What is Banking as a Service and How to Choose a Provider?

Finance has become much more dynamic in recent years, but you already know that. What you may not be aware of is the revolutionary wave reshaping the very foundation of banking. It’s changing its interaction with technology, businesses, and everyday consumers. Welcome to the world of Banking as a Service (BaaS), a groundbreaking model that blends the robust infrastructure of traditional banking with the agility and innovation of fintech. Thanks to BaaS platforms, developing new fintech products is cheaper and easier than ever before. This article delves into the intricacies of it. It explores how Banking as a Service is revolutionizing finance by enabling non-financial tech companies to offer banking services.

Banking as a Service explained

How does Banking as a Service work?

Banking as a Service, or BaaS, is a model that allows third parties (non-bank businesses) to offer financial services by leveraging the technology and regulatory framework of traditional banks. Imagine it as a bridge. This bridge connects fintech innovation with the robust infrastructure of established financial institutions. The model operates via Banking APIs (Application Programming Interfaces). These APIs facilitate seamless interactions between banks and third-party providers. The value proposition? It’s all about agility and customization. BaaS platforms, like Mambu, Synapse, and Solaris, can tailor financial services to the specific needs of their customers, offering everything from payments and lending to account management, all under the brand of the third-party provider.

Traditional banking vs. BaaS: key differences

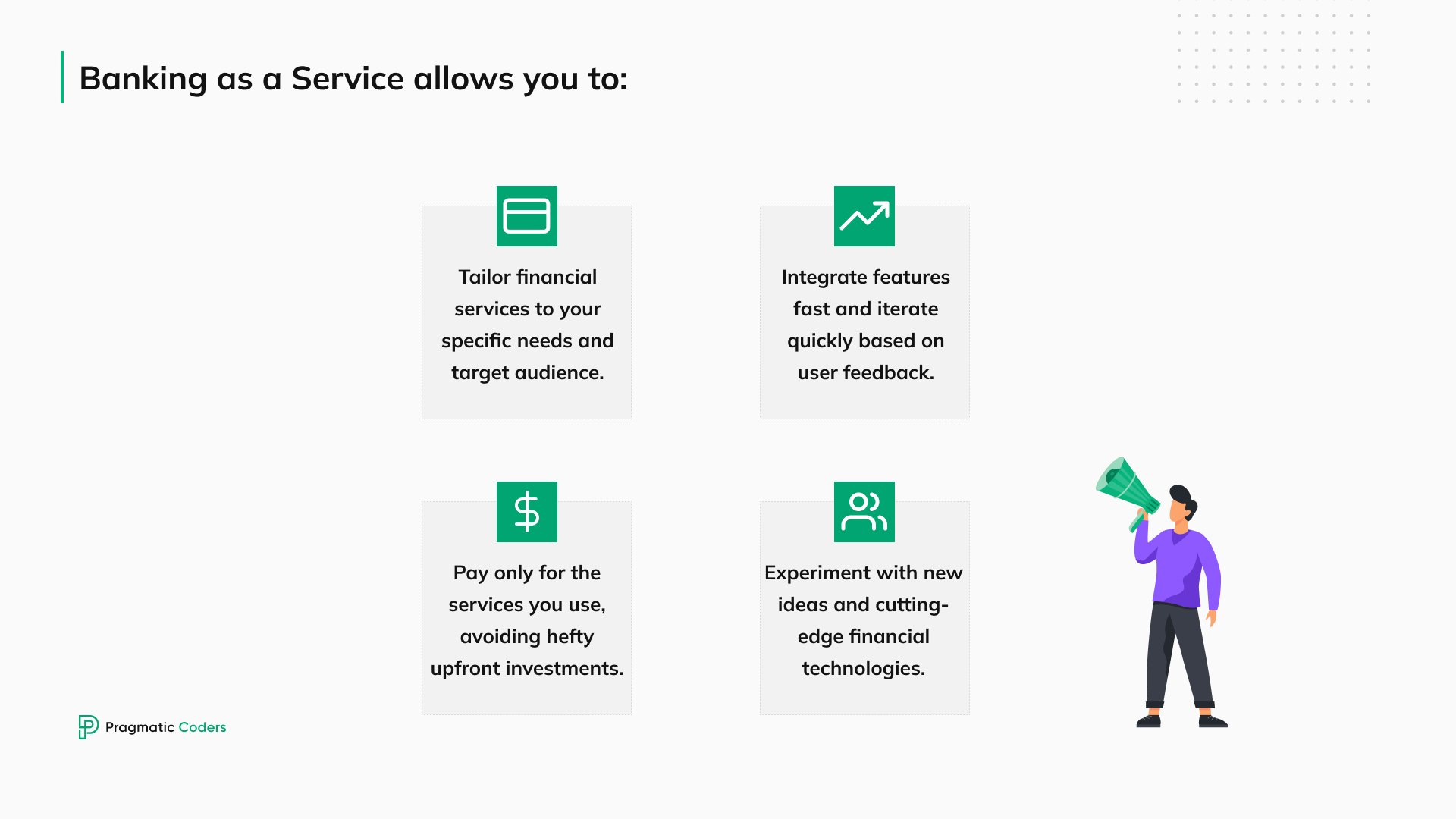

Traditional banking is like a one-size-fits-all suit: it’s reliable but not the perfect fit for everyone. These institutions are often hampered by legacy banking systems, making it hard to adapt to the fast-evolving demands of digital-savvy customers. BaaS, on the other hand, is like a tailored suit. It’s designed to meet the exact needs of its wearer. It breaks down the monolithic structure of traditional banking. This offers flexibility, lower costs, and a personalized customer experience. The top benefits of Banking as a Service include:

- Customization: You can tailor financial services to your specific needs and target audience.

- Speed and Agility: You can integrate features fast and iterate quickly based on user feedback.

- Cost-Effectiveness: You pay only for the services you use, avoiding hefty upfront investments.

- Innovation: You gain access to cutting-edge financial technologies and can experiment with new ideas.

The regulatory landscape of BaaS

Navigating the regulatory landscape is crucial for BaaS providers. They must ensure that their services comply with a myriad of financial regulations designed to protect consumers and ensure the stability of the financial system. This includes adhering to anti-money laundering (AML) laws, the General Data Protection Regulation (GDPR) in Europe, and other local regulations. For BaaS providers and their partners, this means implementing robust security measures, maintaining transparency, and fostering trust with customers. The regulatory environment is challenging, but also essential for sustaining the growth and integrity of BaaS. Recently, however, we have observed the rise of Regulation Technologies that help ensure compliance, making this less of an issue.

Benefits of BaaS for businesses

Who can benefit from BaaS-based financial services?

BaaS is not just a fintech phenomenon; it’s a versatile tool that can benefit various industries. E-commerce platforms can offer branded payment solutions, loyalty and rewards programs, and even financial products like loans to their customers. Tech startups, particularly SaaS (Software as a Service) providers, can integrate financial services directly into their platforms. This enhances their value proposition. Even traditional sectors like retail and healthcare can leverage BaaS to streamline payments, manage finances, and improve customer experiences. All this without the need for a banking license!

