evolving landscape, one thing is certain: adaptability is key. Whether you’re a startup, a tech giant, or a traditional bank, staying ahead means embracing change, innovating, and always putting the customer first.