Case studies: how businesses leverage BaaS

Consider an e-commerce giant that introduces its own payment processing service, reducing fees and offering seamless checkout experiences. For example:

- Shopify partnered with Stripe to offer direct payments through Shopify Payments. This significantly reduced transaction fees and offered a smoother checkout experience for merchants.

- Amazon launched Amazon Pay, allowing customers to pay on other websites using their Amazon account information. This improved convenience and security.

Or maybe a SaaS provider that integrates embedded financial services like invoicing and payments directly into its platform, simplifying operations for its users:

- Slack integrated Stripe to enable subscription payments directly within the platform. This streamlined the experience for users and increased subscription rates.

- Zoom partnered with PayPal to offer in-app payment options for subscriptions and other purchases. This made it easier for users to manage their accounts.

There’s also the example of on-demand service platforms that offer immediate payouts to their workers, thanks to BaaS solutions:

- DoorDash leverages a BaaS solution to enable instant payouts to its delivery drivers. This improves their financial well-being and satisfaction.

- Uber uses BaaS for instant payments to both drivers and riders. This creates a frictionless experience and boosts platform adoption.

These real-life examples showcase the rise of banking as a service in the past decade. With BaaS, technology companies can offer innovative financial services that differentiate them from competitors. A significant aspect of this evolution is the integration of core banking systems within the BaaS framework, allowing financial institutions to streamline operations and enhance service delivery.

The BaaS toolkit: core services and features

At the heart of the BaaS stack are the core services and features it offers: payment processing, account management, lending and credit services, and even investment products. These services can be customized and branded by BaaS clients, offering their customers a seamless financial experience. For instance, a retail brand might offer branded debit cards and savings accounts. Or, a gig economy platform might provide instant loan approvals for its workers based on their earning history.

Seamless integration: implementing BaaS through APIs

The technical backbone of BaaS is API integration, allowing for the seamless embedding of financial services into a business’s existing platforms. These banking APIs must be secure, reliable, and scalable. They need to handle high volumes of transactions and data. For businesses, this means considering the technical infrastructure, data security, and user experience during implementation. Properly executed, BaaS integration can transform user experiences. It makes financial transactions as simple and intuitive as using a smartphone app.

BaaS trends set to reshape finance

Open banking: unleashing the power of collaboration

Open banking is one of our Top 5 banking technology trends of 2024, rooted in the idea of using open APIs to allow banks and third-party providers to share financial information securely. This collaboration creates a more interconnected financial ecosystem, benefiting everyone involved. For customers, it means a more personalized banking experience, with services tailored to their needs. For digital banks and fintechs, it’s an opportunity to innovate, create value-added services, and unlock new revenue streams. The essence of open banking is in its ability to foster competition and innovation. This ultimately leads to better banking products and services.

Beyond payments: expanding the horizon of BaaS

BaaS is venturing beyond traditional payment processing. It’s moving into realms like investment, insurance, and wealth management. This expansion is not just about adding new banking functionalities. It’s about reimagining how these functionalities are delivered. Imagine investing in stocks or buying insurance directly through your favorite shopping app. Or managing your retirement savings from your mobile banking app. These possibilities are becoming realities as BaaS providers deepen their offerings, making sophisticated financial services accessible to a broader audience.

Data-driven BaaS: personalized experiences and risk management

The power of BaaS lies not just in the core banking services it offers but in the financial data it harnesses. By leveraging vast amounts of data, BaaS platforms can offer highly personalized experiences, from tailored financial advice to customized product recommendations. This data-driven approach also enhances risk management. It enables more accurate fraud detection and prevention measures. The result is a safer, more secure financial environment. It also feels intimately tailored to each user’s needs.

Integrated BaaS: the rise of BaaS platforms and embedded finance

Embedded finance, facilitated by BaaS, is blurring the lines between financial services and other industries. Whether it’s white label banking services that allow brands to offer financial products under their own name, or embedded finance solutions that integrate lending or payments directly into non-financial platforms, the trend is clear. Finance is becoming an integral part of the customer experience across all sectors. This integration is creating new opportunities for businesses to engage with their customers. It’s adding value in ways that were previously unimaginable outside of the banking industry.

How to choose the right BaaS partner

Key considerations for selecting a BaaS provider

Choosing a Banking as a Service provider is a critical decision. It’s not just about the costs or the technology; it’s about finding a partner that aligns with your business’s values and goals. Compliance, security, and regulatory adherence are non-negotiables. Pricing models should be transparent and scalable. The technology stack must be robust and flexible, allowing for seamless integration of financial services to your product. And perhaps most importantly, customer support should be responsive and capable of guiding you through the complexities of weaving financial products and services into your offerings.

Assessing your needs: matching your business goals with BaaS solutions

Every business is unique, and so are its BaaS needs. Some may seek to enhance their customer experience with integrated payment solutions, while others might look to offer new financial products. Identifying your specific requirements and risk tolerance is crucial. This step is not just about what you need today but also about future-proofing your business. A good Banking as a Service provider should be able to scale with you, supporting your growth and evolving with the market.

Building a successful fintech partnership: collaboration and long-term vision

A fruitful BaaS partnership is built on more than just technology; it’s built on shared vision and goals. Effective communication is key, as is a commitment to ongoing support and joint innovation. Look for a provider that is not just a digital banking services vendor but a true partner, one that is invested in your success as much as their own. Together, you can explore new opportunities, navigate challenges, and ultimately redefine what’s possible in your industry.

BaaS and the future of financial services

The impact on consumers: a more inclusive and accessible financial landscape

Banking as a Service (BaaS) is redefining financial inclusivity and accessibility. It breaks down traditional barriers to financial services and products. This enables a broader range of consumers to enjoy personalized banking experiences. Improved access means that more people, including those in underserved communities, can benefit from financial products tailored to their needs. This democratization of finance doesn’t just open doors to new banking opportunities. It also fosters financial literacy and empowerment.

Reimagining the financial industry: collaboration, innovation, and competition

The rise of BaaS marks a pivotal shift in the financial industry. Traditional banks are now collaborating with fintechs and non-financial businesses. This is driving innovation and competition to new heights. The synergy is not about replacing the old with the new. It’s about enhancing and expanding what’s possible. Traditional institutions are adopting BaaS to stay relevant. Meanwhile, new players use it to carve out niches. The outcome? A vibrant, competitive landscape that pushes the boundaries of financial services.

Looking ahead: emerging trends and predictions for BaaS

The future of BaaS is bright, with trends pointing towards further integration into everyday life. We’ll likely see more non-financial companies offering financial services, making finance a seamless part of our daily activities. Advances in technology will also play a significant role. AI and machine learning will enhance personalization and security. Moreover, BaaS will continue to break down international barriers. This facilitates global access to financial services. As these trends unfold, the impact of BaaS will extend far beyond banking. It will influence sectors like healthcare, education, and retail.

Conclusion

Banking as a Service (BaaS) is more than a financial innovation. It’s a transformative force reshaping the landscape of financial services. By fostering collaboration between traditional banks and fintech companies, BaaS is unlocking growth. It enhances customer experiences and makes financial services more accessible and inclusive. As we look to the future, the potential of BaaS is vast. It promises a world where financial services are seamlessly integrated into our lives. They are personalized to our needs, and accessible to all.

This journey through the BaaS ecosystem reveals not just the technicalities of how it operates. It shows the profound impact it has on businesses, consumers, and the financial industry at large. As we embrace this new era of finance, the possibilities are as limitless as our capacity for innovation. BaaS isn’t just changing the way we bank. It’s redefining our relationship with money.

.jpg)